XLM Price Prediction: Stellar is under heavy pressure as bears target $0.36

- XLM price momentum is weakening as it continues consolidating after peaking at $0.61 on February 13.

- Losing the 50 four-hour moving average as support could see Stellar take a 23% nosedive.

- Nonetheless, this cryptocurrency could advance higher if bulls defend the 50 four-hour moving average.

XLM price saw a roughly 400% surge since the beginning of the year. Since investors have taken advantage of the rising price action to book profits, the increasing selling pressure appears to be wearing down Stellar’s market value.

XLM price is in the vicinity of a potential sell-off

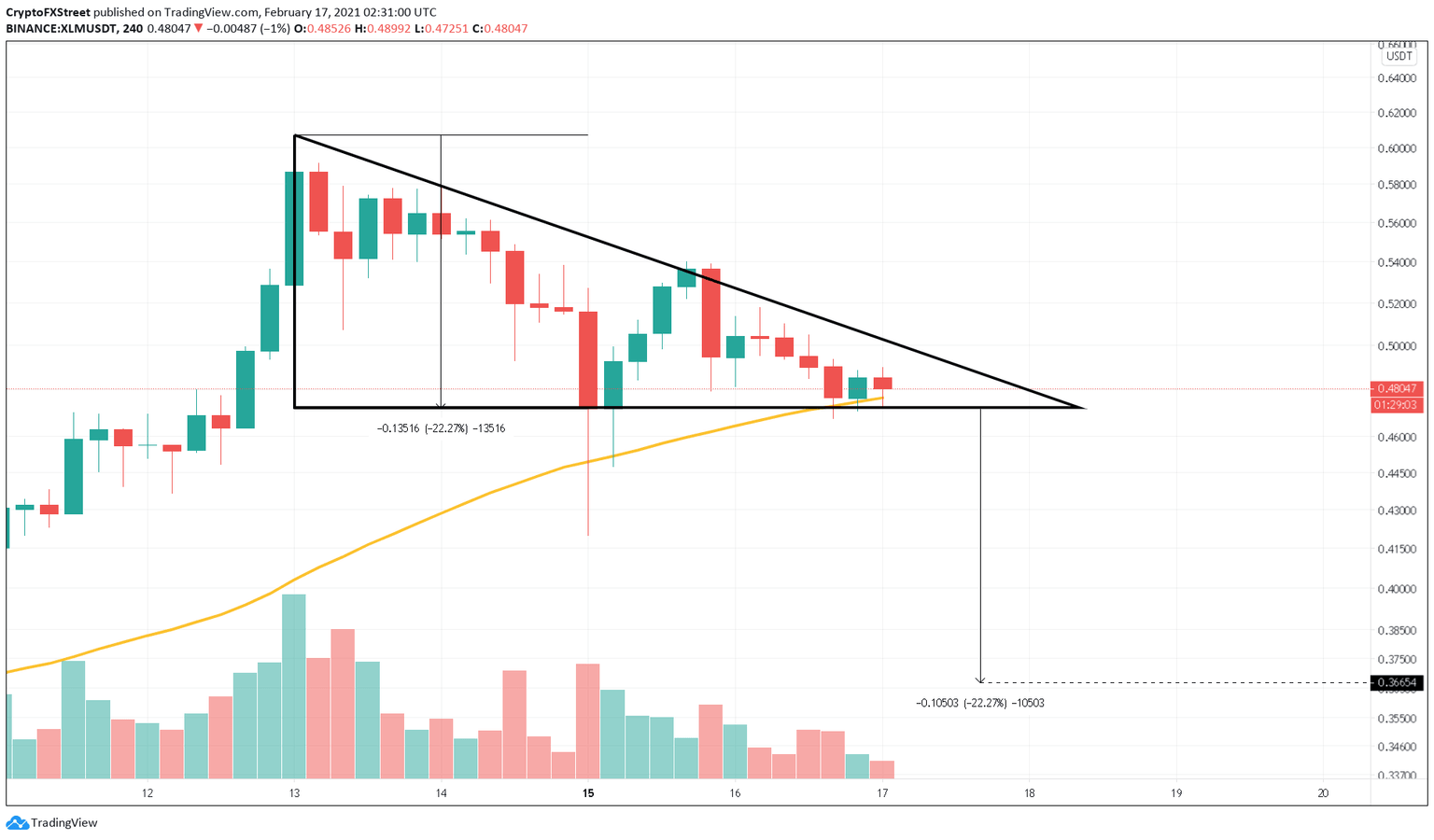

XLM price has been consolidating for the past three days within a descending triangle on its 4-hour chart. The ongoing stagnation phase is reaching a pivotal point as Stellar moves closer to the triangle’s apex.

Although the 50 four-hour moving average is currently serving as stable support alongside the triangle’s x-axis, the current market structure suggests massive losses on the horizon.

The descending triangle forecasts that a spike in selling pressure could see XLM price take a 23% nosedive. If validated, Stellar would target $0.37 upon the break of the $0.47 support level.

This target is determined by measuring the height of the descending triangle’s y-axis and adding that distance to the breakout point.

XLM/USDT 4-hour chart

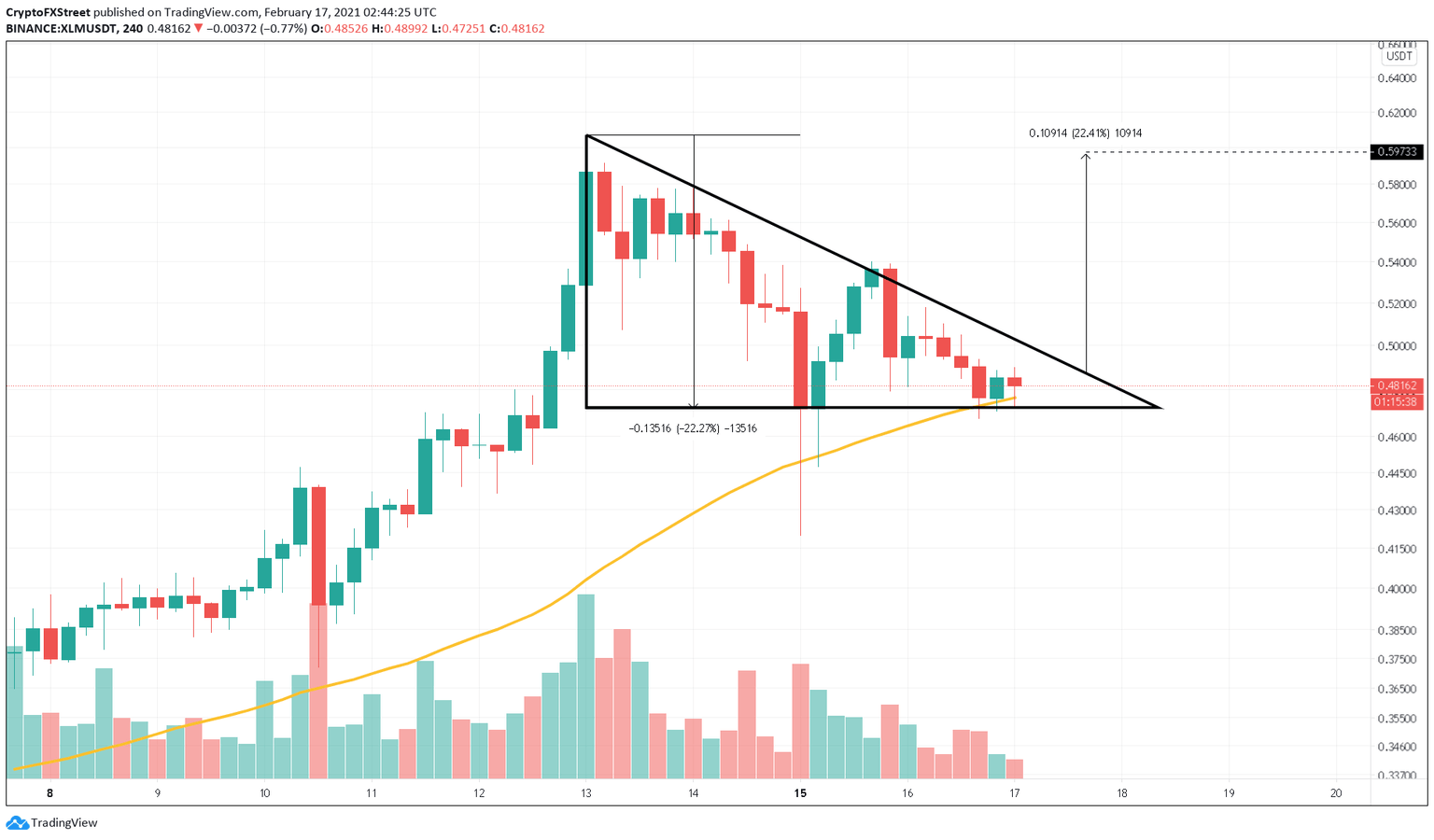

Regardless of the bearish outlook, investors must not turn a blind eye to the possibility of an upswing. A rebound from the 50 four-hour moving average could push Stellar's market value into higher highs.

A sudden increase in upward pressure that allows XLM price to slice through the triangle's hypotenuse at $0.50 may be significant enough to cause FOMO among investors.

In which case, Stellar could be looking at a 23% jump that sends it close to the recent yearly highs of $0.61.

XLM/USDT 4-hour chart

Due to the ambiguous outlook that XLM price presents, it is imperative that investors wait for a decisive 4-hour candlestick close outside of the $0.50-$0.47 range. Moving past this price pocket will determine where Stellar is heading next.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.