Yearn.Finance Price Prediction: YFI looks ready to regain lost ground, bulls target $25,000

- Technical indicators show that YFI's price seems to be gearing for a rebound.

- On-chain metrics give credence to the bullish narrative as the market appears to have found stable support.

Following a significant retracement that has sent the price of Yearn.Finance below $21,000, it would seem that it is on the cusp of an upward trend. After trading in treacherous zones for a while, technical indicators show that the digital asset might not remain there for long.

Yearn.Finance price poised to rebound

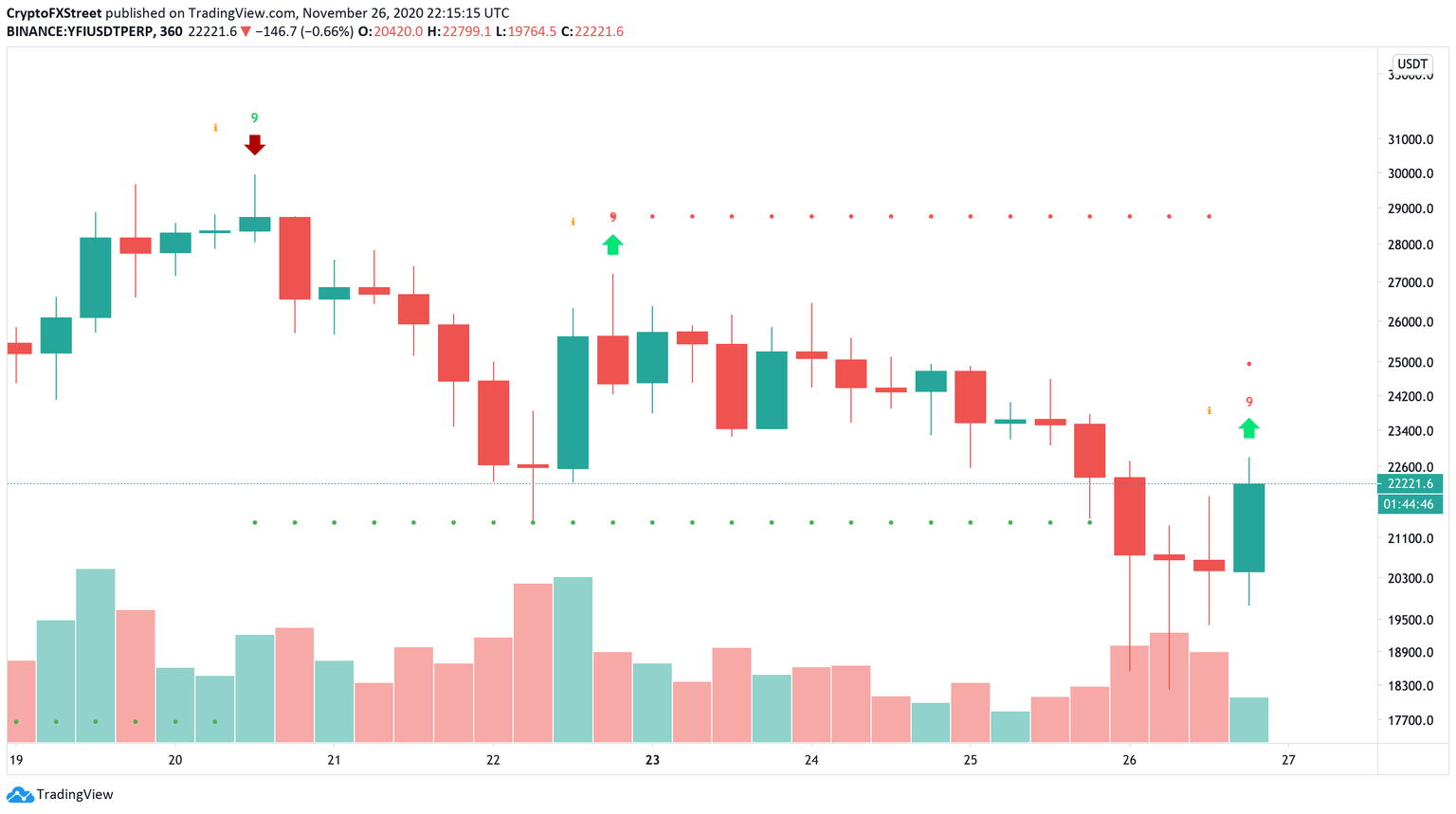

The TD Sequential indicator provided a buy signal on Yearn.Finance's 6-hour chart. The bullish formation came as a red nine candlestick, indicating a potential upswing on the DeFI token’s sight.

Although YFI sits at $22,500 at the time of writing, a spike in buying pressure could see prices soar towards $25,000.

YFI/USD 6-Hour chart

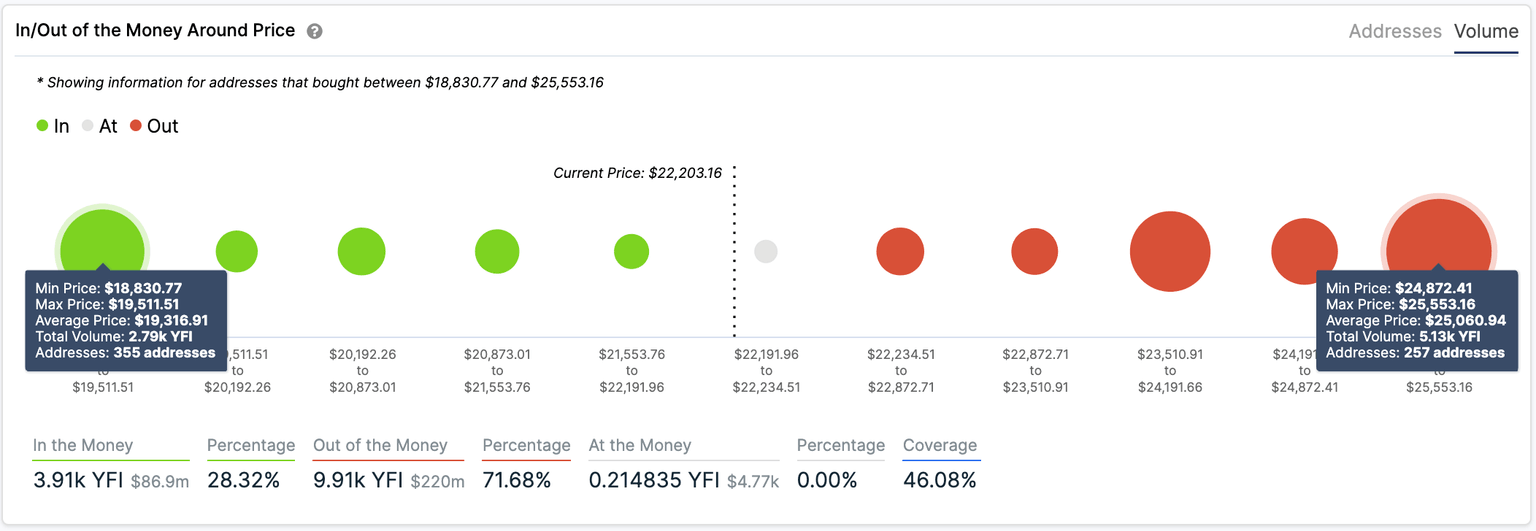

IntoTheBlock's "In/Out of the Money Around Price" (IOMAP) model adds credence to the bullish outlook. Based on this on-chain metric, the only significant resistance level ahead of Yearn.Finance sits at $25,000. Here, more than 250 addresses bought over 5,000 YFI.

In/Out of the Money Around Price for YFI

On the flip side, transaction history suggests that the $19,000 level plays a significant role in Yearn.Finance's trend. The IOMAP cohorts show that this is the strongest support zone underneath this cryptocurrency because over 350 addresses had scooped up nearly 2,800 YFI tokens around this price.

It is very likely that this area would be strong enough to subdue some of the selling pressure and prevent a further decline. Failing to do so may open the pandora box since the IOMAP indicates that the next important support wall sits around $17,700 and $18,100.

Author

FXStreet Team

FXStreet