XRP price could bleed another 9% as traders realize over $130 million in losses

- XRP traders have realized $130.24 million in losses since the beginning of January as Ripple price declines.

- XRP active addresses have decreased by 34% since January 1, signaling a decrease in demand and relevance of the altcoin.

- XRP price is at risk of a fall to $0.50, a 9% drop from the current level.

XRP price is in a downward trend that has shed around a quarter of the altcoin’s value in the last few months. The price decline came even as the community anticipates the approval of a Spot XRP ETF after the recent approval of the Bitcoin ETFs by the SEC. Still, investors with XRP holdings have realized losses in large numbers in January, on-chain data shows, putting Ripple’s token on the path for another 9% decline if the current trajectory persists.

XRP holders realize over $130 million in losses

According to on-chain data from crypto intelligence provider Santiment, XRP holders have realized $130.24 million in losses since January 1.

In this period, there have been consistent spikes in the Network Realized Profit/Loss metric that indicate traders are realizing losses.

Network Realized Profit/ Loss. Source: Santiment

XRP’s active addresses are also on a decline, as seen on Santiment data. There is a 34% decrease in Ripple’s active addresses between since the beginning of the year. This signals a drop in demand and activity of XRP holders.

XRP active addresses. Source: Santiment

XRP price at risk of 9% decline

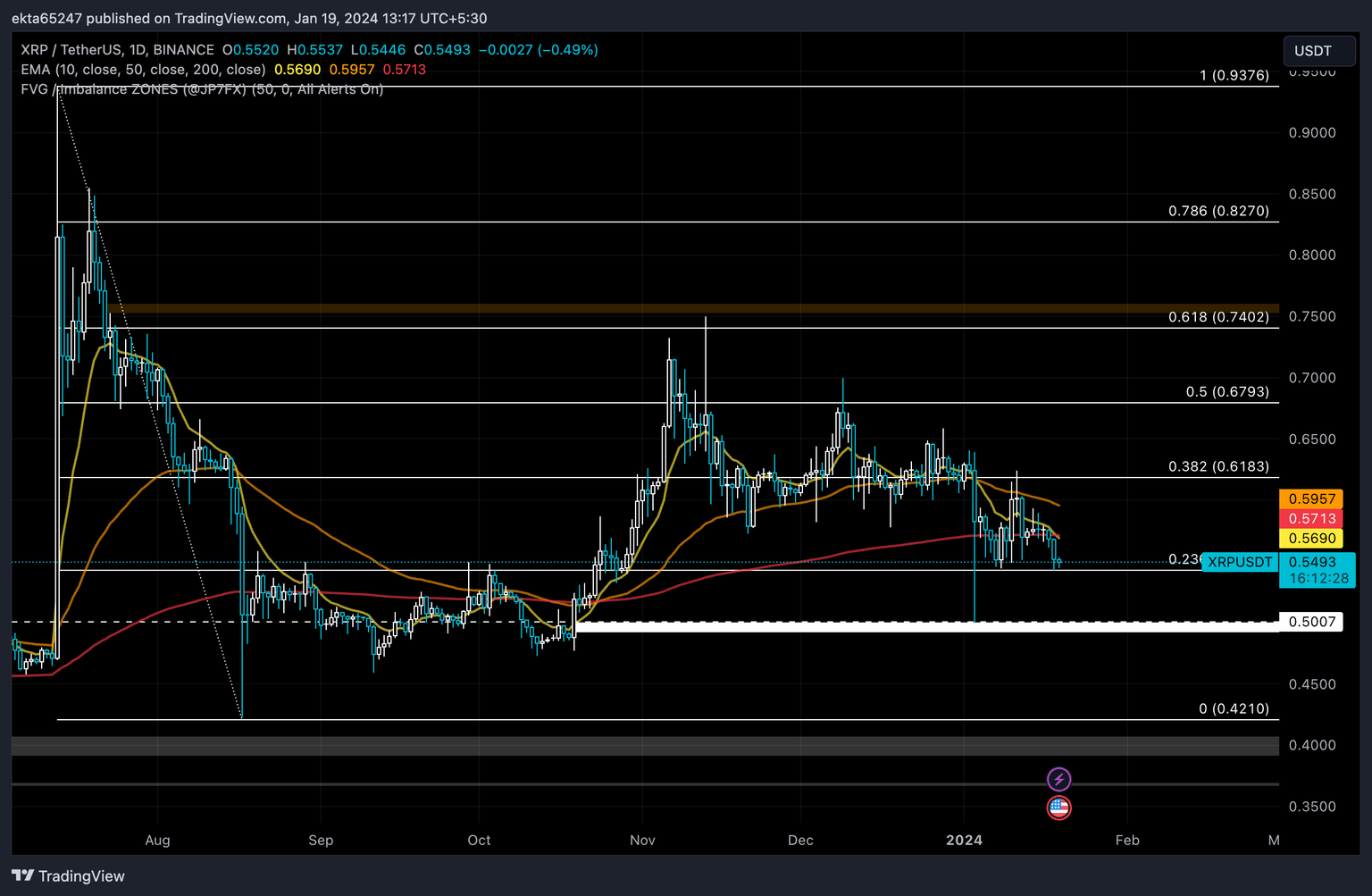

XRP price is in a downward trend that started on November 13. Since then, XRP price suffered a 26.94% decline. At the time of writing, XRP trades below its three long-term 10-day, 50-day, and 200-day Exponential Moving Averages (EMAs), at $0.5688, $0.5956, and $0.5713, respectively.

If falls persist, XRP price could find support at $0.5429, the 23.6% Fibonacci retracement level of the decline seen from July to August. In the event of a further drop in the asset’s price, XRP could hit the upper boundary of the bullish imbalance zone at $0.5007, as seen in the chart, a 9% drop from the current price.

XRP/USDT 1-day chart

A daily candlestick close above the 10-day EMA at $0.5690 could invalidate the bearish thesis for XRP price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B12.26.44%2C%252019%2520Jan%2C%25202024%5D-638412489722073269.png&w=1536&q=95)

%2520%5B12.26.39%2C%252019%2520Jan%2C%25202024%5D-638412490233866478.png&w=1536&q=95)