Yearn.finance Price Forecast: YFI poised for recovery aiming for $22,000

- Yearn.finance yVaults will soon support UniSwap (UNI) yield farming.

- YFI/USD renews the uptrend towards $20,000 after bouncing off support at $16,000.

Yearn.finance, received a massive beating last week, losing over 38% of its value. However, the losses were not unique to the decentralized finance (DeFi) token because leading digital assets such as Bitcoin and Ethereum dived to $10,400 and $335, respectively.

Last week, the losses in the market affected most of the cryptocurrencies apart from the top 3 performers, as discussed on Saturday. Meanwhile, YFI is teetering at $19,454 following an extended breakdown from its all-time high of $44,000, traded mid-September. Support at $16,000 is key to the ongoing recovery.

Yearn.finance will soon support UniSwap yield farming

The DeFi remains one of the most diverse and dynamic sectors of the cryptocurrency industry. It has given newly launched tokens like YFI a global presence by allowing them to offer financial solutions to anyone across the world. Yearn.finance users have an opportunity to earn from various DeFi projects through a process called yield farming.

In line with this, Yearn.finance developers have announced the imminent release of version two of yVaults that would farm UniSwap (UNI). UNI is a relatively new token that was launched by the decentralized exchange and liquidity provider, UniSwap. The news has been received well by the community and perhaps it is the force behind the ongoing recovery.

Yearn.finance renews the uptrend as volatility returns

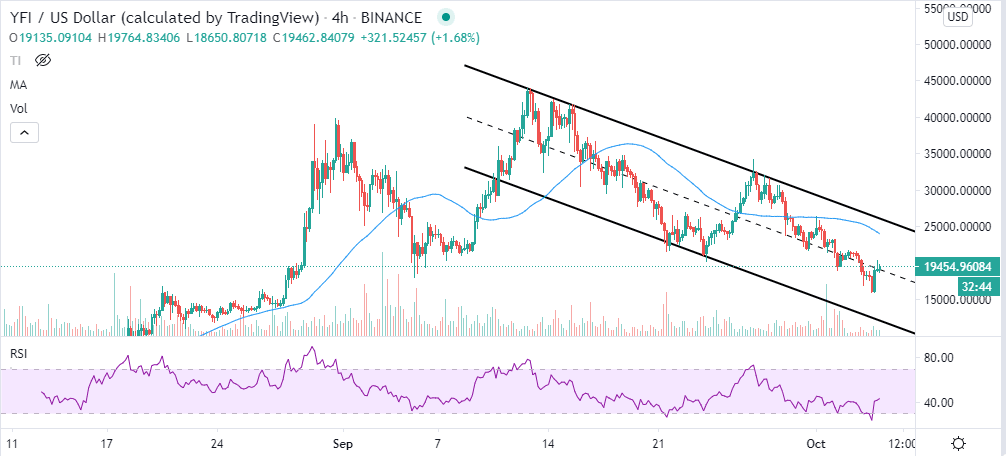

After revisiting support at $16,000, YFI is in the middle of recovery. However, to guarantee sustained gains, the short term resistance at $20,000 must come down. The Relative Strength Index (RSI) clearly shows that the odds favor the bulls. The indicator is almost crossing above the midline. If the uptrend progresses towards the overbought area, the upper leg could extend to $22,000.

The descending parallel channel highlights growing resistance towards $22,000. The channel resistance has not wavered since the all-time high. Therefore, bulls must focus on pulling above the channel to confirm a bull flag pattern.

YFI/USD 4-hour chart

Santiment’s age consumed metric highlights a spike in the movement of tokens as they change addresses. According to Santiment Academy, “age consumed shows the number of tokens changing addresses on a certain date, multiplied by the time since they last moved.” The spike on the chart mainly highlights the movement of a colossal amount of tokens following a long period where they remained idle. Spikes in age consumed tends to signal potential volatility. In this case, 4,800 YFI tokens moved on October 4. The movement happened before the ongoing volatility started.

YFI age consumed chart

%20Age%20Consumed%20chart-637374664640202251.png&w=1536&q=95)

IntoTheBlock’s IOMAP highlights a challenging path towards $22,000. The largest resistance runs from $20,600 to $21,200. Here, nearly 560 addresses previously bought 1,600 YFI. While this is the most prominent resistance, other equally strong hurdles could delay breakout to $20,000. On the flip side, the absence of a strong support area spells doom for Yearn.finance in the near term. The most significant support lies between $17,100 and $17,700, a range where nearly 130 addresses bought roughly 54 YFI.

YFI IOMAP chart

Looking at the other side of the picture

Yearn.finance bulls are taking advantage of the volatility to push their agenda for gains above $20,000 and towards $22,000. However, the descending channel’s middle boundary layer support must stay intact for some of these gains to come into the picture. Otherwise, losses could resume, testing the support highlighted by the IOMAP at $17,700 - $17,100. The same metric brings to light the tough resistance heading to $22,000. Therefore, it is doubtful that there will be a quick rally to the near term target.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637374665420006443.png&w=1536&q=95)