Why retail traders are uninterested in the current Cardano price

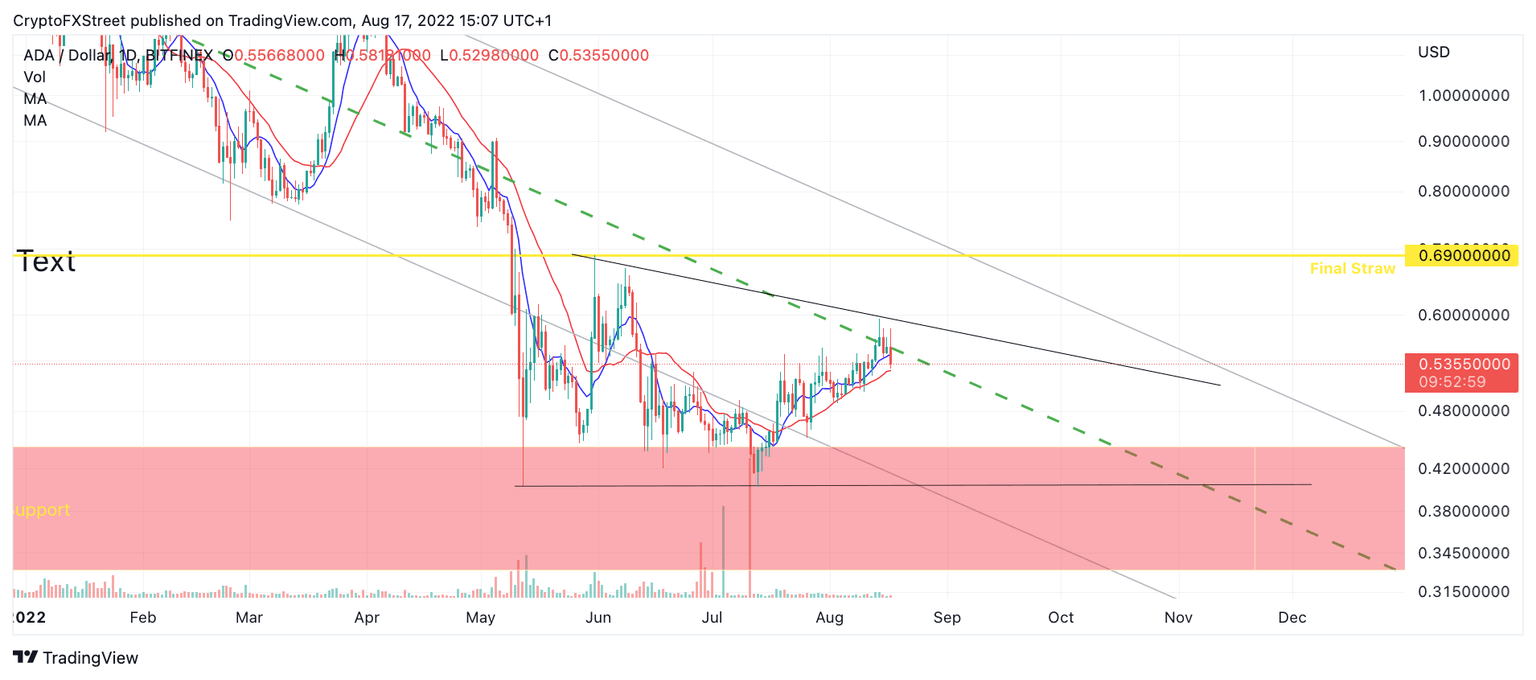

- Cardano price is finding resistance at a descending channel’s median line.

- ADA price shows a sparse volume pattern within the current uptrend.

- Invalidation of the bearish thesis would come from a breach above $0.70.

Cardano price is signaling a lack of interest. If market conditions persist, bears could push price down in a sweep-the-lows liquidation.

Cardano price faces resistance

Cardano price failed to penetrate through the halfway barrier of a Constance Brown-style parallel trend channel, conveying a lack of bullish confidence. The trend channel median line (which influenced the Cardano price since August 2021) is generally a tool for early buyers to take bottom-catching risks within a downtrend. The bears have consistently rejected the Cardno price at the median line since its first reacquaintance with the ADA price occurred last week near $0.59.

Cardano price currently auctions at $0.52 as the smart contract alternative token hovers between the 8- and 21-day Simple Moving Averages (SMA). Since July 13, Cardano price has managed to rally 48%. Amidst the uptrend rally, the Volume Profile Indicator shows a concerning lack of bullish presence. Although the Cardano price’s uptrend still looks intact, it could be severely weakened and primed for a Smart Money sell-off.

ADA/USDT 1-Day Chart

Traders should be very cautious with the ADA price. Currently, a ‘sweep-the-lows’ event is in the cards, with bearish targets at $0.38 and $0.34. Invalidation of the bearish thesis will be a breach of the upper end of the descending parallel channel currently positioned at $0.70. If the bulls can breach this barrier, a rally towards $1.20 would be on the table resulting in up to a 140% increase from today's current market value.

In the following video, our analysts deep dive into the price action of Cardano, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.