ZKsync, Internet Computer hold gains as Bitcoin slips below $100,000

- The broader cryptocurrency market incurs a total liquidation of $2 billion as Bitcoin falls below $100,000.

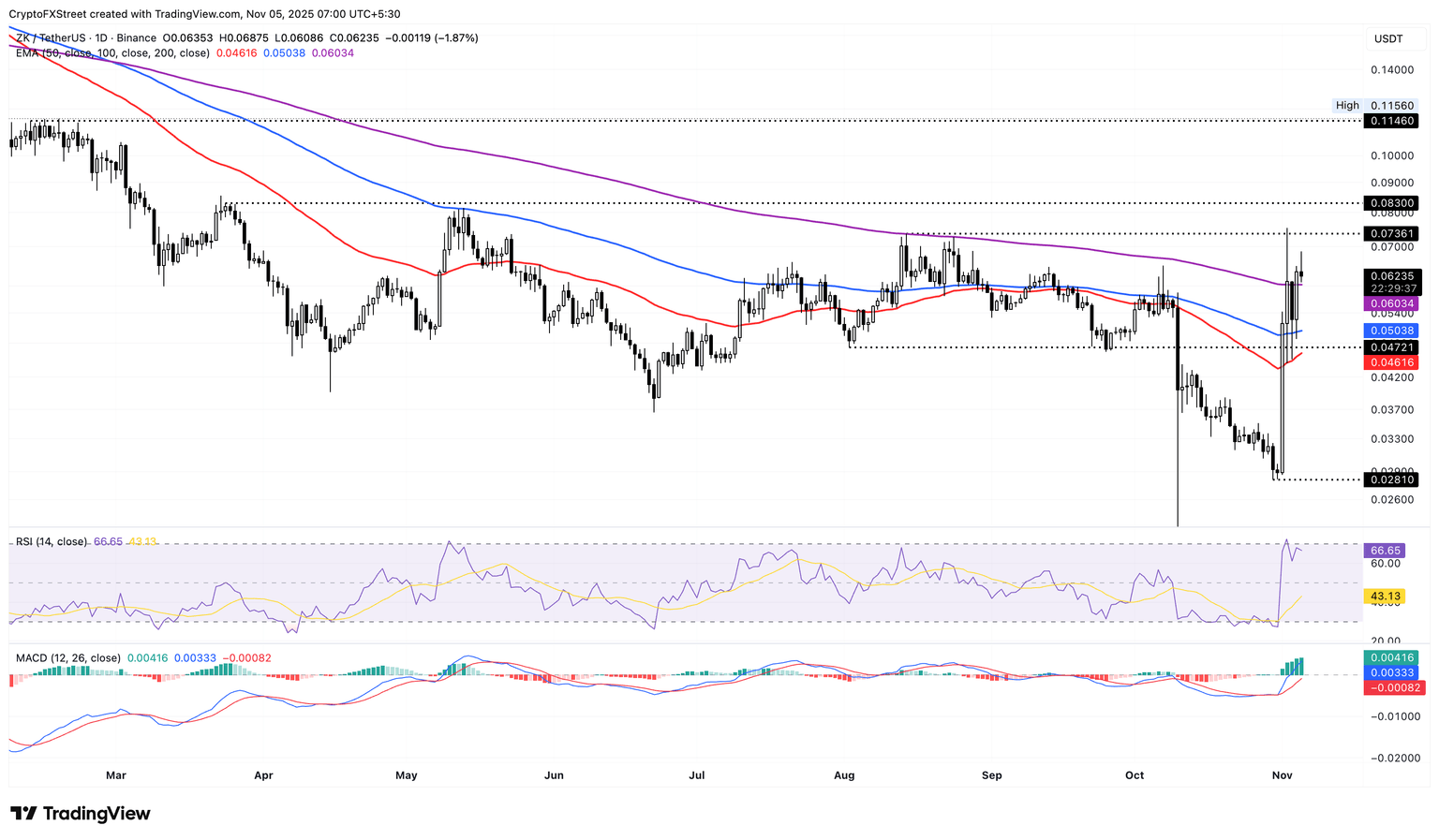

- ZKsync takes a breather above the 200-day EMA after a 20% rise on Tuesday.

- Internet Computer retraces 6% on Wednesday as it aims to shift from a governance token to a real-world utility.

ZKsync (ZK) and Internet Computer (ICP) hold steady amid the broader cryptocurrency market correction as Bitcoin (BTC) drops below $100,000 for the first time since June 23. The sudden decline wipes out $2 billion in total liquidations, with bulls taking the harder hit.

Bitcoin below $100,000 triggers $2 billion liquidation event

Bitcoin trades below $100,000 at press time on Wednesday, recording its third straight day of losses. A bearish crossover between the 50-day Exponential Moving Average (EMA) and the 100-day EMA confirms a short-term bearish dominance.

The immediate support for BTC lies at the $98,200 level, marked by the low on June 22. If BTC slips below this level, the bearish trend could test the $92,800 low from April 28.

Technically, the ongoing pullback has turned the momentum bearish as the Moving Average Convergence Divergence (MACD) extends the reversal from the signal line in the negative direction. At the same time, a successive rise in red histogram bars below the zero line indicates a rise in bearish momentum.

An increase in selling pressure has caused the Relative Strength Index (RSI) to drop to 29, sliding below the oversold zone. If RSI further extends into the oversold zone, BTC could lose further ground.

A potential rebound in BTC could test the $105,250 support-turned-resistance, marked by the July 1 low.

CoinGlass data indicates that over the last 24 hours, $2.07 billion has been wiped out of the cryptocurrency market, affecting 479,792 traders. Out of the total liquidation, $1.67 billion in long liquidation is substantially higher than $389.97 million in short liquidation. This indicates that largely bullish positions were forcefully liquidated, reflecting a bearish market sentiment.

Additionally, the largest single liquidation event in the ongoing market correction happened in the BTC/USDT pair on the HTX exchange, valued at $47.87 million.

ZKsync rally takes a breather

ZKsync, an Ethereum-based Layer 2 governance token, is shifting its focus to provide real-world utility. In an article on X from Tuesday, its founder, Alex Gluchowski, proposes that the governance-focused network could evolve into an incorruptible economy. The proposal shares the need for a token model that enables adaptation and growth in response to the ongoing private “Prividium” modular chains and the “Elastic Chain” for cross-chain interoperability.

At the time of writing, ZK trades above $0.0600 on Tuesday, holding above the 200-day EMA and the 80% gains from last week. If the governance token falls below the 200-day EMA, it could test the 100-day EMA near the $0.05000 psychological level.

The RSI at 66 hovers near the overbought boundary, indicating elevated levels of buying pressure. If RSI retraces towards the halfway line, suggesting a loss in bullish interest, ZK would be at risk of further correction. Corroborating the rise in bullish momentum, the MACD and signal line continue to uphold a rising trend.

Looking up, if ZK breaks above $0.07631 high from August 14, it could extend the rally to the $0.08300 high from March 24.

Internet Computer floats above $5 as buying pressure holds

Internet Computer edges lower by nearly 4% at press time on Wednesday, testing the $5 mark and the 200-day EMA. If ICP marks a decisive close below this average line, it could extend the decline to the 100-day EMA at $4.311.

Still, similar to ZKSync, the momentum indicators on the daily chart suggest intense buying pressure. The RSI at 67 fluctuates below the overbought boundary, and the MACD and signal line hold a steady upward trend.

On the upside, if ICP secures a close above the July 21 high of $6.255, it could extend the rally to the $7.478 high from February 12.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.