XRP Price Prediction: Ripple bulls not in a secure position, pattern projects 25% decline

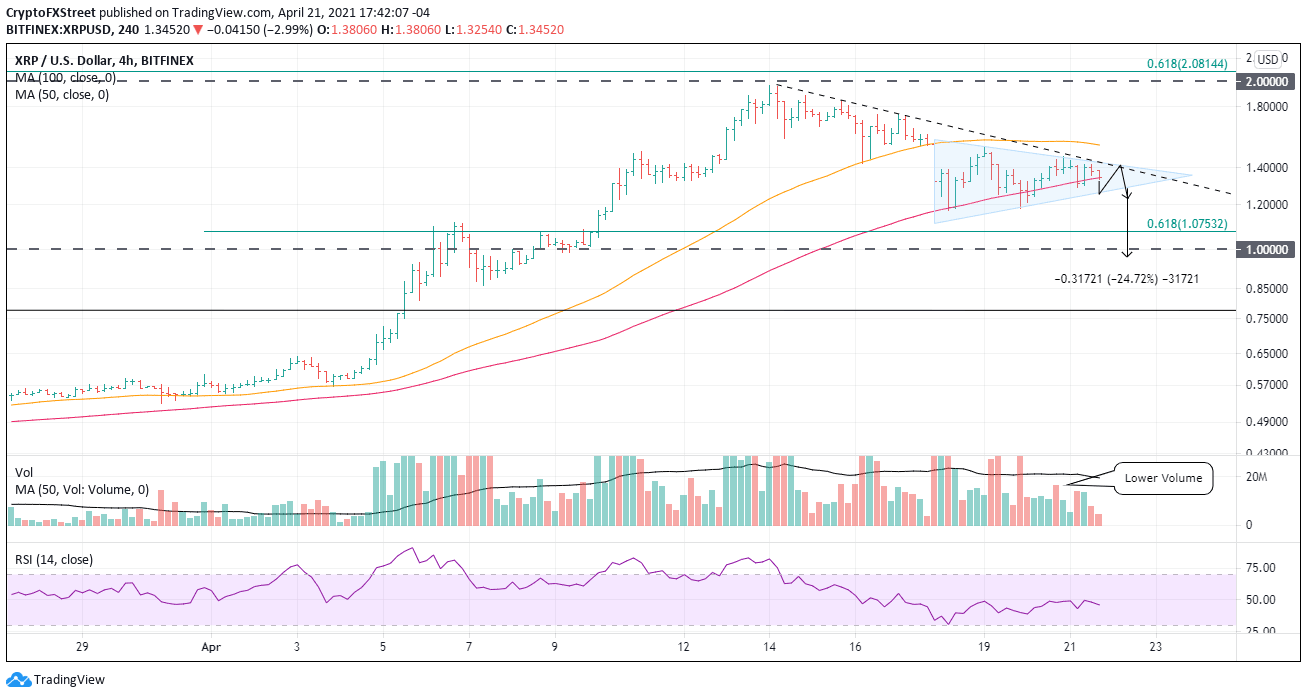

- XRP price indecision is forging a symmetrical triangle on the intra-day charts.

- 100 four-hour simple moving average (SMA) playing a role in the consolidation.

- New SEC Chairman showing no signs of backing away from high-stakes lawsuit.

XRP price rebound following the Sunday crash has moved from being impulsive to corrective, suggesting the consolidation of the past three days is just releasing the price compression of the crash rather than putting in a firm bottom.

XRP price oscillators are best managed with patience

The new United States Security and Exchange Commission Chairman Gary Gensler instructs the SEC to march forward with the case against Ripple executives that alleges that they sold the XRP token without registering it as a security.

The Wednesday filing requested that the federal judge block Ripple’s demands that the regulator hand over internal emails and other communications on the executive’s electronic devices. Additionally, the SEC accused Ripple of harassing the agency and “gamesmanship with respect to discovery.”

It is a new twist in a case with ramifications for other cryptocurrencies. Still, it is a minor blow to the eager market participants that drove up the Ripple price the last two weeks on speculation the new SEC Chairman would not pursue the case any further.

There is not much room left to fill the symmetrical triangle with the descending trendline from the April high, not far above the price. The measured move target of the symmetrical triangle is almost 25% which would carry Ripple down to $0.96, just below the psychologically important $1. The altcoin may find brief support at the 61.8% Fibonacci retracement of the April rally at $1.07

XRP/USD 4-hour chart

Ripple needs a daily close above the upper trend line of the symmetrical triangle and the declining trend line from the April top to void the bearish scenario. If that occurs, the international settlements token will find some resistance at the 50 four-hour SMA at $1.53 before a full-fledged rally back to the April high at $1.96.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.