Why SafeMoon price could double again and here is what you can do

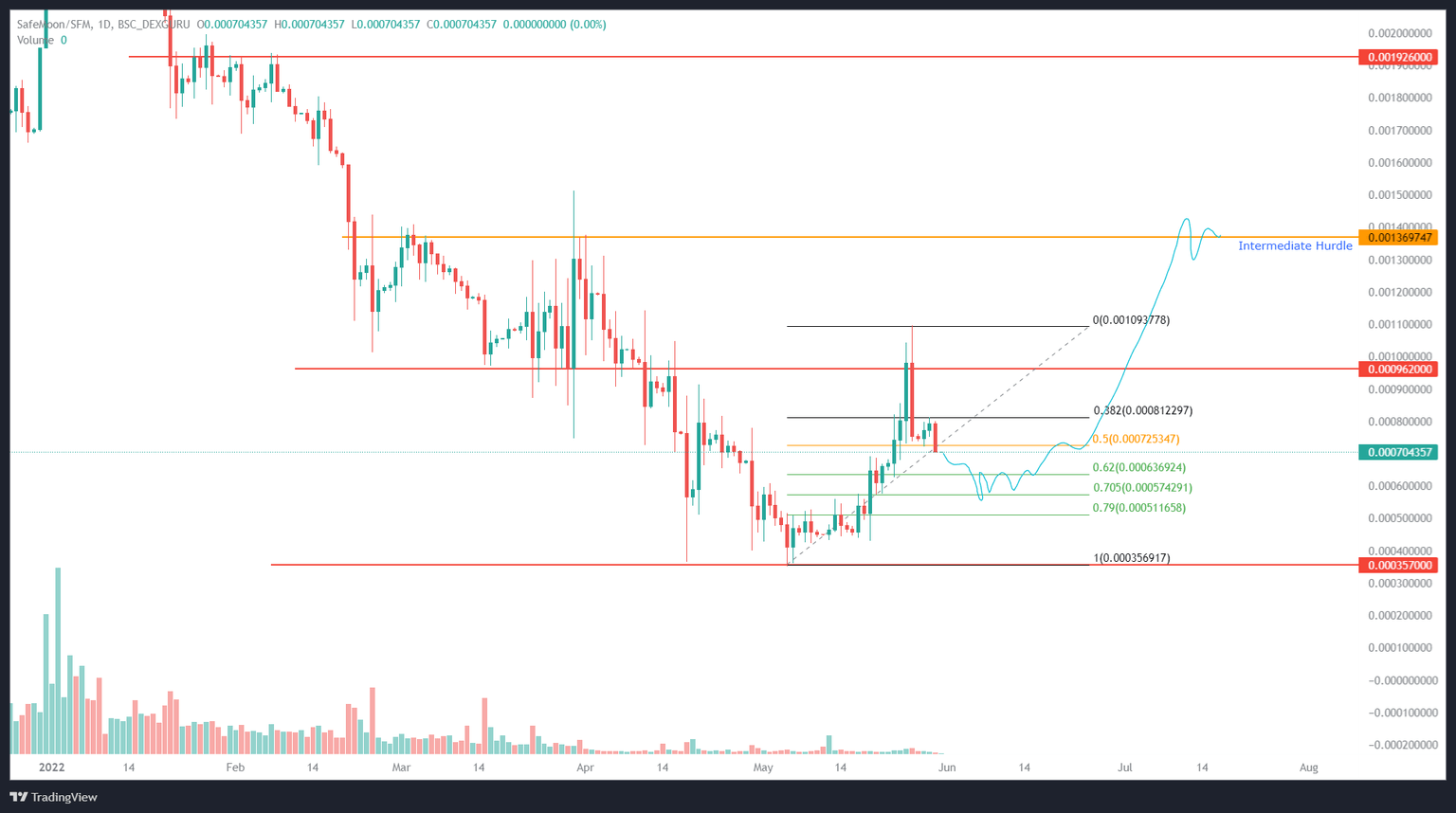

- Safemoon price is retracing to stable support levels after rallying 209% over the last three weeks.

- Willing investors can expect SAFEMOON to take a U-turn around $0.000574 and rally 140% to $0.00136.

- A daily candlestick close below $0.000356 will invalidate the bullish thesis.

Safemoon price shows a healthy pullback after more than tripling over the last three weeks. This retracement will allow bulls to recuperate and regain their strength to trigger another run-up.

Safemoon price plans its next move

Safemoon price set a bottom around $0.000356 between April 18 to May 5 after tagging it multiple times. The resulting rally pushed it up by 209% to set a swing high at $0.00109 after breaching the $0.000962 hurdle.

This move, while bullish, was overextended, leading to a retracement. So far, Safemoon price has dropped 35% and hints that a further descent is likely. Investors can expect the base to form around the 70.5% retracement level at $0.000574.

Any reversal above $0.000511 has the potential to trigger another impressive run-up. Assuming SAFEMOON kick-starts one at $0.000574, the resulting rally could smash through the $0.000962 hurdle and form a higher high at $0.00136, constituting a 140% gain.

SAFEMOON/USDT 1-day chart

While things are looking up for Safemoon price, if the ongoing retracement fails to hold above $0.000511, it will indicate a weakness among buyers. In such a case, if Safemoon price produces a daily candlestick close below the range low at $0.000356, it will invalidate the bullish thesis. This development could see SAFEMOON head into a price discovery mode and produce a new all-time low.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.