Why Binance Coin price could crash below $300

- Binance Coin price inches closer to a major capitulation zone.

- Significant downside pressure to levels not seen since March 2021 is increasingly likely.

- Bulls have limited time to stave off a significant crash.

Binance Coin price, like the rest of the cryptocurrency market, is at risk of a major crash if it fails to hold onto its last levels of support.

Binance Coin price action is on pace to fall another 40%

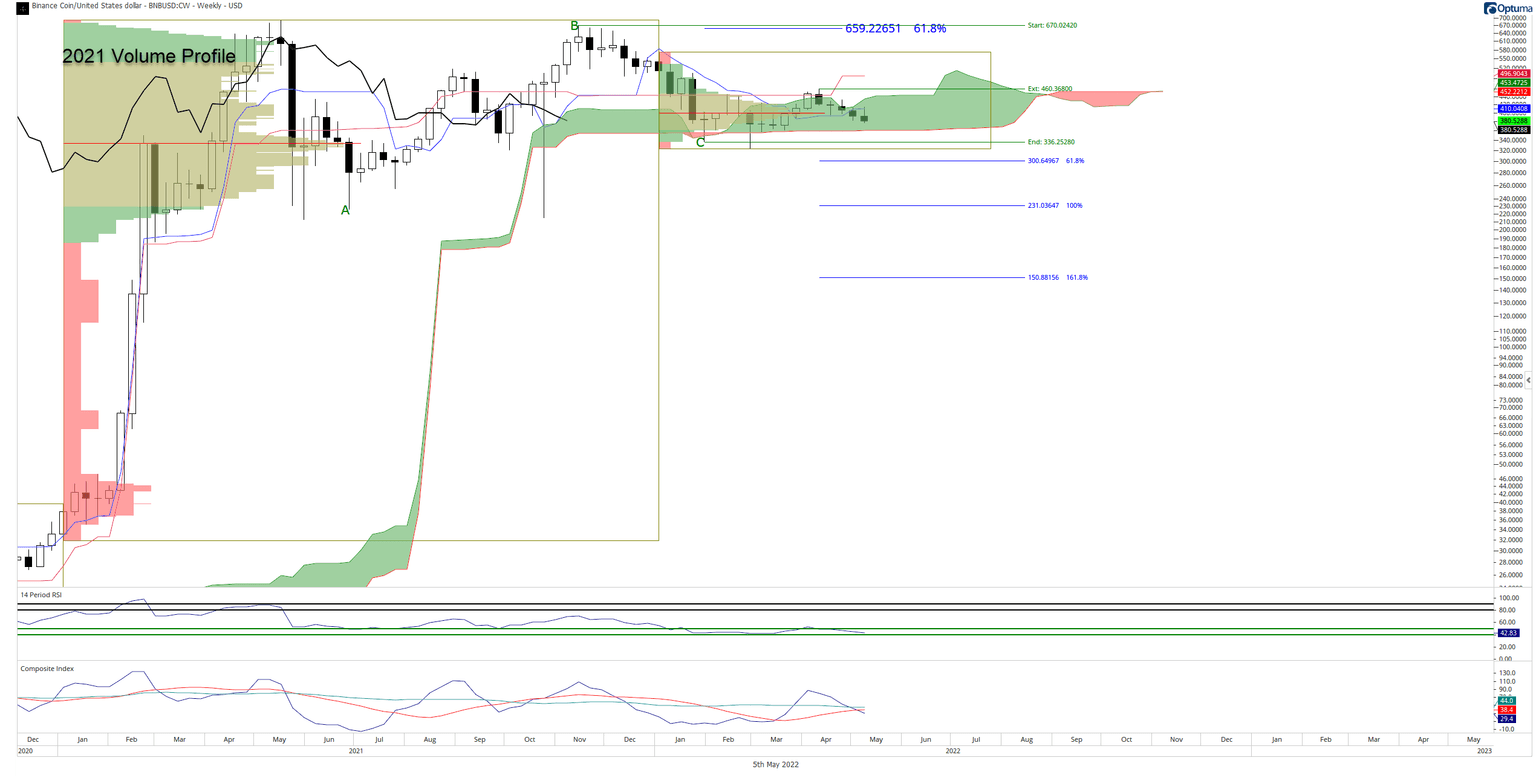

Binance Coin price has one primary support structure left on its weekly chart: the $340 to $360 value area where the bottom of the Ichimoku Cloud (Senkou Span B) and the 2021 Volume Point of Control exist.

Nearly all the conditions for an Ideal Bearish Ichimoku Breakout of Binance Coin price are present:

- The current close is below the Tenkan-Sen and the Kijun-Sen.

- The Tenkan-Sen below the Kijun-Sen.

- Future Senkou Span A is below Senkou Span B.

- Chikou Span is below the bodies of the candlesticks and in open space (a condition where the Chikou Span won’t intercept, horizontally, the body of any candlestick over the next five to ten periods).

- The current close is below the Cloud.

The only condition missing is number five. A close at or below $359 would confirm an Ideal Bearish Ichimoku Breakout. Additionally, a close at $359 would put BNB below the final major support from 2021’s high-volume node. From there, Binance Coin price could collapse towards the 100% Fibonacci expansion at $231.

BNB/USDT Weekly Ichimoku Kinko Hyo Chart

If Binance Coin price bulls want to invalidate any near-term bearish outlook, they’ll need to pursue a weekly close above the Ichimoku Cloud at or above $444. If that occurs, the beginning of a new uptrend may not be far away.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.