Worse than March 2020? Bitcoin price dives below $33K

A “key level” comes into play as Bitcoin challenges longer-term support lines and deals a major blow to long positions.

Bitcoin (BTC) fell by $8,000 in hours on Wednesday as hodlers saw a return of levels not seen since the start of February.

BTC/USD 1-minute candle chart (Bitstamp). Source: TradingView

Bitcoin comes for leveraged traders... again

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD stumbling to new lows of $32,200 on Wednesday.

Selling pressure, already high, kept coming as claims of a fresh Chinese crackdown combined with a stocks rout and a strengthening United States dollar.

In what is being called by some a “capitulation bottom,” Bitcoin failed to hold $40,000 support and began abrief freefall below its significant 200-day moving average.

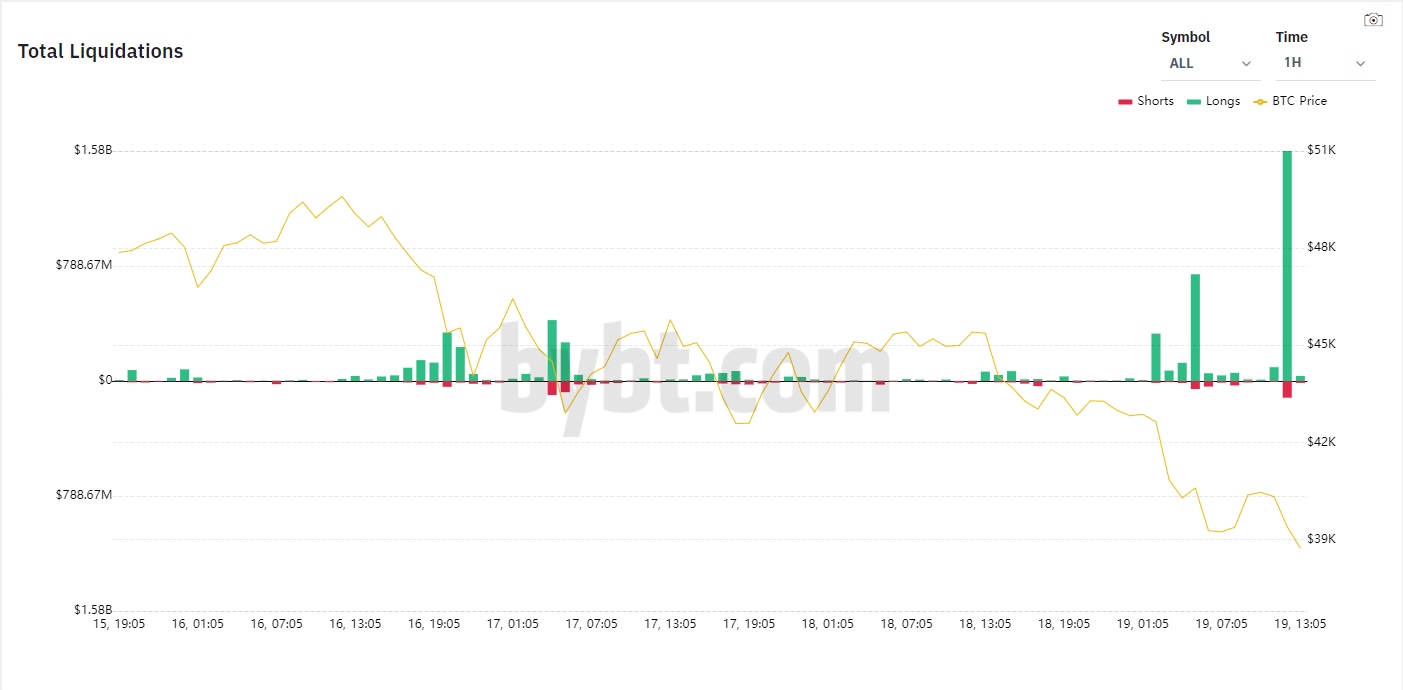

While the dip in dollar terms was average by Bitcoin’s standards, it caused mayhem among speculative traders, with a single hour seeing $2.7 billion of liquidations. Total 24-hour liquidations stood at $6.5 billion.

“Long leveraged traders liquidation spike on that move down in the past hour,” Philip Swift, founder of analytics resource LookIntoBitcoin, tweeted alongside a chart.

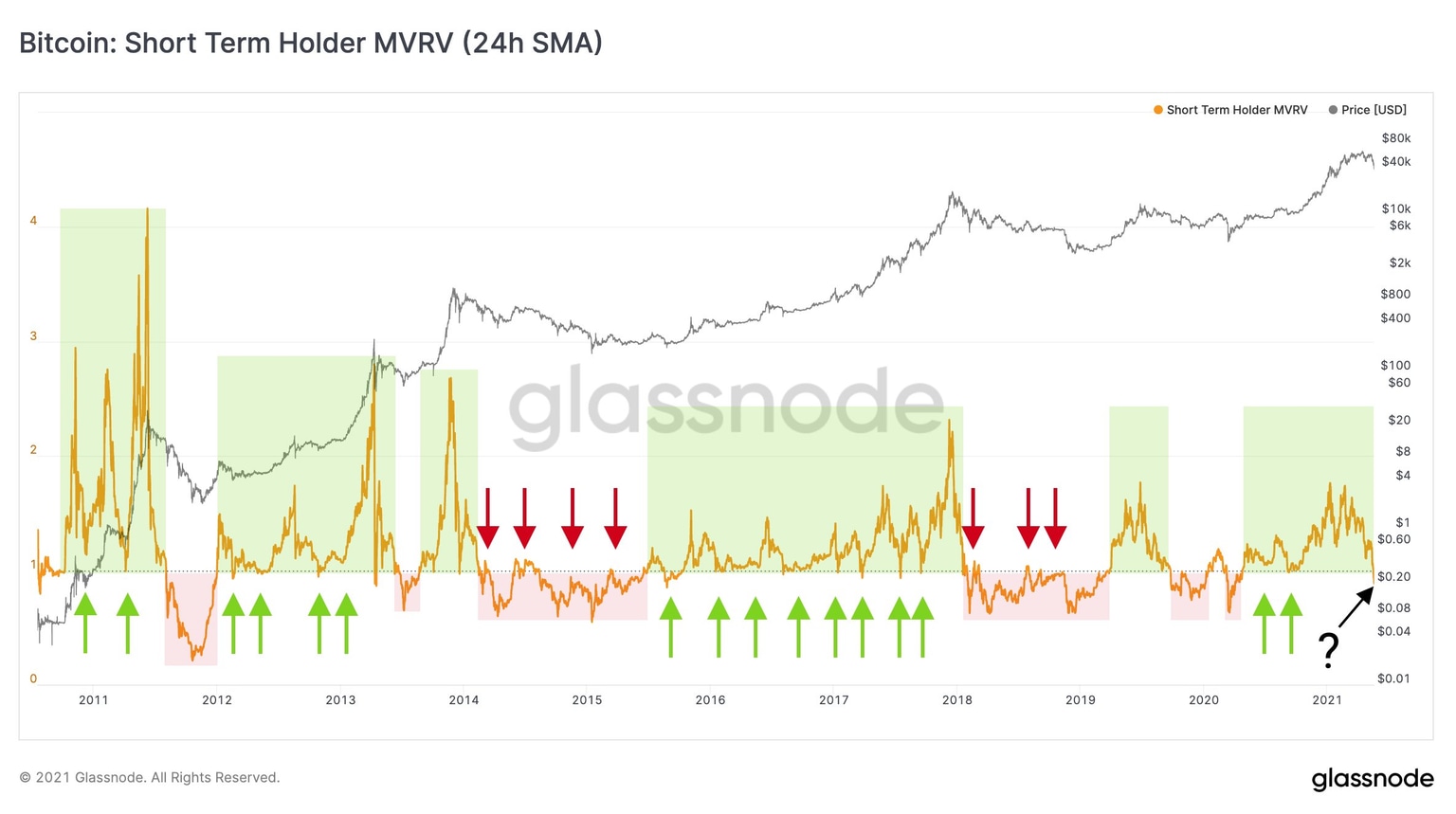

Rafael Schultze-Kraft, co-founder of fellow analysis resource Glassnode, added that short-term BTC investors were now at a loss and that current prices represented a line in the sand.

He referenced Glassnode’s Short Term Holder MVRV indicator, which looks at the price of unspent transaction outputs 155 days old or less.

“Short-term holders now under water, as STH-MVRV drops below the neutral line. Key level,” he commented.

Bitcoin Short Term Holder MVRV chart. Source: Rafael Schultze-Kraft/Twitter

Altcoins fall in line

At the time of writing, Bitcoin was attempting to cement a floor above $37,000 amid uncertain conditions.

On altcoins, the picture was similarly grim, with many major-cap tokens shedding nearly 30% on the day.

Among the biggest drops were Telcoin (TEL) and Shiba Inu (SHIB), both of which had previously booked significant gains.

Ether (ETH), meanwhile, briefly lost sight of $2,000 before recovering.

A silver lining for Bitcoin bulls was its market capitalizatio dominance, which rose from below 40% to nearly 45%.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.