Why this bullish signal could trigger SafeMoon price to double soon

- SafeMoon price has been on a downtrend since the 1st week of 2022 but shows a potential reversal signal.

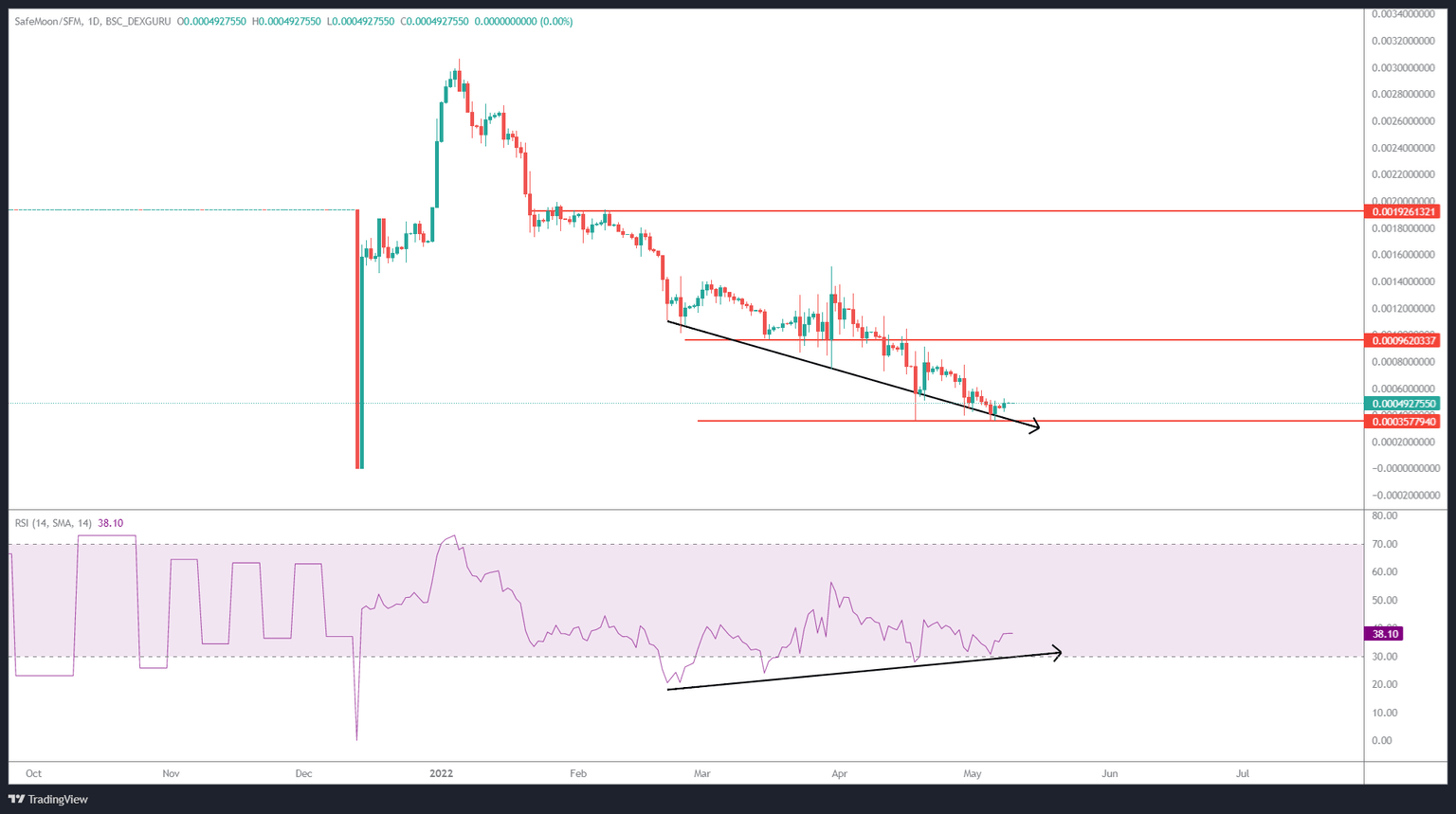

- The bullish divergence indicates that SAFEMOON is ready to rally 100% to the immediate resistance barrier at $0.000962.

- A daily candlestick close below $0.000357 will create a lower low and invalidate the bullish thesis.

SafeMoon price has been on a losing streak for more than four months and shows signs of a potential recovery. The daily time frame reveals a bullish pattern that is in development and could trigger a reversal.

SafeMoon price to flip 180

SafeMoon price has been on a nosedive since January 6 and has lost roughly 88% of its value. Regardless of the massive bearishness, SAFEMOON has created equal lows around $0.000357.

This development suggests the formation of a potential base and hints at a potential reversal. Adding credence to this outlook is the bullish divergence, which also forecasts a positive outcome.

This technical formation is when the asset’s price forms lower lows and the Relative Strength Index (RSI) creates higher lows. The setup indicates that the bullish momentum is on the rise despite the short-term drop in SafeMoon price.

Therefore, investors need to be prepared for a quick reversal that propels SafeMoon price to retest the immediate resistance barrier at $0.000962. This run-up would constitute nearly a 100% gain for the holders and is likely where the upside is capped.

SAFEMOON/USDT 1-day chart

While things are looking up for SafeMoon price, the bearish market structure could ruin the bullish signals described above. In such a case, a daily candlestick close below $0.000357 will create a lower low and invalidate the bullish thesis for SafeMoon price. In such a case, SAFEMOON could continue heading lower and reach new lows.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.