XRP Price Prediction: One wrong move could put Ripple at risk of a 70% nosedive

- XRP price is not out of the woods yet as a 70% decline is on the radar.

- The last line of defense for Ripple is at $0.58 before the bears target $0.18 next.

- The bulls must reclaim $0.63 to void the pessimistic outlook.

XRP price is at risk of a significant move to the downside after it dropped below a critical line of defense. If Ripple slides below $0.58, the bulls can expect further losses as the prevailing chart pattern puts a 70% decline on the radar.

XRP bulls must reclaim $0.63

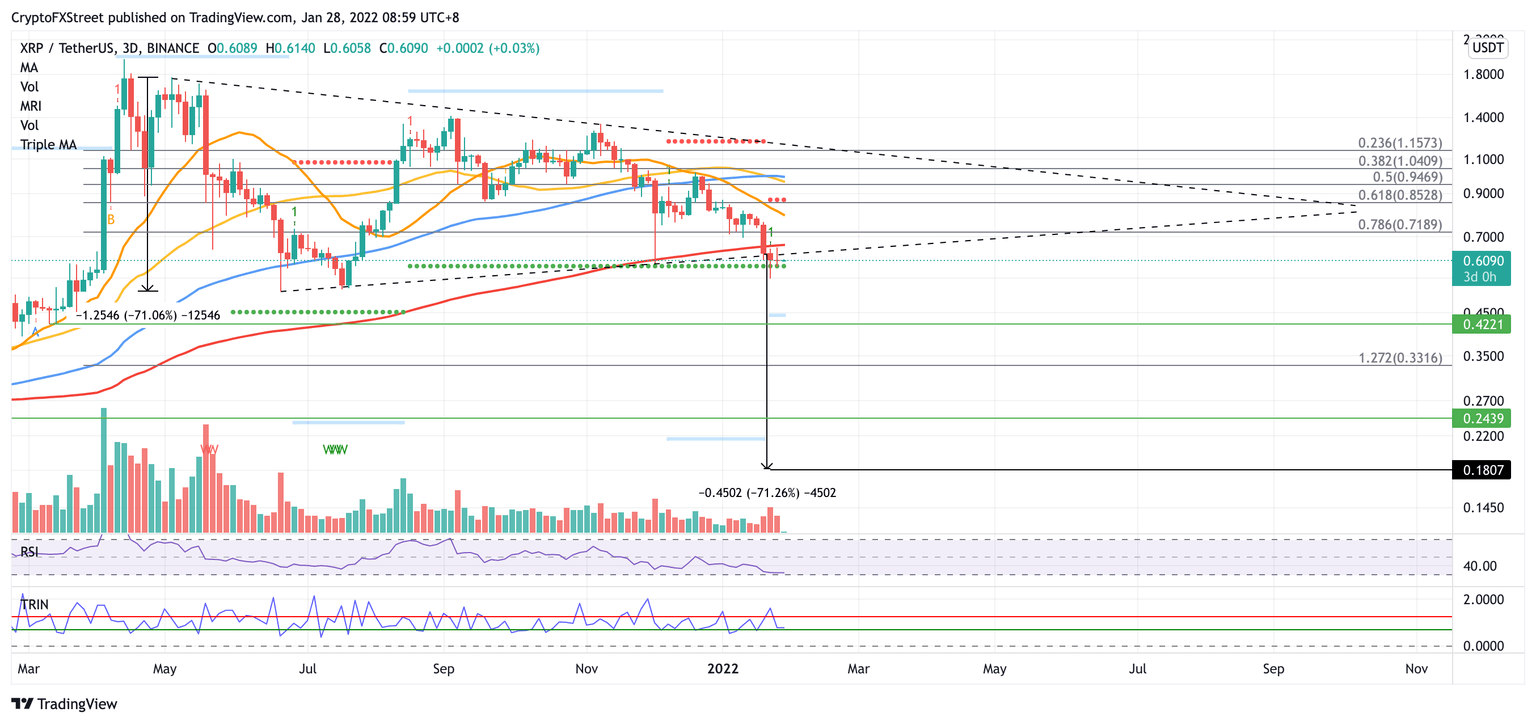

XRP price has sliced below the lower boundary of the symmetrical triangle pattern on the 3-day chart, indicating that a 70% plunge toward $0.18 could be in the offing.

The last reliable line of defense before the anticipated plunge is at the support line given by the Momentum Reversal Indicator (MRI) at $0.58. If Ripple faces additional selling pressure, XRP price could drop toward the March 11 low at $0.42.

An additional foothold may emerge at the 127.2% Fibonacci extension level at $0.33, before XRP price slides further toward the January 28 low at $0.24. A catastrophic spike in sell orders may push Ripple lower toward the pessimistic target at $0.18.

However, if XRP price manages to reclaim the lower boundary of the governing technical pattern at $0.63 as support, the bearish outlook may be voided.

Ripple will face an additional hurdle at the 200 three-day Simple Moving Average (SMA) at $0.66, then at the 78.6% Fibonacci retracement level at $0.71.

XRP price could be confronted with another stiff obstacle at the 61.8% Fibonacci retracement level at $0.85, where the resistance level also sits.

XRP/USDT 3-day chart

If the bulls manage to reverse the period of underperformance and slice above the aforementioned headwinds, XRP price will aim to tag $0.98, where the 50 three-day SMA and the 100 three-day SMA intersect.

If XRP price surges above the upper boundary of the governing technical pattern, the bulls could target bigger aspirations at the November 9 high at $1.34.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.