2020 US Elections: It is Biden's election to lose

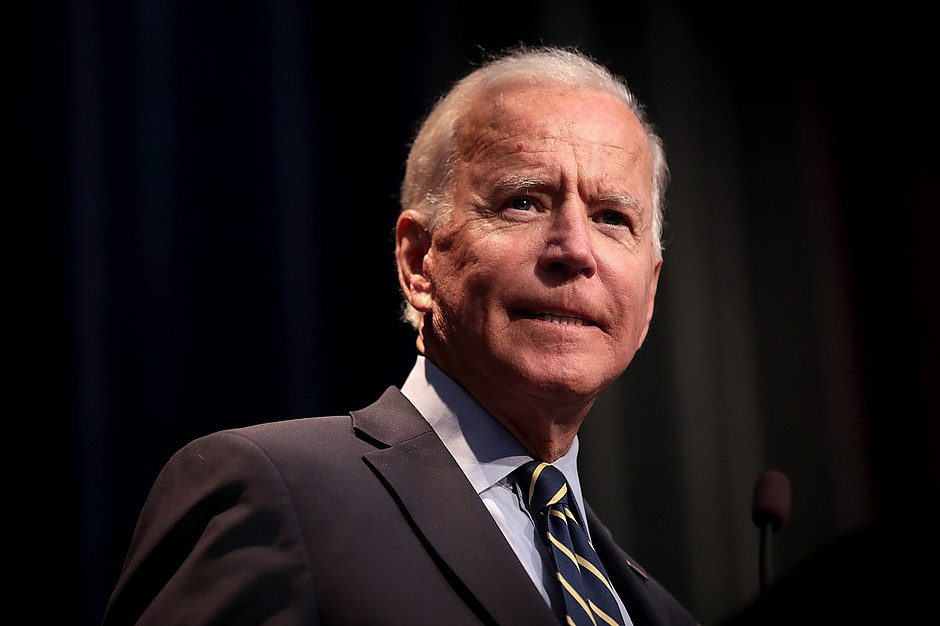

Fox News' polls point to a landslide loss for President Trump – if the elections were held in late June. They are held only in November, and that calls for caution – especially when looking to Clinton led Trump around this time in 2016. However, presumptive Democratic nominee Joe Biden has several advantages over Clinton as there are fewer undecideds in 2020, making Biden's lead more solid and an electoral college more aligned with the national map, FXStreet’s analyst Yohay Elam informs.

Key quotes

“There is a smaller pool of undecideds to choose from now. On election day, support for Clinton in opinion polls hit 45.7% in national polls, around the previous peaks. Ita barely scratched 43% in late June. Both leading candidates received only 79% in late June before both managed to add up some of the undecideds, reaching a total of around 86% on election day. As of late June 2020, Biden receives 50.6% – an outright majority – while Trump stands at 41.4%. Together they already have 92%, above November 2016 levels.”

“Back in June 2016, Clinton led Trump by around 5.5%. After the successful Democratic convention in Philadelphia and amid several Trump scandals, Clinton led by around 7.5% – the high watermark for the nominee. In June 2020, Biden is stabilizing above nine points. Is this the former Vice President's high watermark? Perhaps, yet his low point was a minuscule lead of 3.4% in April, while Clinton temporarily nearly trailed Trump.”

“According to polls by Fox News – Trump is set to lose the large state of Florida by 9%. These surveys also show Biden ahead – albeit by minor margins – in North Carolina, Georgia, and Texas. Contrary to 2016, Trump does not seem to enjoy a lead in battleground states that can compensate for his trailing on the national stage. Overall, the 2016 map has a smaller likelihood of repeating itself in 2016.”

Author

FXStreet Team

FXStreet