Ripple Price Forecast: XRP bulls show no sign of fatigue amid surge in digital asset fund inflows

- XRP sits on a 25% weekly gain, underpinned by steady institutional and retail demand.

- XRP investment products saw a surge in capital inflow to $36 million last week as total net crypto fund inflows reached a record $4.4 billion.

- A spike in whale-to-exchange transactions risks XRP's uptrend if investors reduce exposure for profit.

Ripple (XRP) is gaining momentum and closing in on its all-time high of $3.66 on Monday. The bullish outlook is supported by institutional demand, which continues to drive the expansion of spot and derivatives markets. This is evidenced by the surge in capital inflow into digital asset funds, reaching a record $4.4 billion last week.

Demand propels XRP price toward all-time high

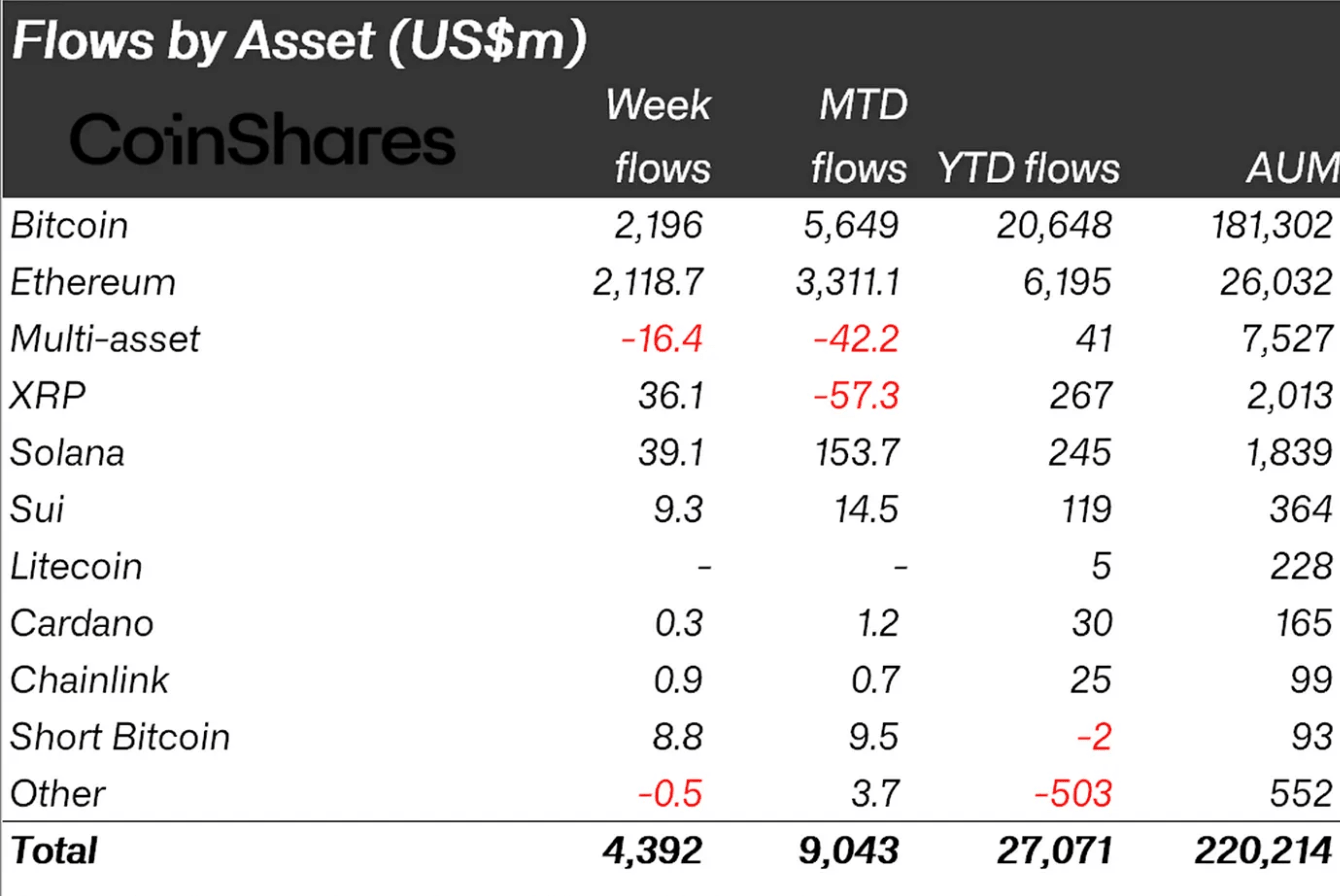

Digital investment products saw a significant increase in demand with inflows reaching $4.39 billion last week, according to a weekly CoinShares report released on Monday.

XRP-related financial products recorded a remarkable increase in the capital inflow, reaching $36 million, from posting outflows of $104 million the previous week. Their total year-to-date inflow currently stands at $267 million net with assets under management (AUM) averaging slightly above $2 billion.

Ethereum (ETH) was the best-performing cryptocurrency last week with inflows of $2.1 billion, slightly below Bitcoin's (BTC) $2.2 billion.

"Digital asset investment products recorded their largest weekly inflows on record, totalling $4.39 billion, surpassing the previous peak of $4.27 billion set post-US election in December 2024," the CoinShares report states.

Digital fund flows data | Source: CoinShares

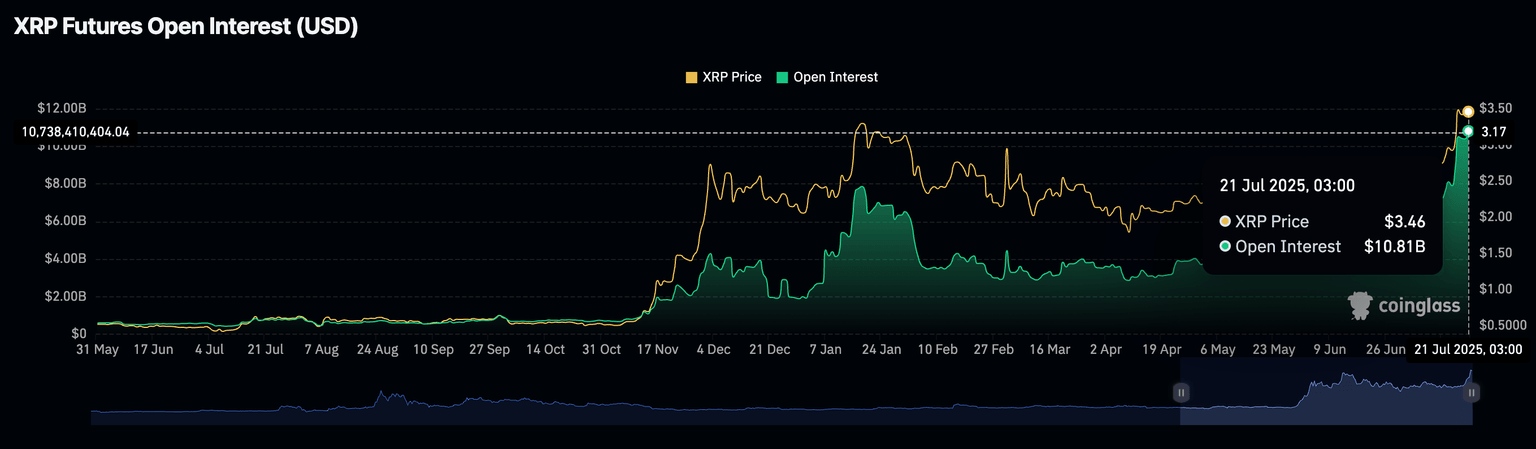

The surge in the XRP futures market's Open Interest (OI) underscores the soaring interest among traders. CoinGlass data shows that Open Interest, which represents the value of all futures and options contracts that have not been settled or closed, has expanded to $10.81 billion from a low of $3.54 billion in June. If traders continue to bet on XRP's price increasing to new record highs, OI could remain elevated in the upcoming weeks.

XRP Futures Open Interest data | Source: CoinGlass

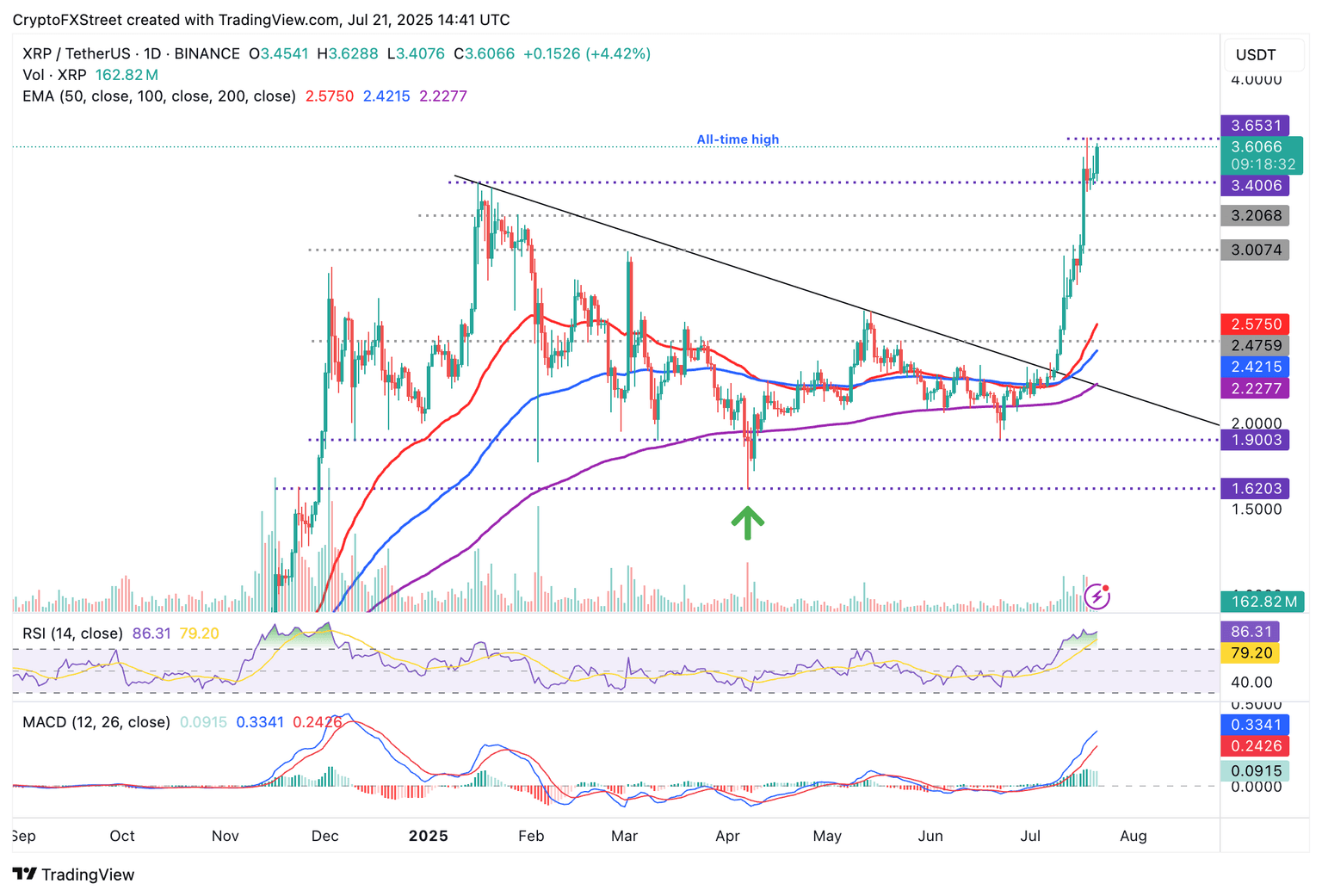

Technical outlook: XRP bulls take control

XRP price is inching closer to establishing new record highs above $3.66, supported by a strong technical structure and positive market sentiment. The Moving Average Convergence Divergence (MACD) indicator reinforces the bullish outlook, flaunting a buy signal triggered on June 28.

In addition to XRP trading significantly above key moving averages, a recently confirmed Gold Cross pattern, formed when the 50-day Exponential Moving Average (EMA) crossed above the 100-day EMA, predisposes the token for the price discovery phase.

XRP/USDT daily chart

On the other hand, traders should be aware of the sudden increase in whale-to-exchange transactions, which exceeded 43,000 on July 11, according to data from CryptoQuant. There was another smaller increase in similar transactions, reaching 4,672 on Friday, followed by a subsequent decline to 2,339.

XRP whale-to-exchange transactions (Binance) | Source: CryptoQuant

Sharp increases in this metric can have a negative impact on the price of XRP, particularly if whales sell for profit as the token trades near its all-time high.

A reversal from the current price level could result from profit-taking activities, sudden changes in market dynamics and sentiment, particularly with the implementation of United States (US) President Donald Trump's higher tariffs on August 1.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren