Worldcoin risks losing $1B valuation as Sam Altman's update compounds bans in Kenya and Indonesia

- Worldcoin price fell to $0.86 on Tuesday, before rebounding 4% to $0.89; regulatory bans in Kenya and Indonesia triggered volatility.

- Bearish sentiment grew after Sam Altman reaffirmed OpenAI‘s non-profit status on Monday.

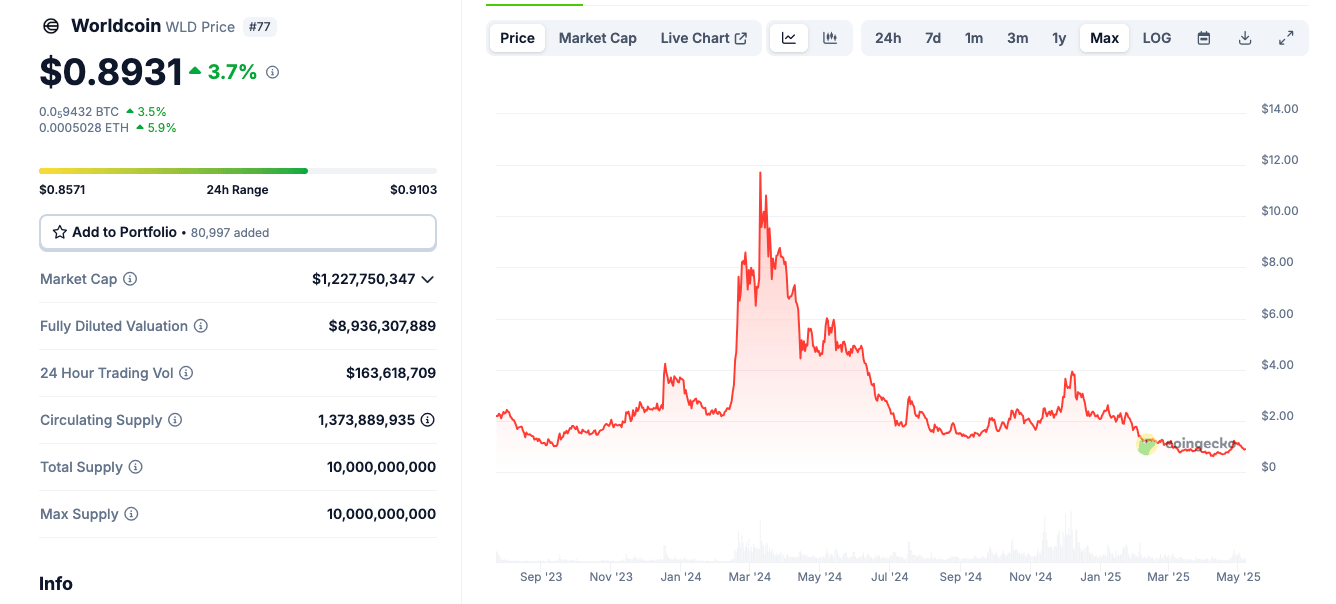

- WLD market cap now sits at $1.2B, down more than 92.4% from the $11.72 all-time high.

Worldcoin price slips below $0.90 as bans in Kenya and Indonesia threaten market confidence and $1 billion token valuation.

Worldcoin price dips below $0.90 after bans in Kenya and Indonesia

Worldcoin (WLD) fell sharply on Tuesday, trading as low as $0.86 before rebounding 4% to $0.89 at press time. The decline was triggered by escalating regulatory crackdowns, with Indonesia officially banning Worldcoin from operating in the country due to unresolved data privacy concerns. This follows a ruling ordering Worldcoin to delete biometric data in Kenya and suspend all ongoing projects.

Indonesia’s Ministry of Communication and Informatics cited violations around data protection as the core reason for halting the iris-scanning crypto initiative. The government emphasized that Worldcoin lacked legal clarity around its identity verification process and data storage policies.

The Kenyan interior ministry echoed similar privacy concerns when it shut down Worldcoin activities in 2023, shortly after a surge of new signups using financial incentives.

Both countries represent key markets in Worldcoin’s global expansion strategy, especially for onboarding unbanked populations. More so, the latest wave of regulatory pressure from two of the largest emerging markets could signal broader international backlash.

Sam Altman’s OpenAI announcement fuels investor skepticism around Worldcoin price prospects

The bearish sentiment around WLD price further deepened in the early hours of Tuesday following a major structural update from Sam Altman, Worldcoin’s co-founder and the CEO of OpenAI. In a letter published Monday, Altman reaffirmed OpenAI’s long-standing non-profit ethos, even as it transitions to a Public Benefit Corporation (PBC).

Altman’s message, intended to position OpenAI for sustainable growth, was interpreted differently by crypto investors seeking profit potential in Worldcoin. Many saw it as a signal that Altman’s ventures—including Worldcoin—may prioritize social mission over financial returns.

In his statement, Altman wrote:

“OpenAI was founded as a nonprofit, and is today overseen and controlled by that nonprofit. Going forward, it will continue to be overseen and controlled by that nonprofit… The nonprofit will control and also be a large shareholder of the PBC, giving the nonprofit better resources to support many benefits.”

While unrelated to the token’s codebase or operations, the timing of Altman’s public reaffirmation raised investor concerns over the profitability narrative underpinning Worldcoin’s tokenomics.

Altman’s reinforced commitment to a non-profit structure casts a shadow over Worldcoin’s long-term ROI potential, especially for institutional investors seeking clarity on tokenholder rights and revenue streams.

Market Impact: Worldcoin valuation now 90% below all-time highs

As of Tuesday, Worldcoin traded at $0.89, with intraday lows touching $0.8571, according to live market data from Coingecko. WLD current market capitalization stands at $1.2 billion, hovering dangerously close to the $1 billion threshold, a critical psychological level for investor sentiment.

This marks a more than 90% decline from its all-time high of $11.72, set in March 2024. In contrast, critical crypto market reference assets like Bitcoin (BTC) and Binance Coin (BNB) are down just 15% and 31% from their historical peaks, respectively.

Worldcoin market data as of May 6, 2025 | Source: Coingecko

More so, WLD trading volumes have thinned across centralized exchanges, and the 24-hour price swing between $0.8571 and $0.9103 increasing volatility. WLD’s seven-day return remains negative at a 17.7%.

Without a clear resolution on its regulatory and governance trajectory, WLD could struggle to hold its 4% gains on the current daily chart.

Unless Worldcoin secures support from new jurisdictions for compliant identity data collection and efficient onboarding, its valuation risks slipping below the billion-dollar mark. With WLD prices trading down 90% from last year’s peaks, a decline below the $1 billion valuation milestone could potentially trigger rapid capital flight.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.