NFT marketplace LooksRare signs new deal to reach 10 million users; Opensea loses dominance to Blur

- NFT sales reached a seven-month high following the crypto market’s recovery.

- LooksRare joining hands with MoonPay will allow the traders to purchase NFTs and native token LOOKS on the platform directly.

- Opensea, over the last week, has lost its position as the biggest NFT marketplace to NFT marketplace and aggregator Blur.

Non-fungible tokens (NFTs) exploded to their peak last year. Since then, they have only declined in trade volume and sales to the point that the month of December 2022 recorded less than $4 billion worth of sales. Even so, NFT marketplaces are attempting to expand their reach, an instance of which can be seen in the case of LooksRare as well.

LooksRare joins hands with MoonPay

In a blog post on Thursday, the cryptocurrency payment service provider MoonPay announced its partnership with NFT marketplace LooksRare.

The Ethereum-based NFT marketplace will allow users to directly buy and sell cryptocurrencies such as LOOKS, ETH (Ethereum) and wETH (wrapped Ethereum) on the platform.

Going forward, the platform will also integrate NFTs enabling a user to buy NFTs through the platform using a credit card, thus eliminating the compulsion to buy them using cryptocurrencies.

Despite launching just a year ago, in January 2022, LooksRare has grown significantly, even becoming the fourth-largest NFT marketplace over the last week. Conducting sales worth $6.97 million, LooksRare was responsible for nearly 3.5% of all NFT sales.

However, surprisingly Ethereum’s biggest NFT marketplace, Opensea, did not note the highest volume. The decentralized application was overtaken by the recently launched NFT marketplace and aggregator Blur.

Opensea loses the top spot

Launched in October last year, Blur has been pushing its presence in the community as the marketplace for professional traders. Consequently, it has observed a surge in volume, with the last week’s sales surging past Opensea’s.

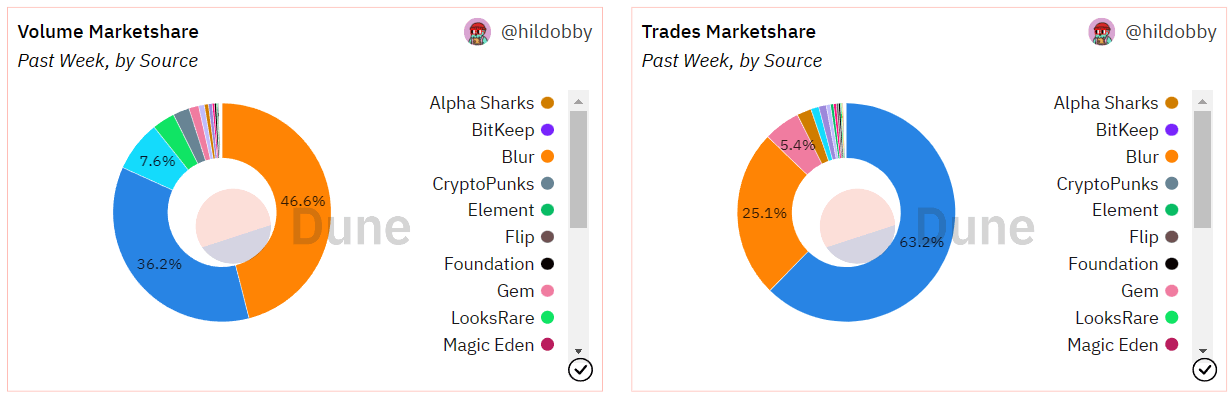

Dominating 46.6% of the market, Blur led the NFT market, with Opensea following with a 36.2% domination leaving X2Y2 with 7.6% sales, followed by LookRare in the fourth place.

NFT sales and trades market share

However, when it comes to the number of trades conducted within a week, Opensea remains at the top of the board. Conducting more than 63% of all the trades in the crypto market, Opensea left Blur with just a 25.1% market share.

This shows that despite observing higher capital movement, Blur is still behind Opensea in terms of user numbers.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.