Will higher Bitcoin leverage by traders fuel volatility in BTC price?

- Bitcoin traders are taking high leverage risk in their derivatives trade on exchanges like Bybit and Huobi Global.

- While BTC derivatives open interest in the number of contracts is at a low, in US Dollar terms it is high in response to the banking crisis.

- Spike in estimated leverage ratio in Bitcoin derivatives alongside positive funding rates is indicative of a likely squeeze to the upside.

Bitcoin traders in the derivatives market have recently increased their leveraged risk in BTC. The estimated leverage ratio for Bitcoin reveals a spike and market participants expect an increase in BTC volatility.

Bitcoin funding rates help determine the direction of BTC price swings in the event of a spike in volatility. The banking crisis fueled market participants’ interest in the largest asset by market capitalization.

Also read: Bitcoin options traders await a catalyst in the asset as BTC slips below $27,000

Bitcoin traders take higher leverage risk, what does this mean?

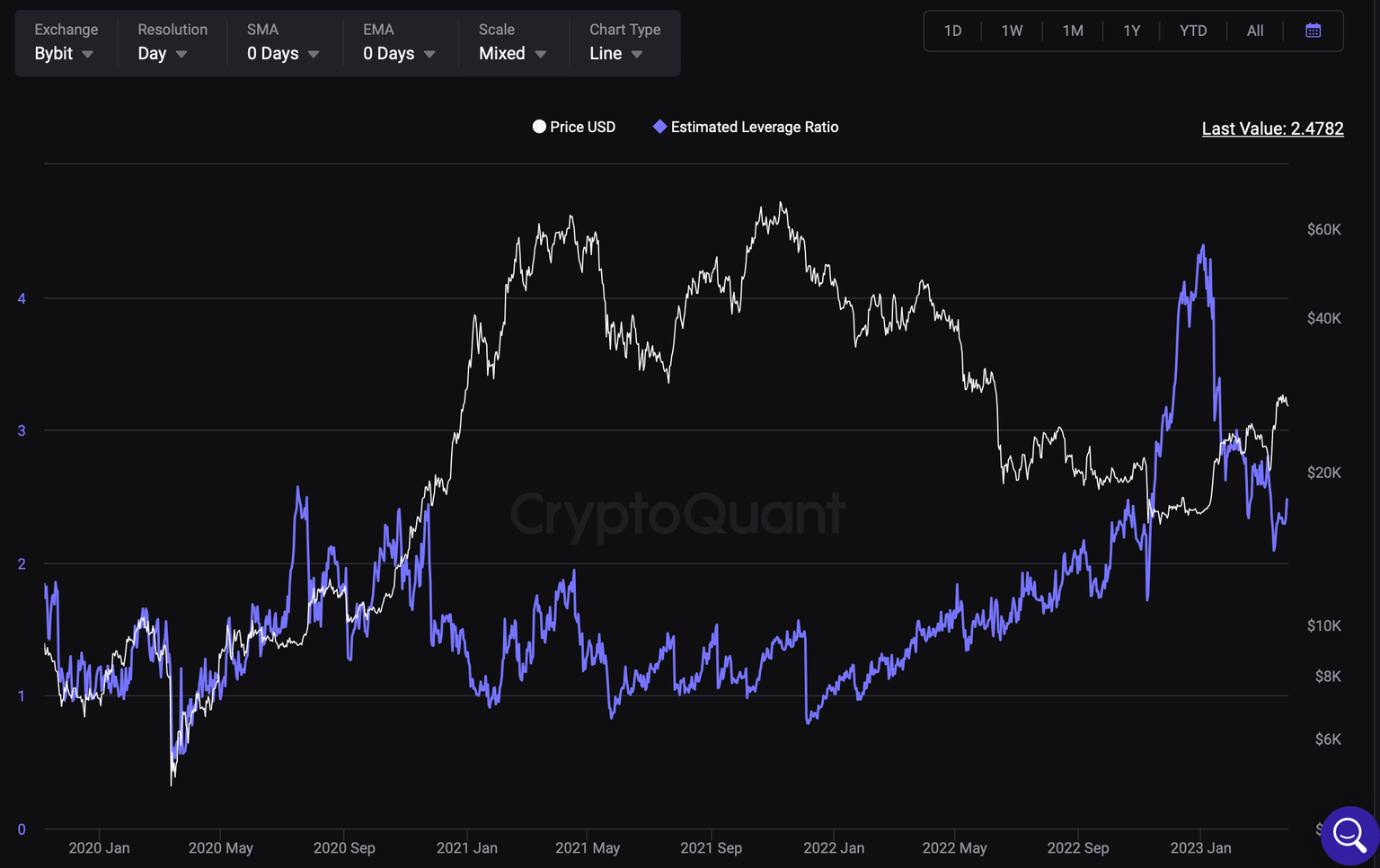

The metric used to measure leverage risk taken by Bitcoin derivatives traders is CryptoQuant’s “Estimated Leverage Ratio.” This metric divides the exchange’s open interest by their coins reserve. If the value of the ratio increases, it indicates that investors are taking a higher leverage risk in their derivatives trades.

The following chart shows the Estimated Leverage Ratio for traders on Bybit.

Bitcoin Estimated Leverage Ratio

After hitting a peak in January 2023, leverage ratio declined before starting to rise again as market participants reacted to the banking crisis. A similar trend is seen among market participants on Huobi Global.

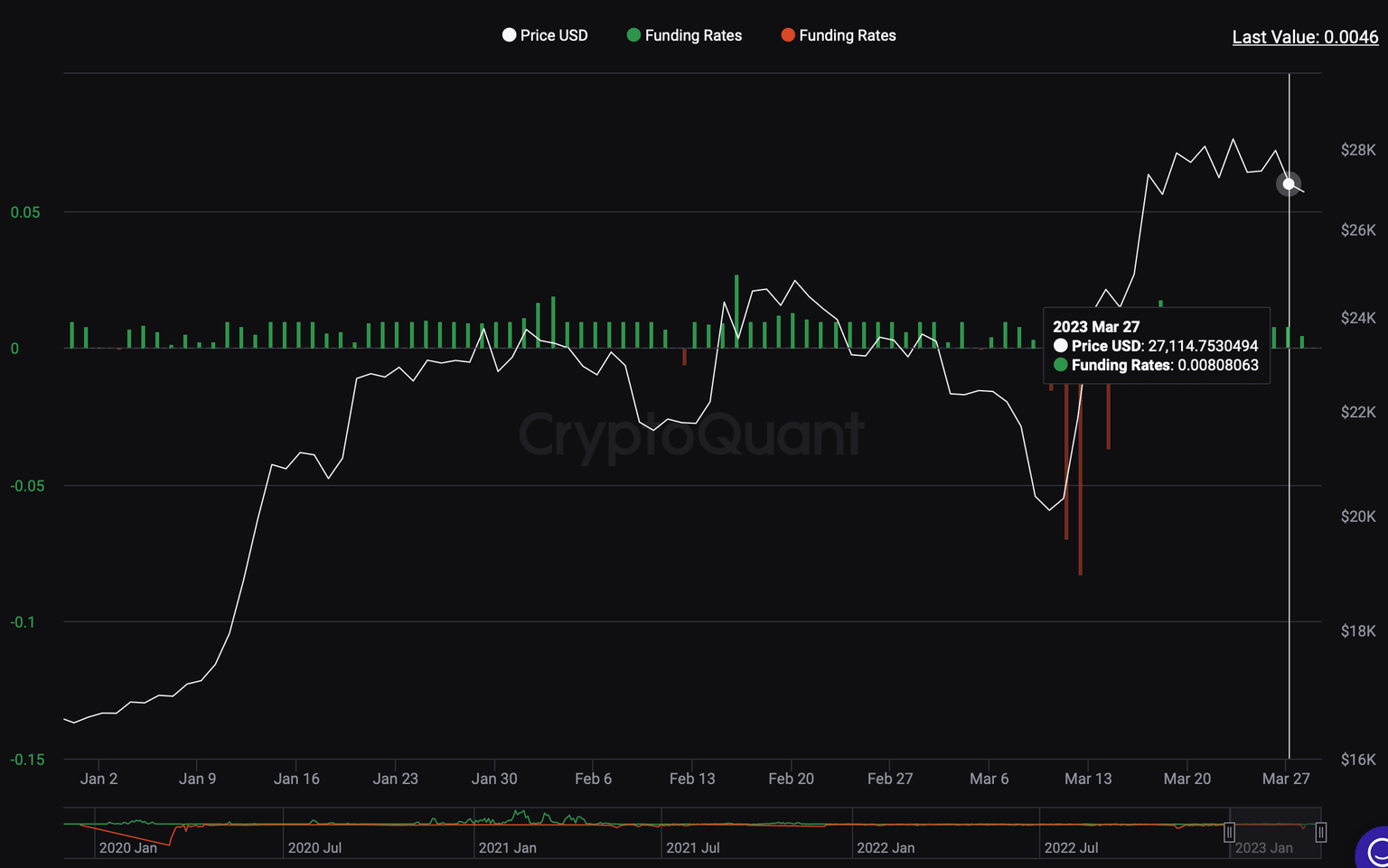

While a spike in this ratio is considered a sign of volatility in Bitcoin price, to determine the direction in which the asset’s price moves. The funding rate on Bybit is positive and a positive funding rate indicates that traders that are long on Bitcoin are dominant and are willing to pay funding to short traders.

At the same time this indicates Bitcoin price is most likely to climb higher, the volatility swing will occur towards the upside in BTC.

Bitcoin funding rate on Bybit exchange

Experts on crypto Twitter comment on high leverage in Bitcoin

Alex, a quantitative trader and expert on crypto Twitter commented on the leverage in the asset and noted that Bitcoin derivatives open interest in the number of contracts is at lows, but in US Dollar terms it is nearing a high.

Bitcoin Historical Open Interest Stablecoin Margined

Alex argues that there is a good amount of leverage in the system, typically considered indicative of volatility in the asset’s price in the short-term. Combined with the data from funding rates, Bitcoin price is likely to witness a swing to the upside in the short-term, despite neutral sentiment among options traders.

Bitcoin price targets to watch out

If the bullish thesis surrounding the spike in Bitcoin leverage alongside positive funding rates stand validated, the asset is set to climb higher. BTC price could face resistances at $28,784, a key level and the weekly high at $29,380, that coincides with the 38.2% Fibonacci Retracement level.

Once BTC price crosses the two hurdles, the asset could continue its climb towards the target of $30,040, a level that previously acted as support for Bitcoin during mid 2022.

BTC/USD 4H price chart

As seen in the chart above, Bitcoin is currently in an uptrend with no significant deviation in its Relative Strength Index (RSI). The price is currently above two key Exponential Moving Averages (EMAs) that are likely to act as support in the event of a price decline.

The $26,888 level is a key support for BTC, followed by the monthly high at $25,270 and low at $21,376 in the event of a decline in the asset.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.