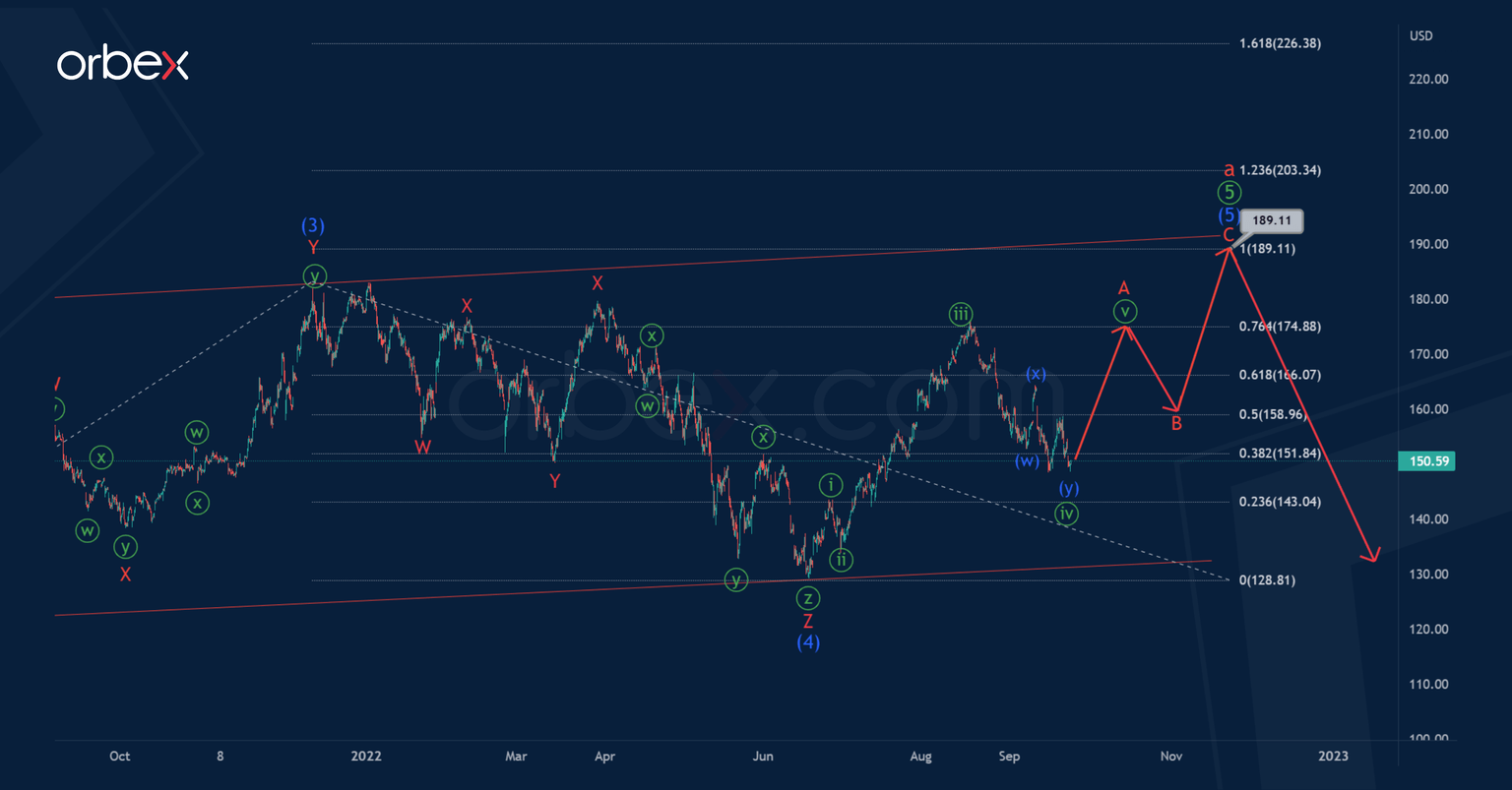

AAPL: Bullish minor zigzag pattern likely to complete final diagonal near 189.11

AAPL suggests the development of the primary fifth wave, taking the form of an ending diagonal (1)-(2)-(3)-(4)-(5) of the intermediate degree. Wave ⑤ is the final leg in a scale impulse a of the cycle degree.

Most likely, the market has completed the construction of an intermediate correction (4) in the form of a minor triple zigzag W-X-Y-X-Z.

Thus, now the price is moving up, in an intermediate wave (5), which may take the form of a standard zigzag A-B-C, as shown on the chart, where wave A is a minute impulse.

Bulls in wave (5) may reach 189.11. At that level, wave (5) will be equal to wave (3).

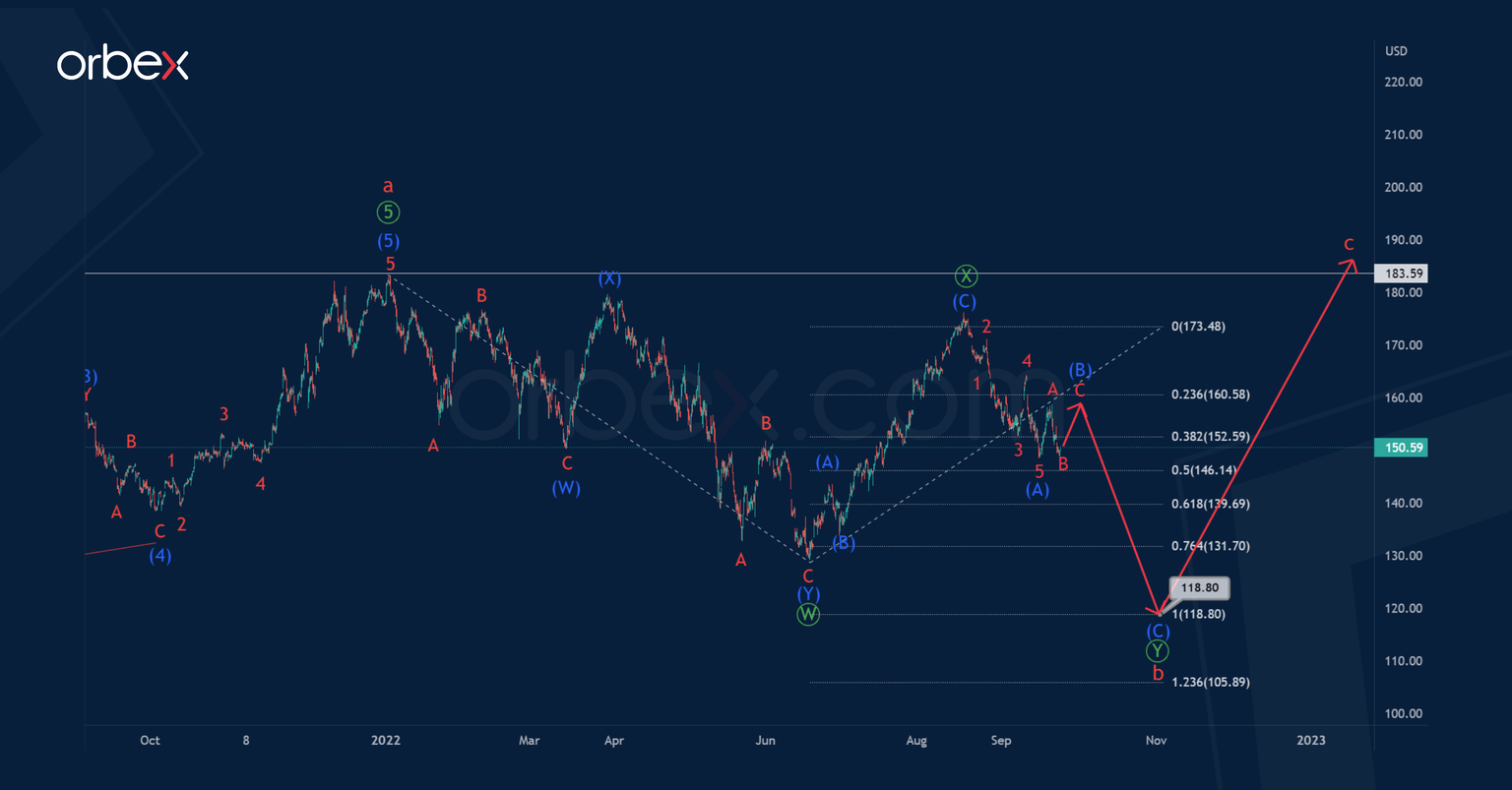

An alternative scenario assumes that the cycle wave a has been fully completed.

Thus, in the last section of the chart, we see a downward corrective movement of the stock price in a cycle wave b, which may take the form of a double zigzag of the primary degree. It seems that the first two primary sub-waves Ⓦ-Ⓧ have already been formed.

There is a high probability that the bears in the final sub-wave Ⓨ, in the form of an intermediate simple zigzag (A)-(B)-(C), will be able to bring the market to 118.80. At that level, primary wave Ⓨ will be at 100% of wave Ⓦ.

An approximate scheme of possible future movement is shown on the chart.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.