XRP/USD technical analysis: Ripple breaks the 0.3000 psychological mark

- Ripple is trading 6.28% higher and has just broken the 0.3000 level.

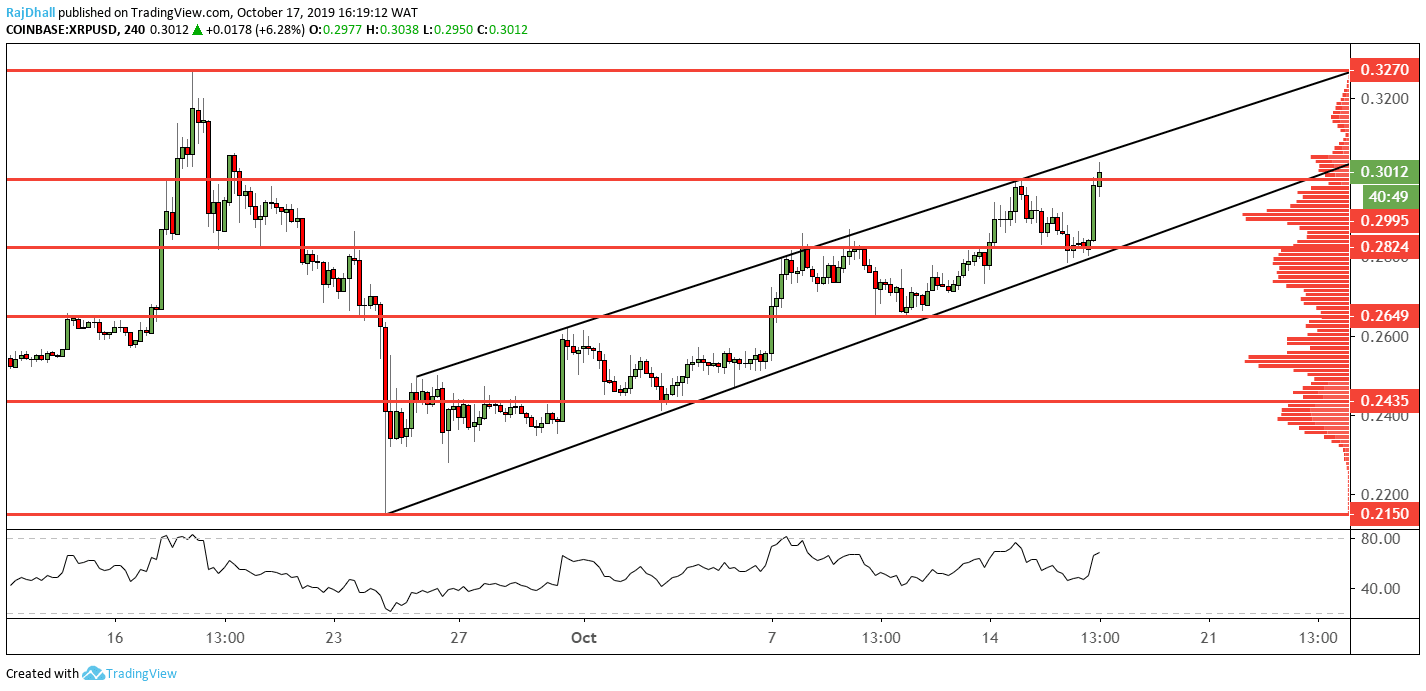

- The XRP/USD price is still in a channel formation and looks set to test the top.

XRP/USD is one of the outperformers in the cryptocurrency markets, trading 6.28% higher on the session.

The price structure interestingly stayed in an uptrend while lots of the crypto majors fell to lows in Wednesday's session.

We see why, as the trend of higher lows and higher highs continues. There was a really strong thrust higher which momentarily stopped at 0.3000 and subsequently price broke through on the next four-hour candle on the chart below.

The price is above the peak of the bell curve on the volume profile indicator and could continue to the next resistance at 0.3270, which is the wave high from September 18th.

On the daily chart, we are still in a downtrend and only if the wave high of 0.3270 is broken we can consider it a technical break in trend.

Also of note, on the relative strength index (RSI) indicator, the waves may make a lower high despite price making a higher high this is often an indication of bullish momentum running out of steam. We will have to wait and see if that is the case.

Author

Rajan Dhall, MSTA

FX Daily

Rajan Dhall is an experienced market analyst, who has been trading professionally since 2007 managing various funds producing exceptional returns.