World Liberty Financial token unlock drives sentiment, WLFI derivatives volume and sell-off jitters

- World Liberty Financial faces 25 billion WLFI token unlock on the first day of spot trading.

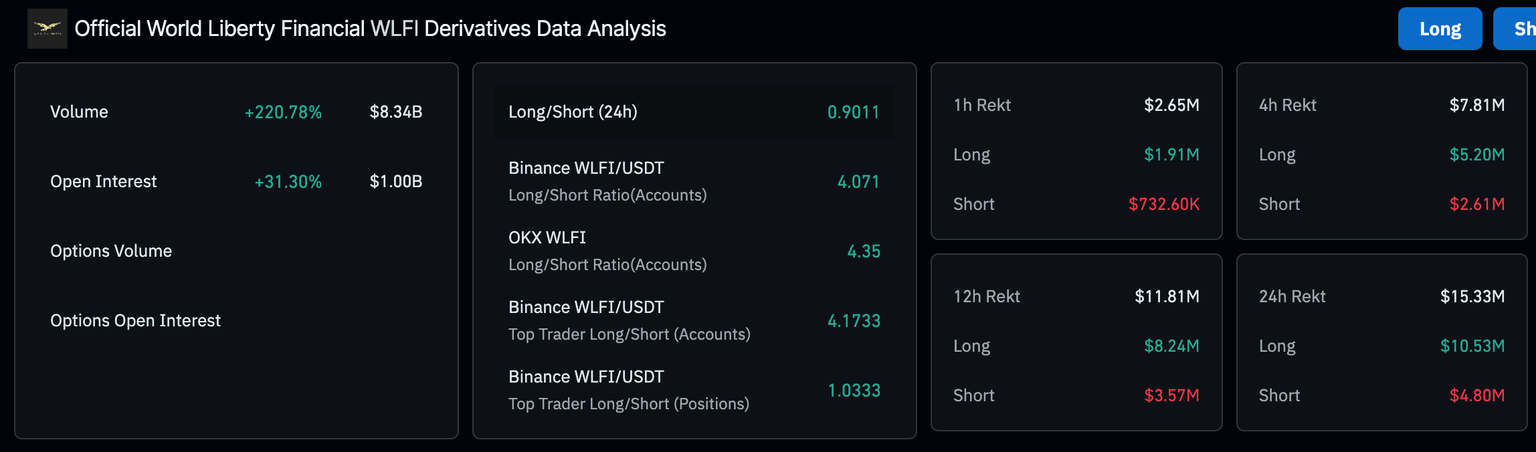

- WLFI Open Interest nears $1 billion, with volume exceeding $8 billion, as investor sentiment skyrockets.

- Traders remain cautious amid concerns that early investors and President Donald Trump's family could dump, triggering liquidations.

World Liberty Financial Token (WLFI), the token backed by United States (US) President Donald Trump's family's crypto empire, has launched spot trading on exchanges amid the protocol's largest unlock.

Cryptocurrency exchanges, including Binance, announced spot trading pairs on Monday, with WLFI trading at around $0.25 at the time of writing. Interest in the token surged ahead of spot trading, with the derivatives market's Open Interest (OI) and volume skyrocketing.

World Liberty Financial token triggers sell-off fears

Investors are strikingly cautious about World Liberty Financial's 24.67 billion WLFI token unlock following the commencement of spot trading. With a total supply of 100 billion, WLFI launched with a fully diluted valuation of over $30 billion.

In a statement released on Monday, World Liberty Financial said that of the 24.67 billion tokens in the circulating supply, 10 billion have been allocated for the team, and 7.8 billion tokens have been reserved for Alt5 Sigma Corporation, which purchased 8% of the total WLFI supply, creating a corporate strategy.

Approximately 2.9 billion WLFI tokens have been set aside for liquidity and marketing purposes to support the initial exchange offering, with the remaining 4 billion WLFI tokens allocated to public sale participants. Only 20% of the total supply is tradable at launch, with the remaining 80% locked until further notice.

"At launch, WLFI will enter the market with 24.67 billion tokens circulating, while a significant portion of the supply remains locked under structured schedules," the team said in a pre-trading statement.

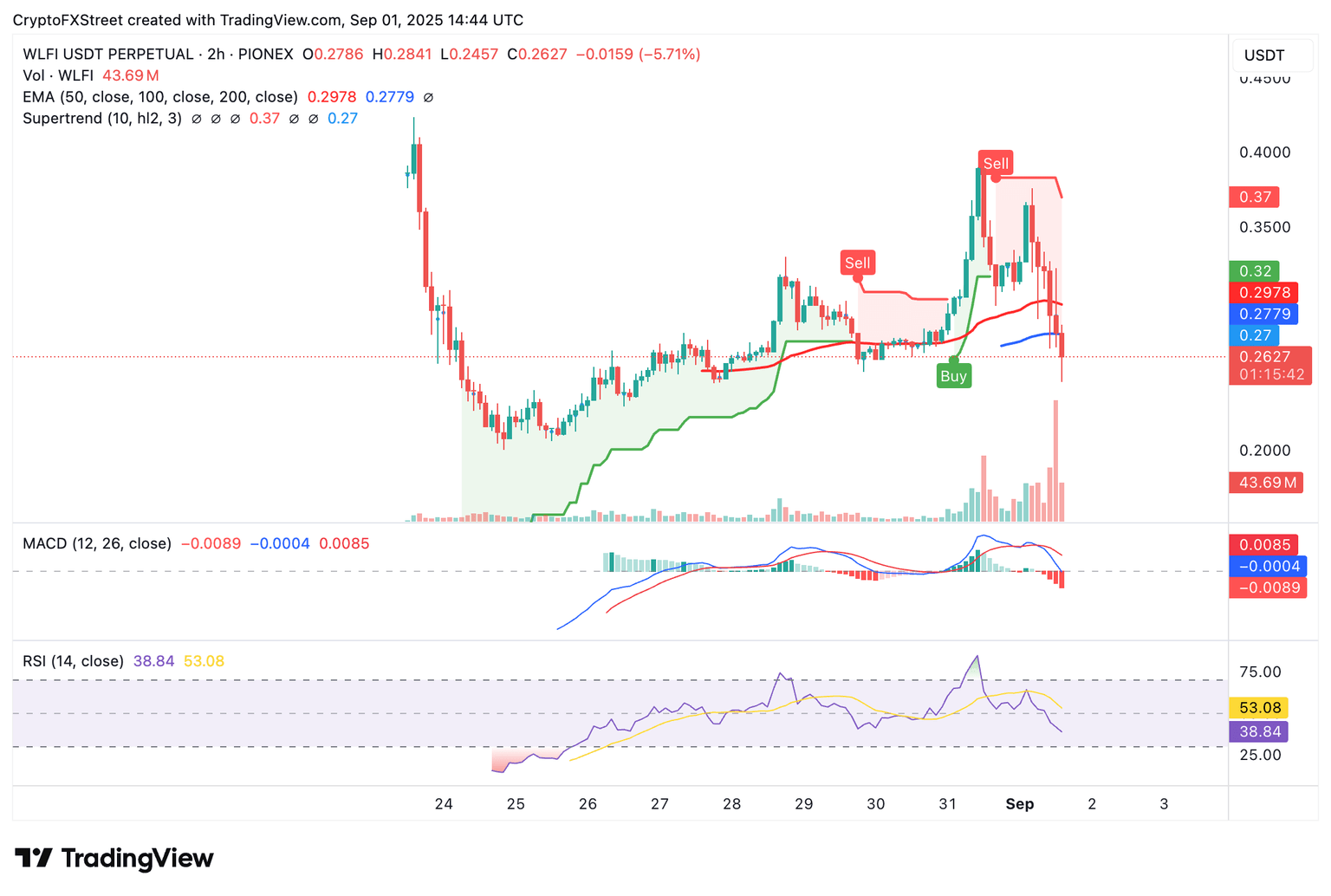

Technical outlook: WLFI's massive token unlock could dampen pre-market gains

WLFI is trading at around $0.25, down nearly 20% at the time of writing. The decline following the launch of spot trading reflects a shift in market sentiment, which initially increased to its highest level on record.

The derivatives market's Open Interest (OI) increased 31% to $1 billion over the last 24 hours, with the trading volume skyrocketing 220% to $8.34 billion.

Traders will be monitoring WLFI performance in the derivatives market to gauge interest and demand. A steady OI would indicate that more traders are betting on increases in the WLFI price.

WLFI derivatives market stats | Source | CoinGlass

The path with the least resistance remains downward at the time of writing, backed by a sell signal from the Moving Average Convergence Divergence (MACD) indicator. If sentiment declines due to the massive token unlock, profit-taking could accelerate the decline, encouraging traders to reduce exposure.

WLFI/USDT 2-hour chart

Key areas of interest for traders include the round-figure support at $0.25 and resistance at $0.30 and $0.35, tested during pre-market futures trading.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren