Why I am bearish on Bitcoin in the near-term

Bitcoin has been on a remarkable journey, evolving from a niche digital concept into a widely recognized asset that continues to capture global attention. Over time, it has grown into the most established cryptocurrency in the world and has become a benchmark for how the digital asset space moves. With its increasing visibility and influence, it often sets the tone across the broader crypto landscape, and because of that, I always feel it’s important to approach it not just with excitement—but with discipline and caution.

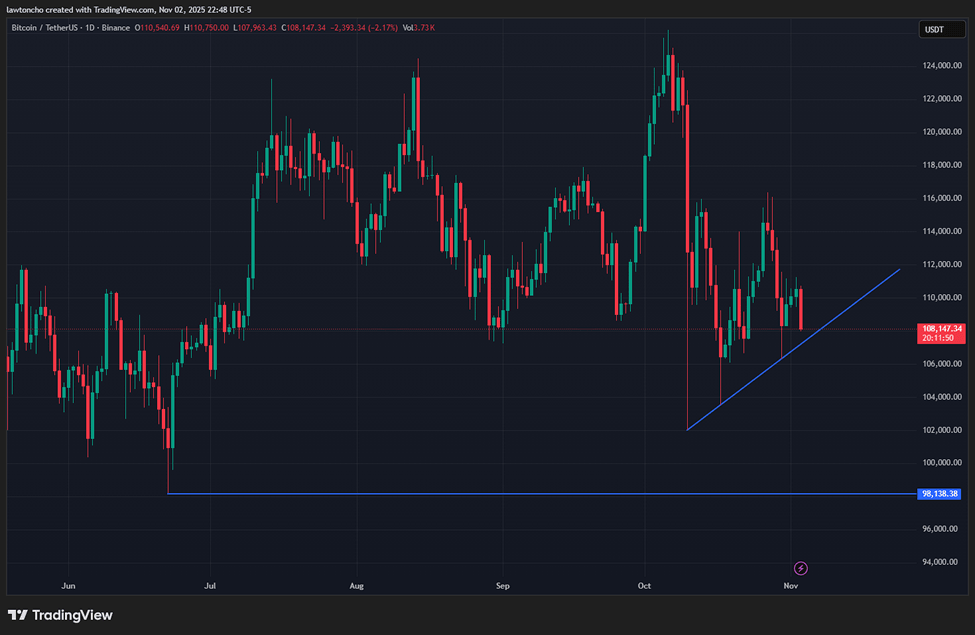

Bitcoin (BTC) recently pushed to new all-time highs at the beginning of last month, reaching levels around $126,000. Since then, the price has pulled back meaningfully, with BTC now trading more than 14% below those highs. Even though it has bounced off those recent lows and is currently sitting more than 6% above them, I remain bearish here. Markets can be emotional, but I rely heavily on technicals to guide my view, and right now the chart is telling me to stay cautious.

On my end, I am tracking a clear upsloping trendline that connects the recent lows from October 10th, October 17th, and October 30th. This trendline matters to me because it forms a structure that can often lead to a continuation lower, if broken. In my playbook, this type of uptrending support during a pullback phase can lean bearish, and a break below it would favor further downside. There are two ways I would personally look to trade this: either enter on that initial break of the trendline, or wait for price to retrace back into the trendline after breaking it, and then take a position there. Both setups require patience and discipline, and I never like to rush into trades without clear confirmation from the price action.

My downside targets are straightforward. The first level I am watching is the psychological $100,000 zone, and from there, I am eyeing the pivot low around $98,000 from June 22nd. These levels are areas where I could see price gravitating if the trendline gives way and sellers take initiative again. Nothing in trading is guaranteed, but I respect structure, and those are the levels that matter most to me right now.

As always, risk management is at the core of how I trade—especially in cryptocurrency. Momentum can flip fast, and emotions can run high, but staying consistent with my plan and not getting shaken out is key. Whether price respects support or breaks lower, I want to be positioned with intention, not impulse.

Author

Lawton Ho

Verified Investing

A marketing expert sharing his journey to mastering the charts.