XRP price hits five-month high as crypto markets cheer Bitcoin's new milestone

- XRP’s bullish momentum has no sign of fatigue with the price approaching $3.00 on Monday.

- The XRP derivatives market holds steady, with the Open Interest expanding to $8.3 billion.

- XRP’s uptrend is steady despite related digital investment products experiencing $104 million in outflows last week.

Ripple (XRP) is trading around $2.95 on Monday as investors tighten their grip, increasing exposure, particularly in the derivatives market. The surge in interest in XRP can be attributed to positive market sentiment, backed by Bitcoin (BTC) price’s rally to the highest level on record above $123,000.

XRP approaching $3.00 despite capital outflow

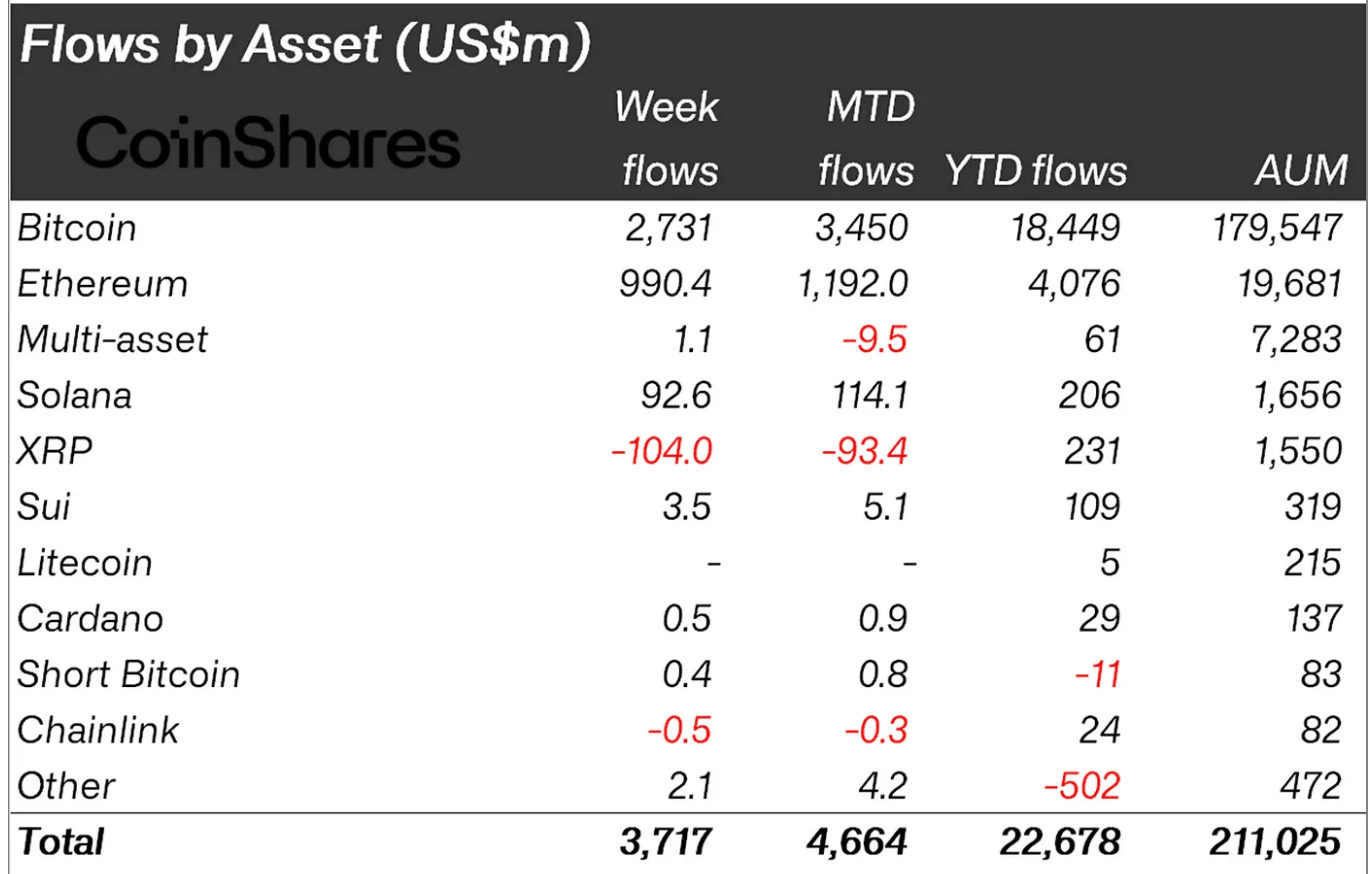

Digital investment products posted the second-largest cumulative weekly inflow volume of $3.7 billion in history. Bitcoin and Ethereum (ETH) led the bullish streak with $2.73 billion and $990 million, respectively.

According to CoinShares’ report, released every Monday, interest in XRP dropped last week with related digital investment products experiencing a total outflow of $104 million. XRP’s total assets under management (AUM) adjusted to $1.55 billion, with the year-to-date inflow averaging $231 million. Chainlink was the only other asset characterized by net weekly outflows of $500,000.

Digital asset investment products flow stats | Source: CoinShares

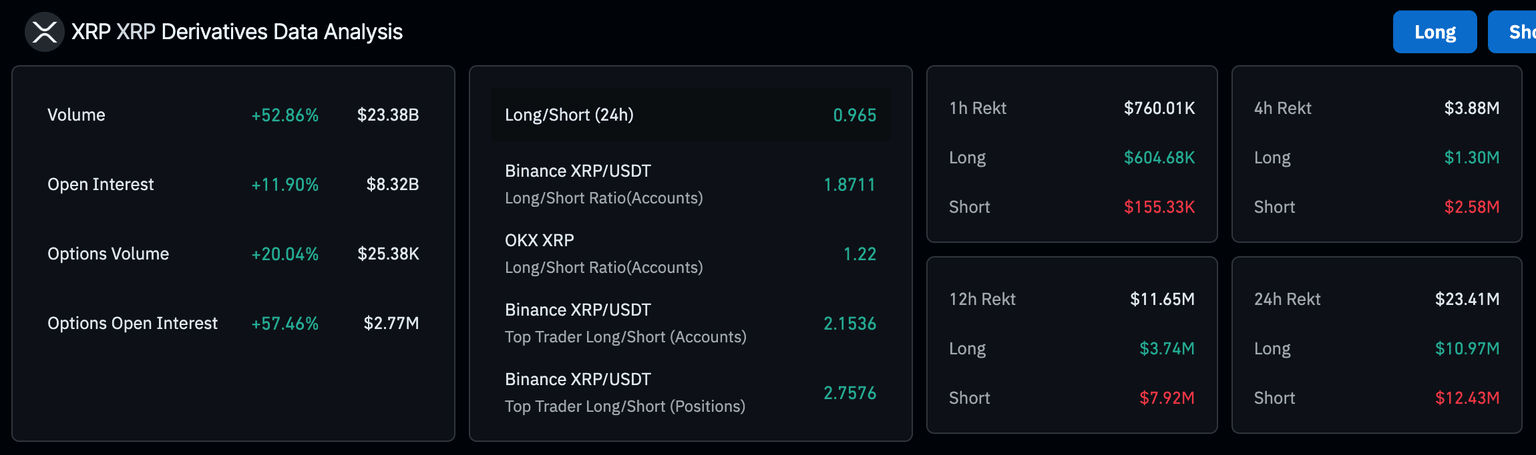

Despite the negative flows last week, retail interest seems steady based on the derivatives market outlook. CoinGlass data highlights a significant increase in the Open Interest (OI), which expanded by nearly 12% to $8.3 billion over the past 24 hours.

A subsequent 53% rise in the trading volume to approximately $23 billion in the same period underscores a strong risk-on sentiment and a surge in trading activity. In other words, traders are leaning bullish and betting that the price of XRP will continue to rise, extending the rally in the short term.

A break and daily close above the critical round-figure hurdle at $3.00 is likely in upcoming sessions, especially if the crypto market continues cheering Bitcoin’s rally to record highs.

Meanwhile, QCP Capital said in Monday’s market update that “the Crypto Fear & Greed Index has shifted dramatically, rising from 40 to 70 in just three weeks, flipping sentiment from fear to greed.”

In other words, while the market is bullish at the momentum, caution is advised as greed levels can often result in sharp reversals, especially if investors sell for profit.

The total supply in profit hit 58 billion XRP on Wednesday, underpinning the potential for sell-side pressure. With the supply on exchanges rising, as seen last week, overhead pressure could overshadow demand, thus increasing the probability of the price dropping.

XRP supply in profit data | Source: Glassnode

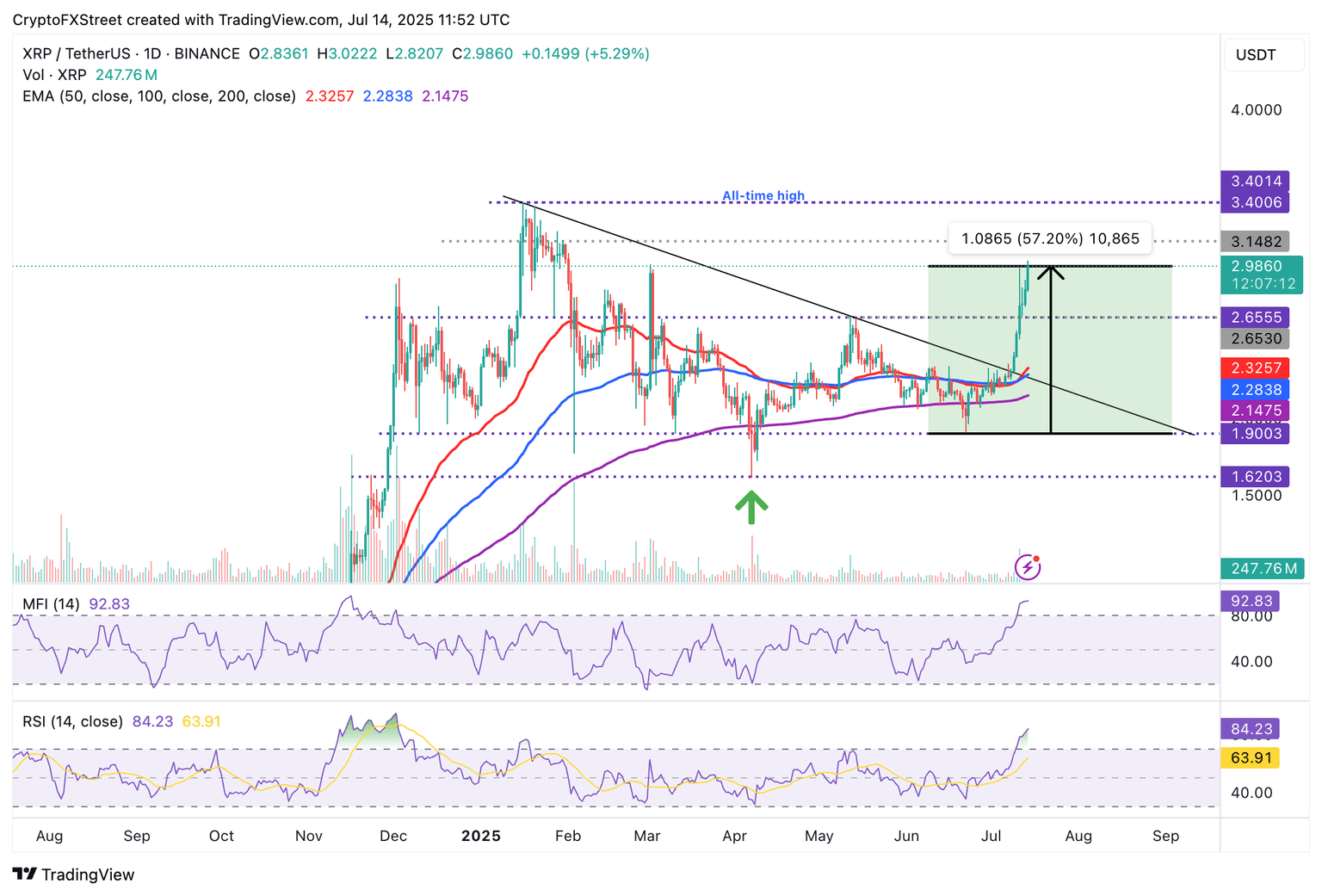

Technical outlook: XRP accelerates uptrend, eyeing $3.00

XRP is closing in on the $3.00 critical level, showing that bulls are expanding their scope to record highs at around $3.40. The path of least resistance holds upward, backed by the steady rise of the Money Flow Index (MFI) indicator to 92 on the daily chart below.

The MFI indicator tracks the amount of money entering and leaving XRP. If the uptrend persists, risk-on sentiment could buoy XRP’s rally.

However, since the indicator is heavily overbought, traders should tread carefully, keeping in mind that overhead pressure could result in a sudden trend reversal, fueled by profit-taking activity and the change in sentiment in the broader cryptocurrency market.

XRP/USDT daily chart

Still, the Relative Strength Index (RSI) flaunts overbought levels at 84, which could keep the uptrend steady in the short term. A technical reversal would not be a far-fetched idea, especially due to the same overbought conditions. Hence, there’s a need to keep eyes glued on XRP price behavior around the immediate $3.00 resistance level. Tentative support levels include May’s peak at $2.65 and the 50-day Exponential Moving Average (EMA) near $2.32.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren