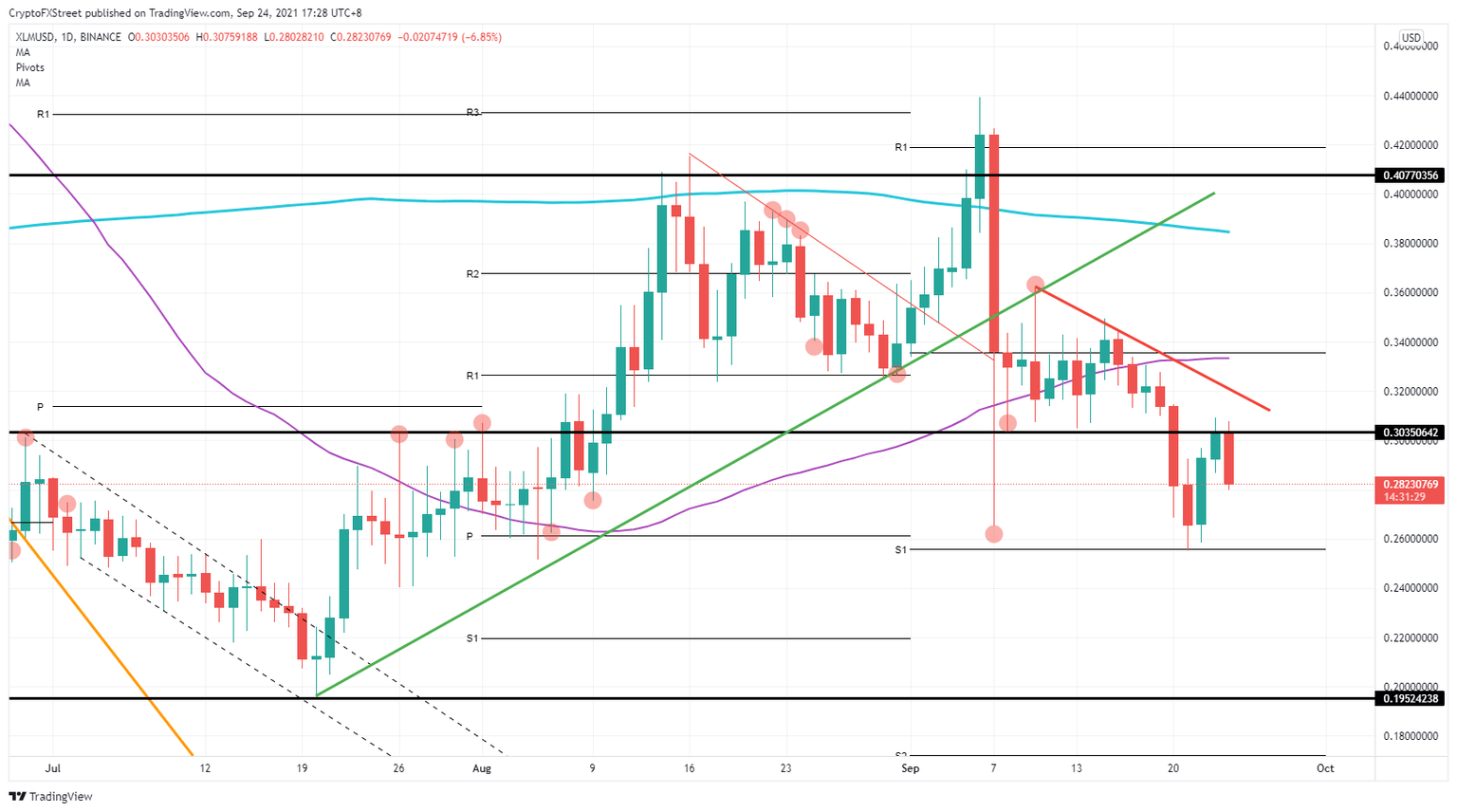

XLM Price Prediction: Stellar traps bulls as it targets $0.195

- Bulls picked up Stellar coins at the monthly S1 pivot near $0.26

- Although Stellar price action looks to claw back, a bear trap appears to be forming.

- A bull trap would spell bad news for XLM price action that could fall to $0.19

Since Wednesday, the Stellar (XLM) price has been paring back losses, but price action has already started to fade on XLM. Bulls cannot push the price above $0.30, and XLM price has startedto form a bull trap. A further downturn would spell more buyers' headaches as the downtrend would still be intact and attract more sellers to the stage.

Stellar bulls worries as downtrend look to be intact

Stellar price looked to favor the bulls on Thursday as price action in XLM tried to push above $0.30. With the price fading today, it seems as if a bull trap is being formed. Price not getting back above the $0.30 level spells bad news for the buyers in Stellar. As that $0.30 level starts to drift away, buyers will start closing their positions, giving sellers the chance to drive price action further down. With not many supporting factors in the way, expect a retest of the monthly S1 supporting pivot at $0.26.

XLM price will not stop there, and buyers will get stopped out upon the stops that they placed just below the S1 monthly support. As this will prove that the downtrend in Stellar price action is still very much intact, expect a break lower $0.20. With the confirmation of that downtrend, sellers will add short positions along the way as there are few places where buyers will step in between $0.26 and $0.20.

XLM/USD daily chart

Except with the downtrend, sellers stay in charge of the Stellar price until some supporting grounds can be found where buyers might start to go long again when Stellar has been discounted enough in its price. That level looks to be $0.20, which is the low of last summer and has proven its importance on two occasions already.

Should any favorable tailwind reemerge and XLM push price action back toward the buyers, expect a shift in sentiment back toward $0.30. It would be imperative, however, that a daily or even a weekly close above there is needed to break the downtrend unfolding at the moment.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.