World’s second-largest NFT marketplace Blur launches its native token for traders and creators

- Blur emerged as the closest competition to OpenSea, generating $1.2 billion worth of trades in the span of four months.

- BLUR launched at a price of $0.6854 with support from cryptocurrency exchanges, including Coinbase, Huobi and OKX.

- Blur emerged as the fastest-growing NFT marketplace, with its weekly volume surpassing OpenSea’s.

The Non-Fungible Token (NFT) market gained prominence over the last year, with OpenSea leading the pack as the largest marketplace. Rightfully so, given that the NFT marketplace was launched on Ethereum nearly five years ago. However, the emergence of Blur is challenging the crown of the biggest marketplace.

Blur expands its presence

Despite being launched less than five months ago, Blur has posed OpenSea a serious threat as the marketplace overtook its competition in terms of traded volume. The marketplace is now taking another step in ameliorating its reach with the crypto community by launching its native token BLUR.

BLUR came to life on February 15 with the marketplace launching its “Season 2”. Treating the second season as a different phase, Blur is aiming at decentralizing itself, beginning with the distribution of 360 million BLUR tokens.

Set to be distributed among the traders, Care Package holders and creators, BLUR will give the decision-making powers to the users. At its launch, the marketplace stated,

“BLUR gives the community control over the protocol’s value accrual and distribution. The Blur Foundation has been created to help foster community-led growth for the protocol.”

At the time of writing, the token could be seen trading at a price of $0.6689 with a market capitalization of $241.1 million.

Blur takes the reigns from OpenSea

The launch of the BLUR token might prove to be beneficial to the NFT marketplace, which is already performing exceptionally. Since its launch four months ago, Blur has managed to amass a user base of about 146,823 unique users, which cumulatively have conducted trading worth nearly $1.2 billion.

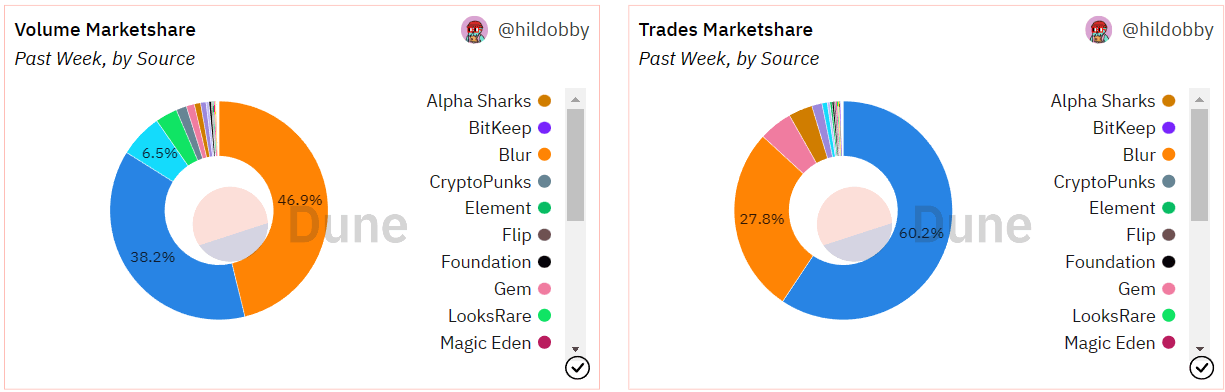

NFT market volume and trade share distribution

This has been reflected in the weekly traded volume as well. In the last seven days, the total volume traded on OpenSea contributed to just 38.2% of the total market share. Blur, on the other hand, dominated almost 47% of the market. Opensea still has the domination when it comes to the total number of trades, but Blur is not far behind, as it has captured about 28% of the market.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.