Zcash Price Prediction: ZEC bounces off a substantial support level targeting $80

- ZEC is currently trading at $59 after defending the daily 200-MA and $56 support level.

- Bulls are now fighting to stay above the daily 200-EMA at $59.81.

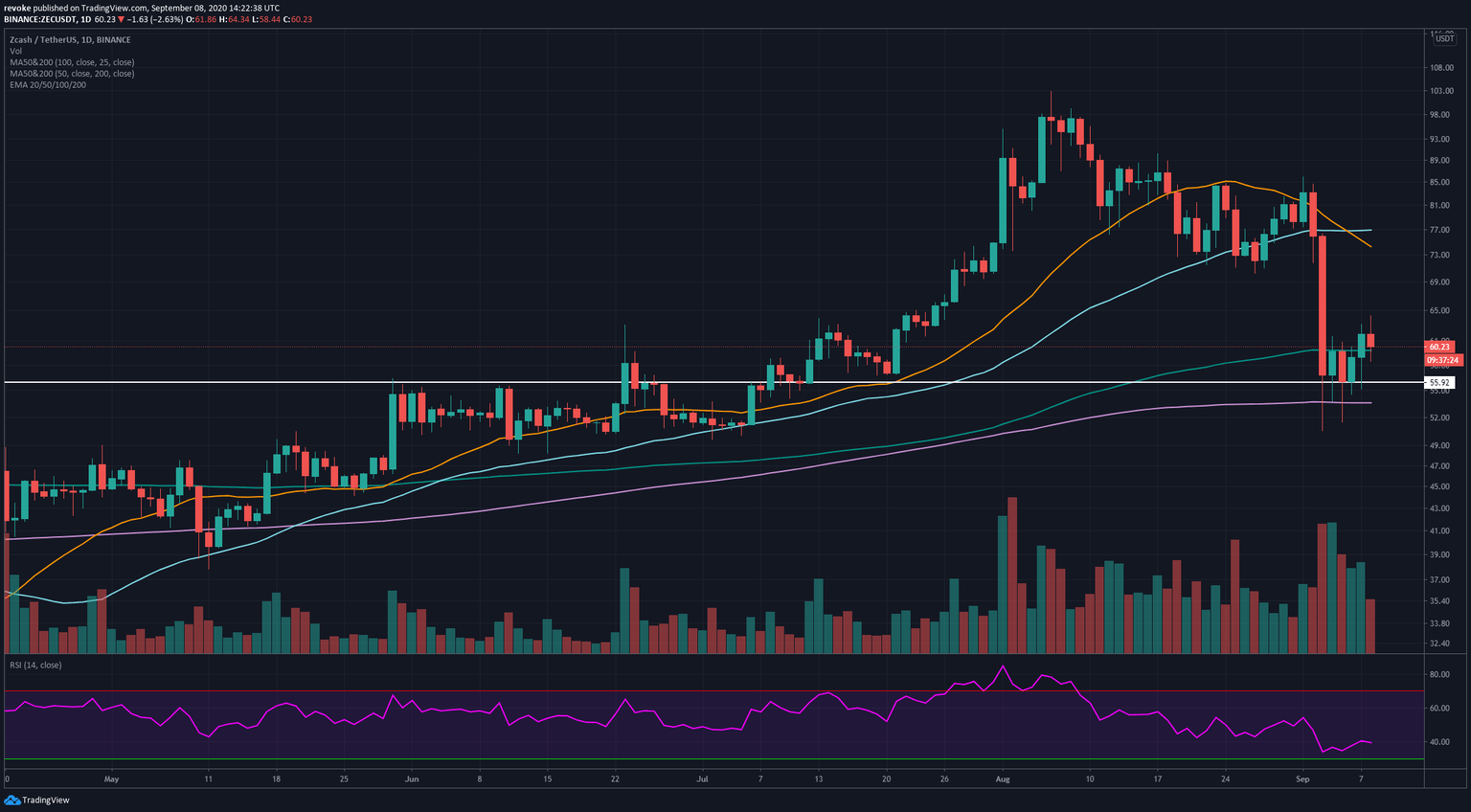

Zcash had one of the worst crashes in the market, losing more than 25% of its value in just one day. ZEC bulls are trying to recover after prices bounced from the daily 200-MA as there aren’t many resistance levels on the way up.

ZEC/USD daily chart

The initial crash took ZEC price as low as $50.56, and bulls managed to establish a healthy support level around $56. The price of Zcash has bounced several times from that level and the daily 200-MA, currently at $53.59.

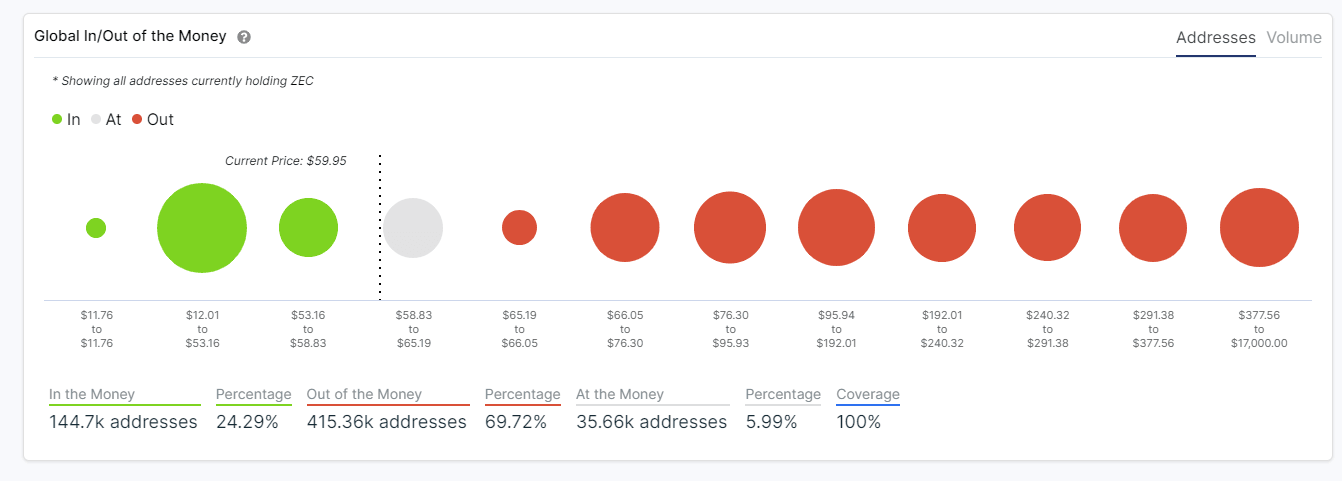

The $56 support level is crucial because many addresses bought around that level. According to the IOMAP model, $56 and $42 are the most critical support levels. As for resistance, bulls will encounter a strong level at $71 and $83.

ZEC/USD 12-hour chart

On the 12-hour chart, the MACD is on the verge of a bull cross after the bounce from the overextended RSI. There are very few resistance levels on the way up to $80 besides the Moving Averages. The MACD in combination with the RSI should serve as a good buy signal considering the crash didn't leave too many resistance levels on the way down.

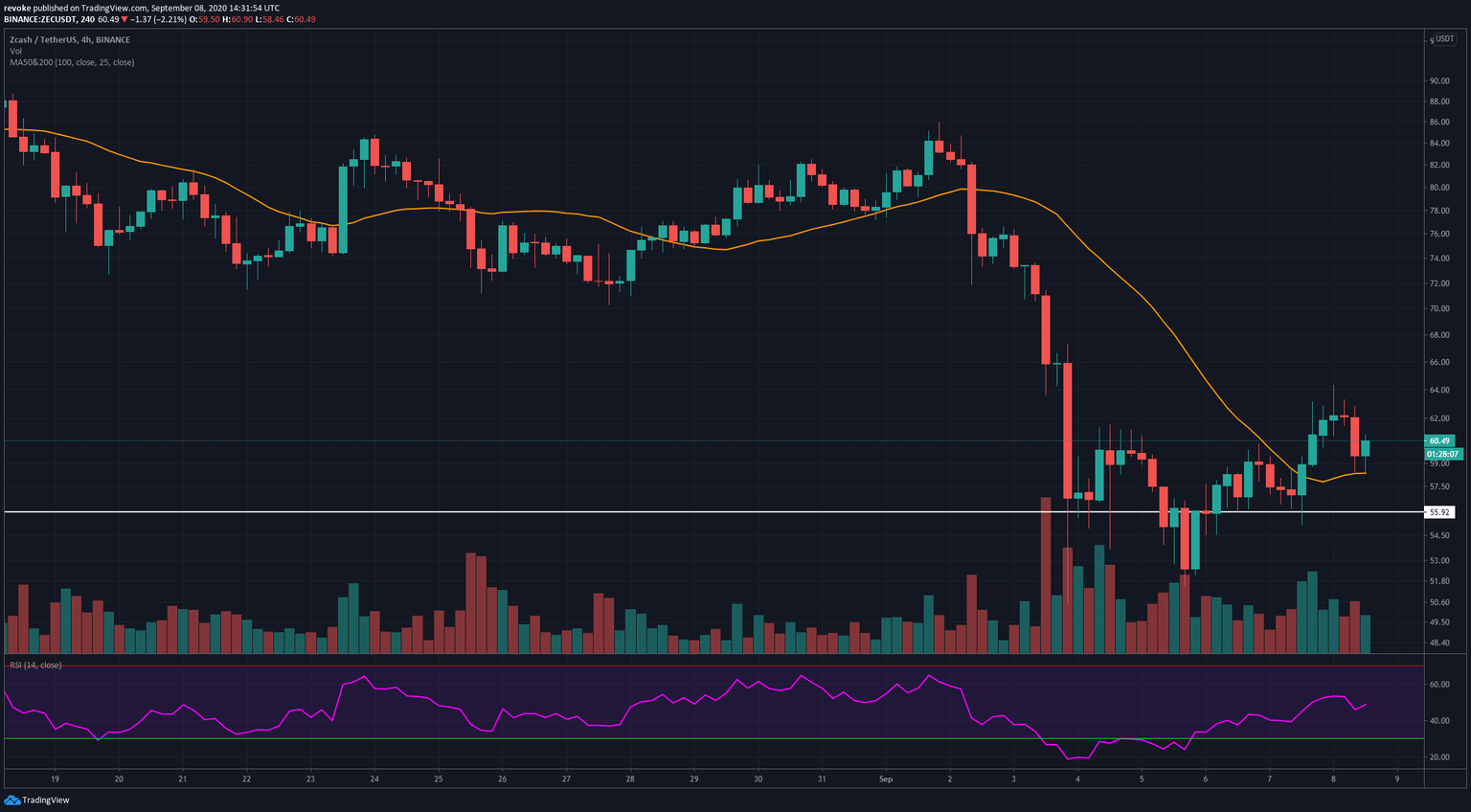

ZEC/USD 4-hour chart

ZEC appears to be in an uptrend, based on its 4-hour chart, after bulls formed a low at $51.5, followed by a higher low at $ 55.14. ZEC buyers also managed to make the price climb above the 100-MA at $58.35. The RSI remained overextended for around two days before the bounce. The next short-term resistance point is located at $64.34, the high of the last four days.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637351762384139476.png&w=1536&q=95)