XRP Price Prediction: One more pump then a dump

- XRP price has established two legs of a triangle.

- If the technicals are correct, XRP could rally to $0.56 and then experience a sharp sell-off.

- Invalidation of the triangle thesis targeting $0.56 iis a breach below $0.4564.

Ripple's XRP price could be on its way toward $0.56. Still, caution should be applied as the technicals suggest the uptrend could be the final wave before a reversal.

XRP price back to $0.56

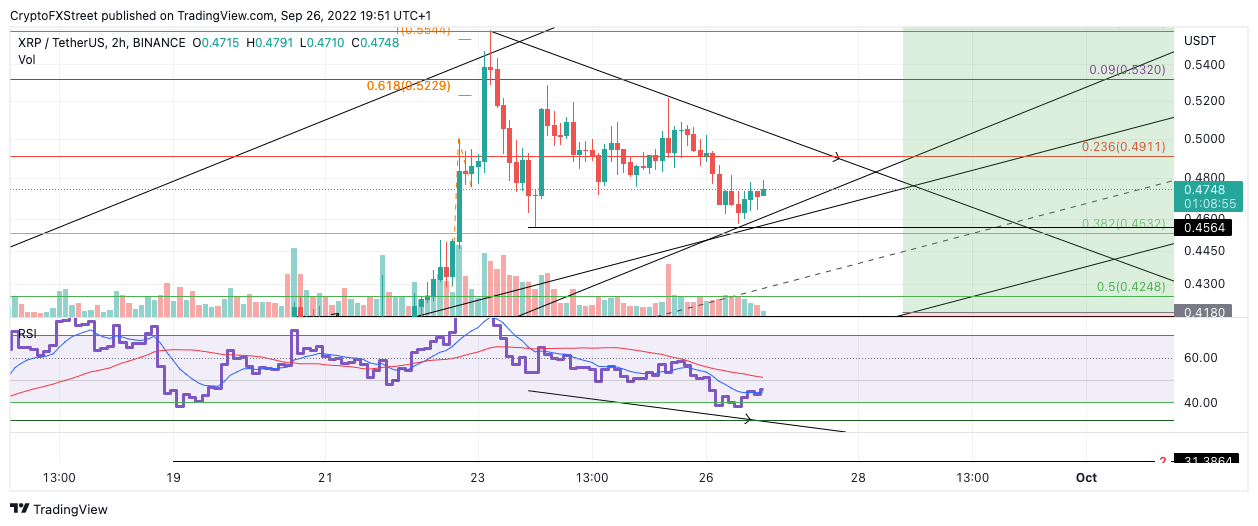

XRP price could set up a 14% rally targeting the recently established monthly high at $0.5590. On Monday, September 26, the bulls rebounded after an early morning sell-off. The RSI shows a divergence between the current lows and the previous swing at $0.4564. If the newfound low at $0.4576 holds as support, a triangle is likely underway for the digital remittance token.

XRP price currently auctions at $0.4745. Amidst the consolidation, the volume is still reading less than the last 75% bull run that occurred last week. The technicals suggest that Ripple will remain range bound for a few more days between $0.45 and $0.51. Using the triangle's largest swing, a 14% rally could occur targeting the $0.56, but currently, the confirmation needed would be a breach above the September 25 swing high at $0.5215.

XRP USDT 2-Hour Chart

Investors should remember that triangles are usually the last pattern displayed before a trend reversal occurs. While the $0.4564 holding as support is good for short-term bullish scalpers, the uptrend since the low $0.325 could be in jeopardy in the long run. The bears could jump into the market with extreme force near the $0.56 zone. Such a decline would result in a 30% dip in the current XRP price.

Invalidation of the triangle thesis targeting $0.56 is a breach below $0.4564. If the bears breach this level an additional 11% decline targeting previous resistance at $0.41 would be a probable bearish target.

In the following video, our analysts deep dive into Ripple's price action, analysing key market interest levels. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.