XRP Price Forecast: Ripple could be on the verge of a breakout to $0.40

- For the past two weeks, XRP price has been trading sideways.

- The digital asset has experienced a significant loss in trading volume after the SEC decided to sue Ripple.

After losing more than 60% of its value in December 2020, XRP has been trading sideways without much action throughout 2021. The SEC has sued Ripple alleging that it conducted illegal sales of XRP which they consider a security. As long as the SEC doesn’t call a final decision, XRP price could remain trading sideways.

XRP price might have some hope of a breakout

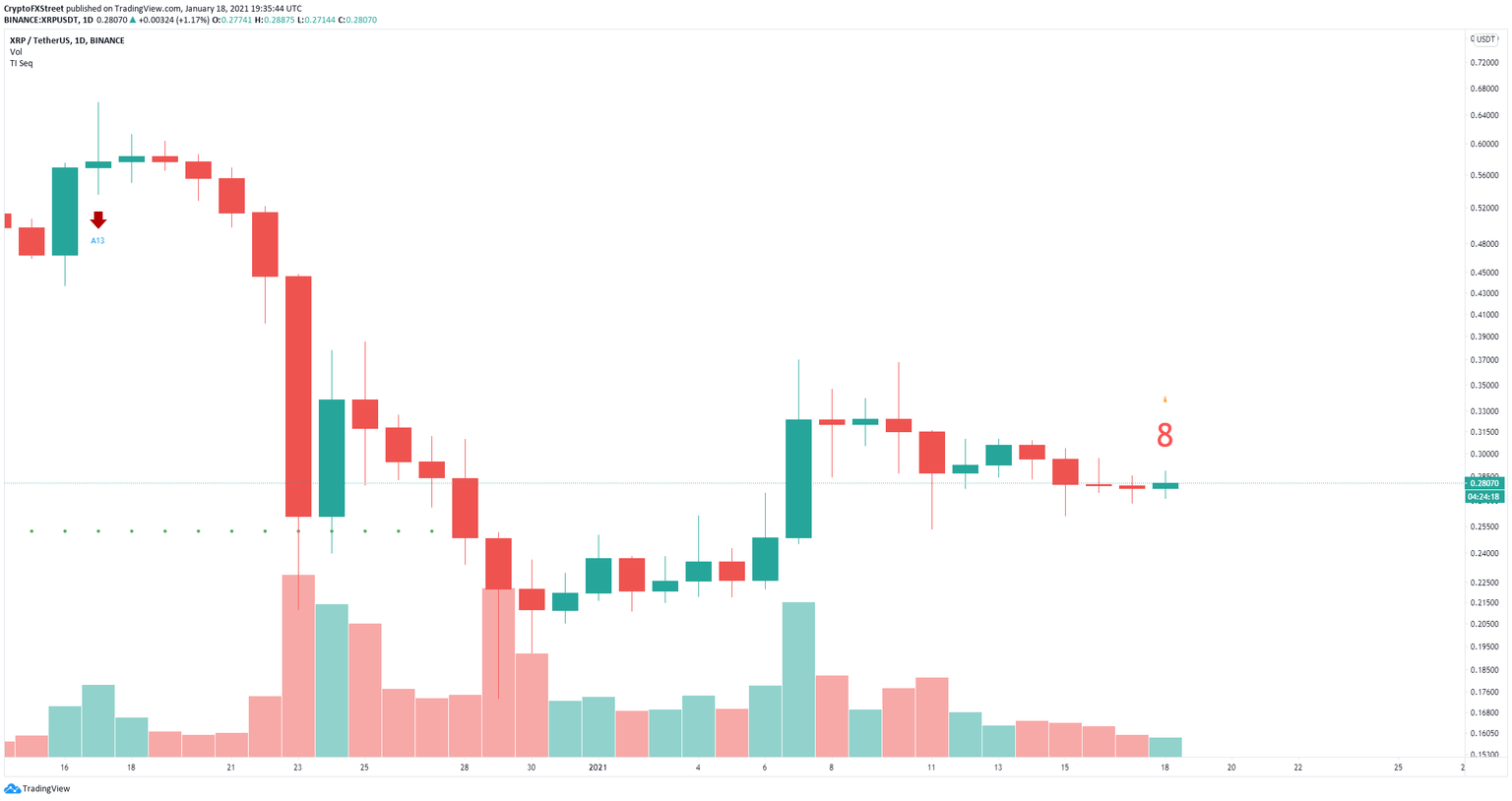

Although most of the recent price action for XRP has been flat, on the daily chart, the TD Sequential indicator has presented a red ‘8’ candlestick which is usually followed by a buy signal.

XRP/USD daily chart

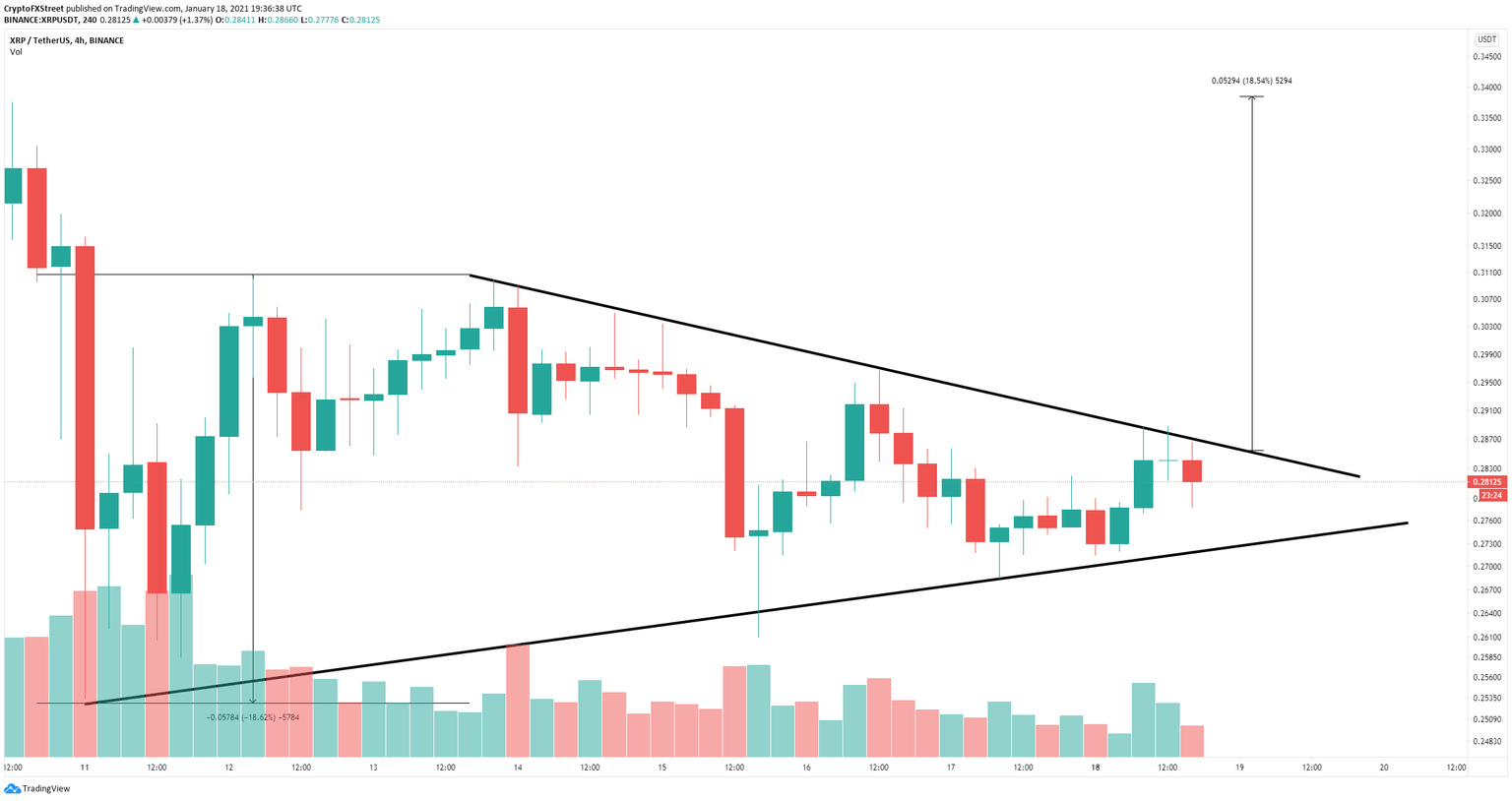

On the 4-hour chart, XRP has established a symmetrical triangle pattern which is on the verge of breaking out. If the daily buy signal gets confirmed, the likelihood of XRP price cracking the resistance level at $0.285 increases.

XRP/USD 4-hour chart

A breakout above this crucial resistance level could quickly push XRP price towards $0.34 but even as high as $0.40 in the longer-term as there is not a lot of resistance on the way up.

XRP Holders Distribution chart

Unfortunately, in the past two weeks, the number of whales holding at least 10,000,000 XRP coins has decreased by 10 which indicates large holders are getting rid of XRP. Losing the $0.27 support level would send XRP price down by 18%.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.38.21%2C%252018%2520Jan%2C%25202021%5D-637465958089601037.png&w=1536&q=95)