XRP consolidation continues, bulls wait for a breakout to $0.80

- XRP price congestion continues, extending its length to ten days.

- Trade opportunities for bulls and bears are now present.

- Further downside pressure remains strong.

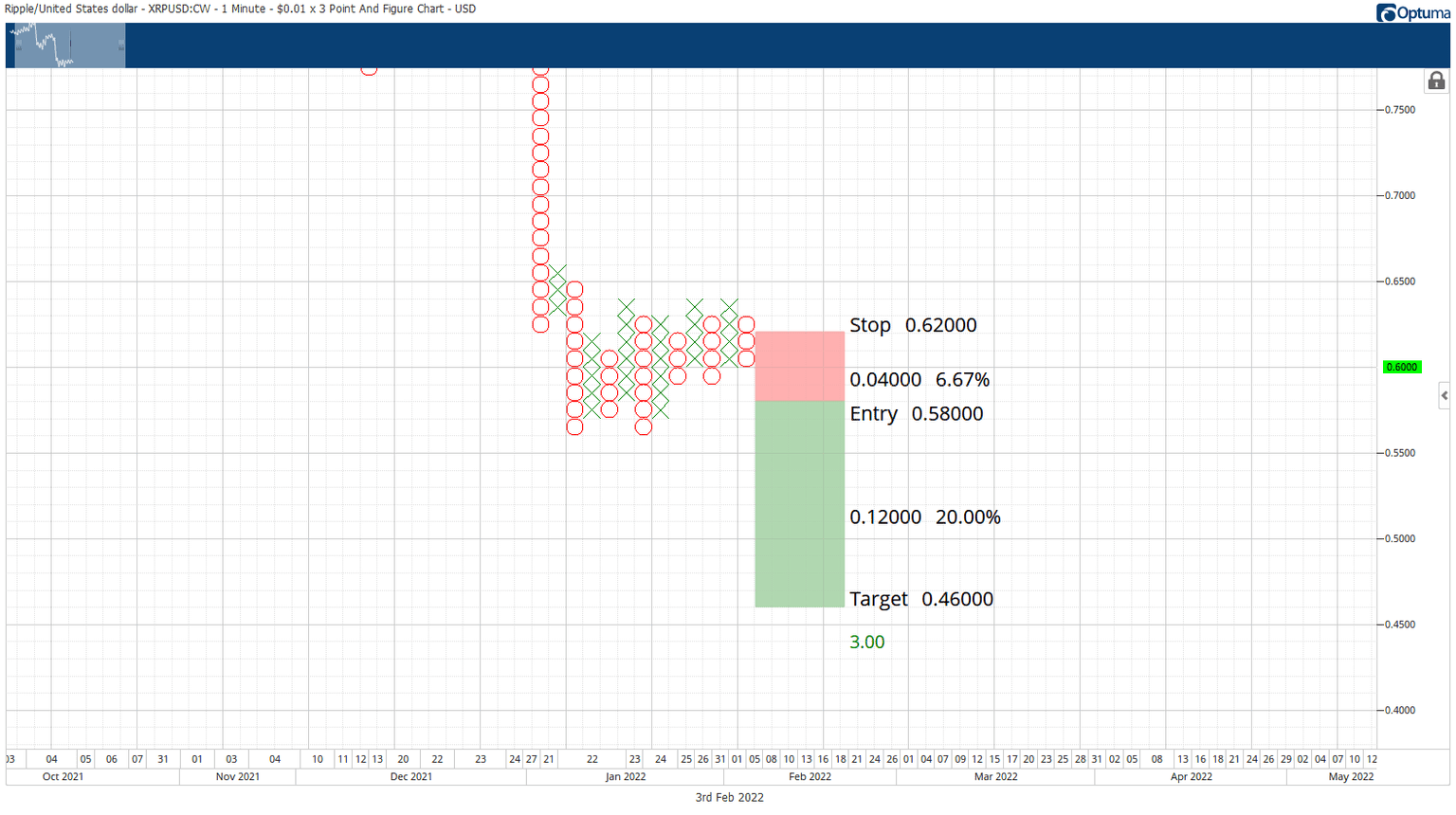

XRP price continues to consolidate in a relatively tight trading range between $0.58 and $0.62. However, the time spent in this sideways movement creates confusing and difficult trading conditions, especially on a time-based chart like Japanese candlesticks.

XRP price action develops trade setups for the long and short sides of the market

XRP price could see some explosive moves soon – the question is where the breakout will occur and in which direction. From the perspective of a Japanese candlestick chart, that can be a difficult task even within the Ichimoku Kinko Hyo system. However, Point and Figure charting clears much of the ‘noise’ and provides a clearer vision for the future.

On the long side of the market, the hypothetical setup is a buy stop order at $0.65, a stop loss at $0.61, and a profit target at $0.80. The entry is based on the breakout above a triple-top pattern that would develop at $0.64. It could also be interpreted as a split quadruple-top breakout.

The long entry represents a 3.75:1 reward/risk with an implied profit target of nearly 24% from the entry. Because trades rarely reach their full profit target potential, a two to three-box trailing stop would help protect any implied profit. The trade is invalidated if the current O-column moves to $0.57.

The theoretical short setup is a sell stop order at $0.58, a stop loss at $0.62, and a profit target at $0.46. The entry is based on a triple-bottom breakout that simultaneously confirms a breakout below a bear flag.

While the profit target identified is at $0.46, any drop from the present value area would likely face firm support and buying pressure at the psychological and technical price level of $0.50. A two-box trailing stop would help protect any profit made post entry. The XRP price short setup has the least profit potential compared to the long setup.

The short setup is invalidated if a new X-column forms and moves up to $0.67.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.