XLM price eyes 20% ascent as Stellar bulls reappear

- XLM price seems to be coming around after almost a week of consolidation.

- A resurgence of buying pressure is likely to push Stellar up by 21% to $0.388.

- If the sellers breach the $0.299 support floor, it will invalidate the bullish thesis.

XLM price experienced a nasty drop between September 6 and September 7. However, the buyers stepped in cauterized the wound. Since then, Stellar has been coiling up, waiting for a massive and volatile move.

XLM price to restart its uptrend

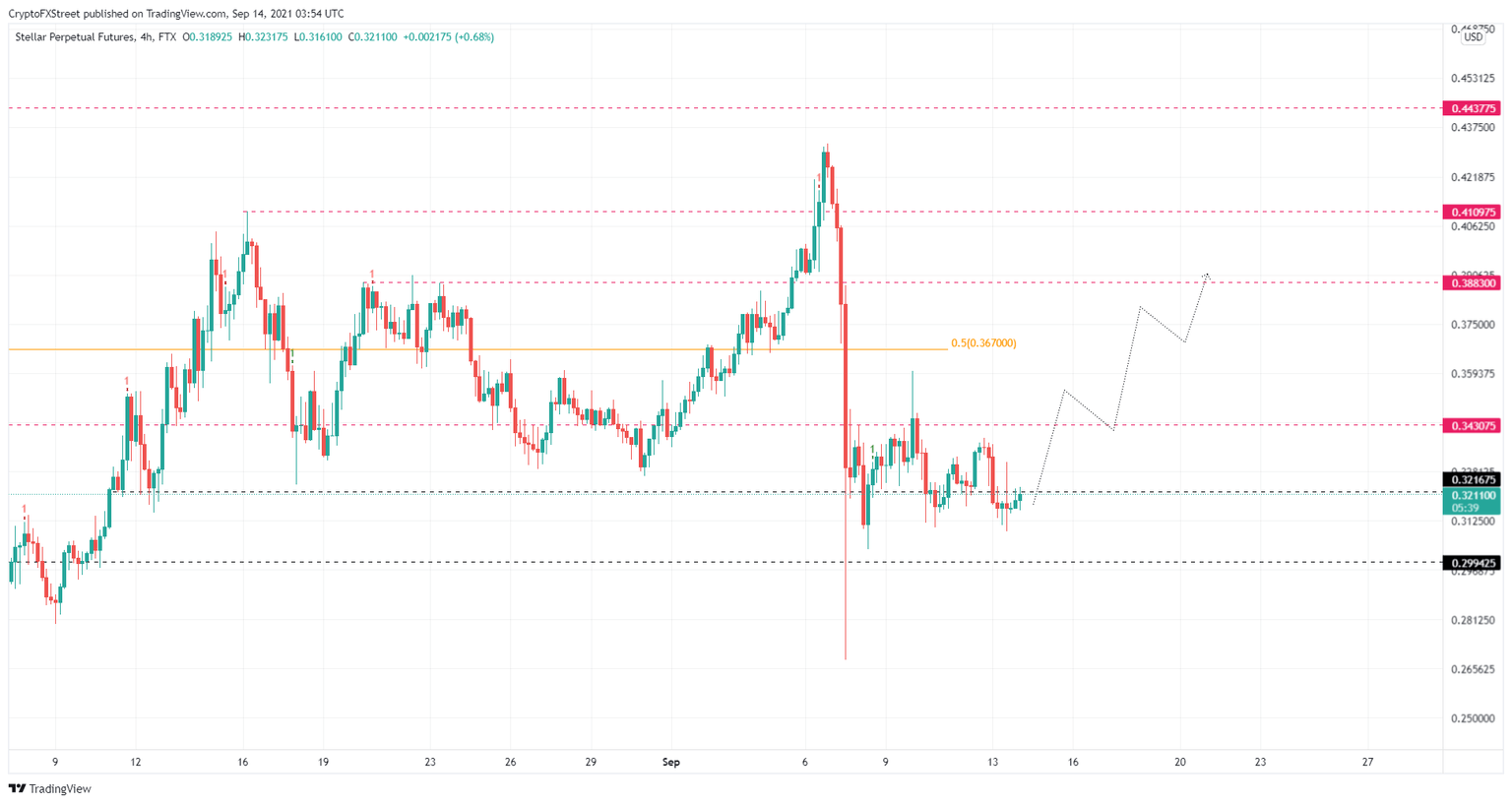

XLM price dropped 38% over 16 hours starting on September 6. However, the recovery pushed Stellar back to $0.33, where it has been consolidating over the past week. While the sideways movement shows no directional bias yet, the overall market structure looks bullish for altcoins.

Therefore, investors can expect XLM price to shatter through the immediate resistance level at $0.343 to kick-start the new uptrend.

Doing so will open the path for Stellar bulls, but this journey up is not without hurdles. The buyers need to slice through the 50% Fibonacci retracement level at $0.367, followed by a retest of the $0.388 ceiling.

This move from the current position to $0.388 would constitute a 21% ascent, but in some cases Stellar could continue the climb to tag the $0.411 hurdle.

XLM/USDT 4-hour chart

Regardless of the bullish outlook in the general cryptocurrency market, a massive spike in selling pressure could undo the optimism. A failure to slice through the $0.322 might knock XLM price down to $0.299.

A decisive 4-hour candlestick close below this support floor will invalidate the bullish thesis. In such a case, Stellar could revisit the September 7 swing low at $0.268.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.