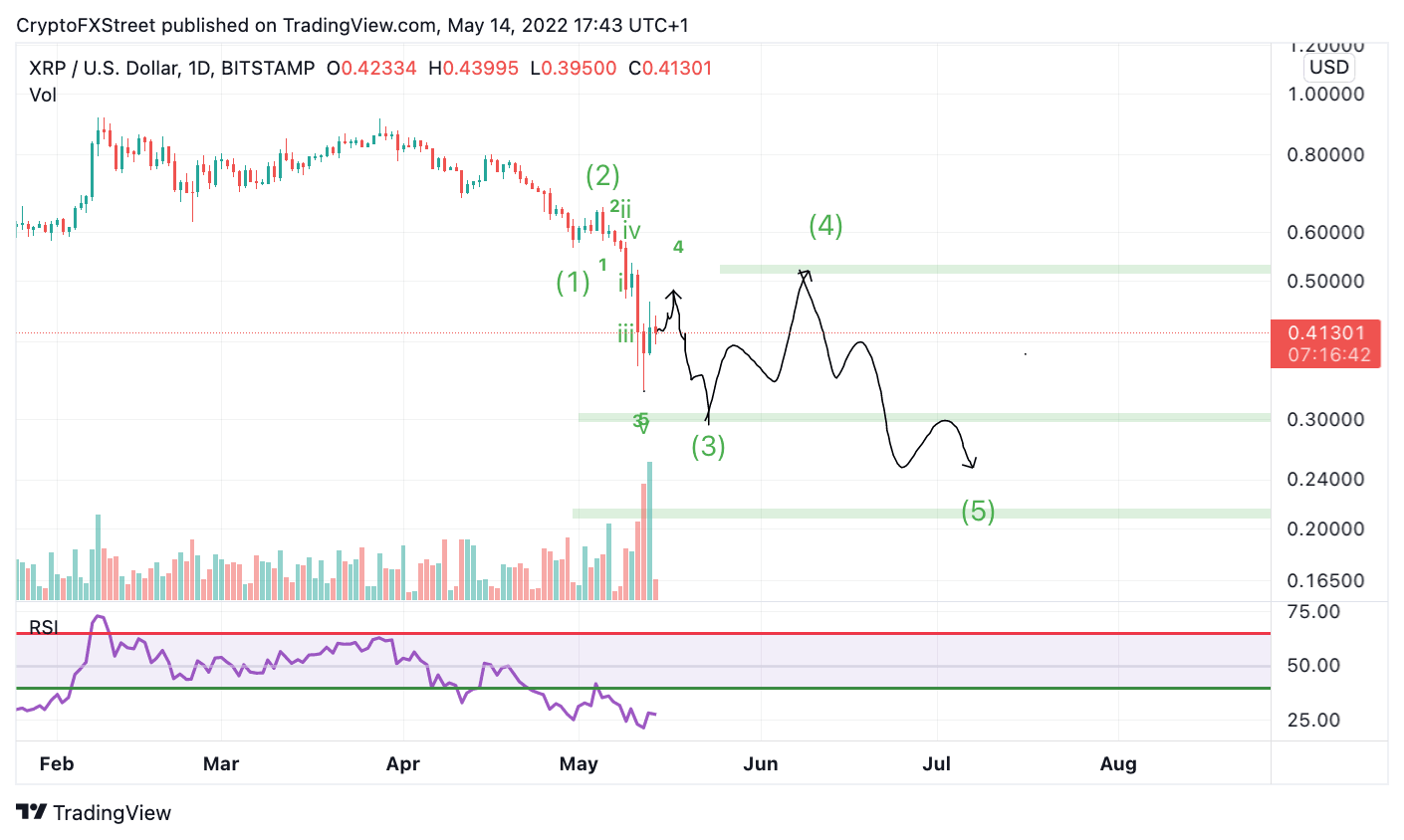

XRP price could sweep the lows before a countertrend rally towards $0.50 occurs

- Ripple price has printed the largest bearish engulfing candle within the trend on the 2-day chart.

- XRP price is unfolding as an extending impulse wave

- Invalidation of the bearish downtrend is a breach above $0.58

Xrp price could become a favorable chart for intraday trading. Here's the scenario to be aware of.

XRP price Unfolding as a Zig-Zag C Wave

XRP price has been on a steep decline as the bears are wiping out liquidity levels dating back to February 2021. Analyzing the technicals, the bears are picking up steam as a large bearish engulfing candlestick has been printed on the 2-day chart. Elliott Wave theory suggests this move is just halfway from the intended target. The following bearish targets lie around $0.30 and 0.28 cents.

XRP price could sweep the current monthly lows at $0.33 in the days to come. However. The technicals also indicate a need for a retracement back into the 4th wave of a previous degree to complete this extending impulse pattern. Thus a profitable buy opportunity could present itself in the coming days for swing traders. A deep and time-consuming wave 4 (relative to wave the wave two correction) is a probable scenario for the XRP price. Traders could look for an impulsive rally into the $0.50 levels.

If the technicals in this chart are correct, The future countertrend rally is set to be a deep wave four retracement into $0.50, but it should not exceed the $0.58 level. If the $0.58 level is breached, the entire downtrend could be terminated. The bulls could then re-route towards $1.16, resulting in a 100% increase from the current XRP price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.