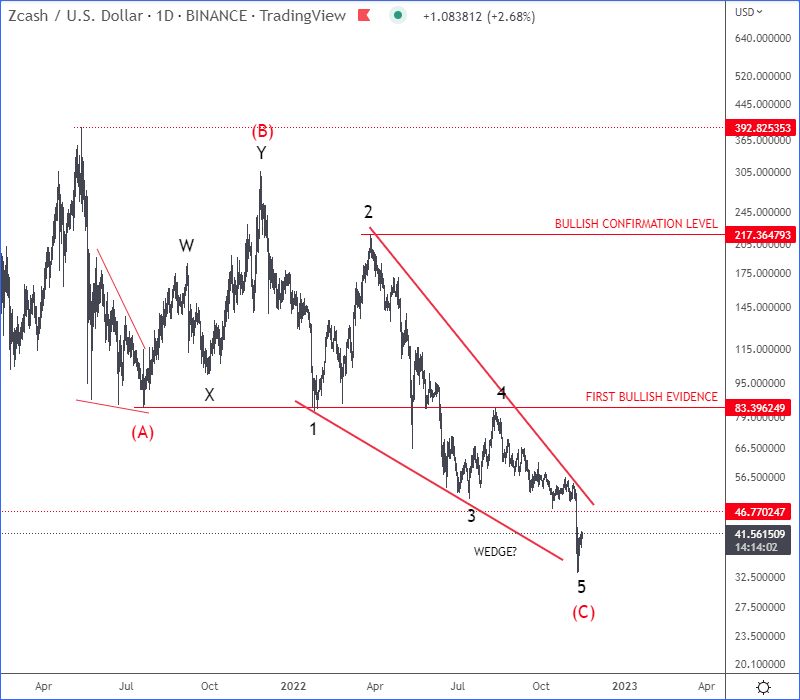

Zcash forms the wedge pattern

Zcash (ZECUSD) is trading bearish for the last year, but looking at the wave structure from Elliott wave perspective, we can see it forming and potentially finishing an ending diagonal a.k.a. wedge pattern within wave (C) of an (A)-(B)-(C) correction from the highs.

Looking at the ZECUSD daily chart, we can see a leading diagonal in wave (A), then a complex W-X-Y correction in wave (B), followed by final sell-off within the wedge formation within wave (C). Well, technically speaking, ZECUSD is trading at strong support zone, but at this stage it's important to wait for confirmations. So, only if we see sharp rebound or impulsive recovery back above 83 first bullish evidence level, only then we can confirm support in place and bulls back in the game.

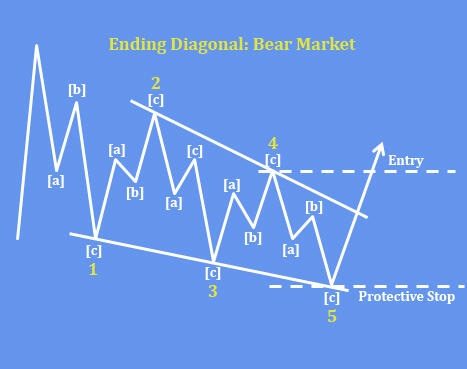

The ending diagonal (wedge) pattern is a special type of wave that occurs in wave 5 of an impulse. An ending diagonal pattern is a type of pattern that can occur at the completion of a strong move. It reflects a “calming” of the market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. Ending diagonals consist of five waves, labeled 1-2-3-4-5, where each wave subdivides into three legs. Waves 1 and 4 overlap in price, while wave 3 can not be the shortest amongst waves 1, 3 and 5.

LIMITE TIME OFFER for wavetraders services: Get 2 Months For Price of 1.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.