Why it may be a good time to start paying attention to Algorand

- Algorand price action has been devastated, dropping nearly 55% this week alone.

- ALGO returned 2021 lows and promptly bounced.

- Massive buying pressure at fifteen-month lows likely signals an impending bullish reversal.

Algorand price action has been no different than nearly every other cryptocurrency and nearly every other risk-on asset class. After hitting a weekly loss of 52%, buyers stepped in and have thus far continued to support ALGO.

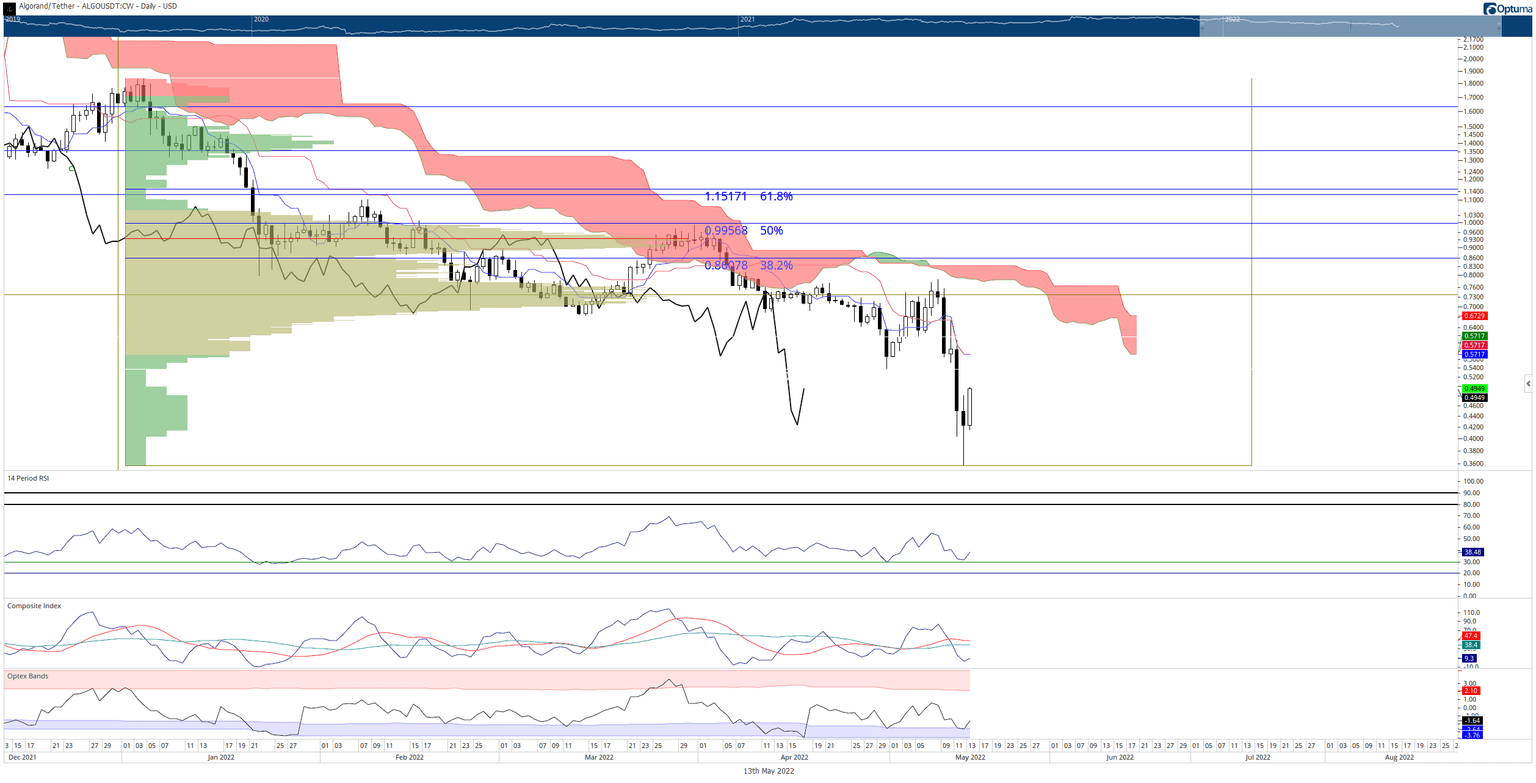

Algorand price on the road to retest is $0.95

Algorand price is currently up nearly 40% from the new 2022 low established yesterday at $0.36. Bulls have made solid attempts at the $0.50 level, and bears have spent an equal amount of pressure attempting to keep ALGO at or below $0.50.

The first target bulls must close above is $0.50. From there, the high volume node is at $0.73. The most critical resistance zone that Algorand price must close above is between the $0.86 and $0.99 price levels. $0.86 to $0.99 contain the following technical resistance points:

- Top of the Ichimoku Cloud (Senkou Span B) at $0.85

- 38.2% Fiibonacci retracement at $0.86

- 2022 Volume Point of Control at $0.94

- 50% Fibonacci retracement at $0.99

It is very possible that Algorand price may repeat the same moves it experienced throughout 2021. However, downside risks remain a concern.

ALGO/USDT Daily Ichimoku Kinko Hyo Chart

On the weekly and daily Ichimoku charts, Algorand price is still decidedly bearish, and bulls should watch for rallies to face staunch resistance until roughly the $0.86 value area. If bears remain in control and complete a daily close at or below the 2021 low of $0.33, then ALGO may be on its way to testing the Covid Crash lows in 2020.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.