Binance Coin price eyes retest of $475 as BNB bulls comeback

- Binance Coin price retraces to the $396 to $404 demand zone, hinting at a reversal.

- Investors can expect BNB to trigger a 17% ascent to $475.

- A breakdown of the $393 support level will invalidate the bullish thesis.

Binance Coin price has been on a steady downtrend after failing to set up a higher high. This downswing is currently stabilizing around a support level as BNB prepares for a new attempt.

Binance Coin price to give upswing another go

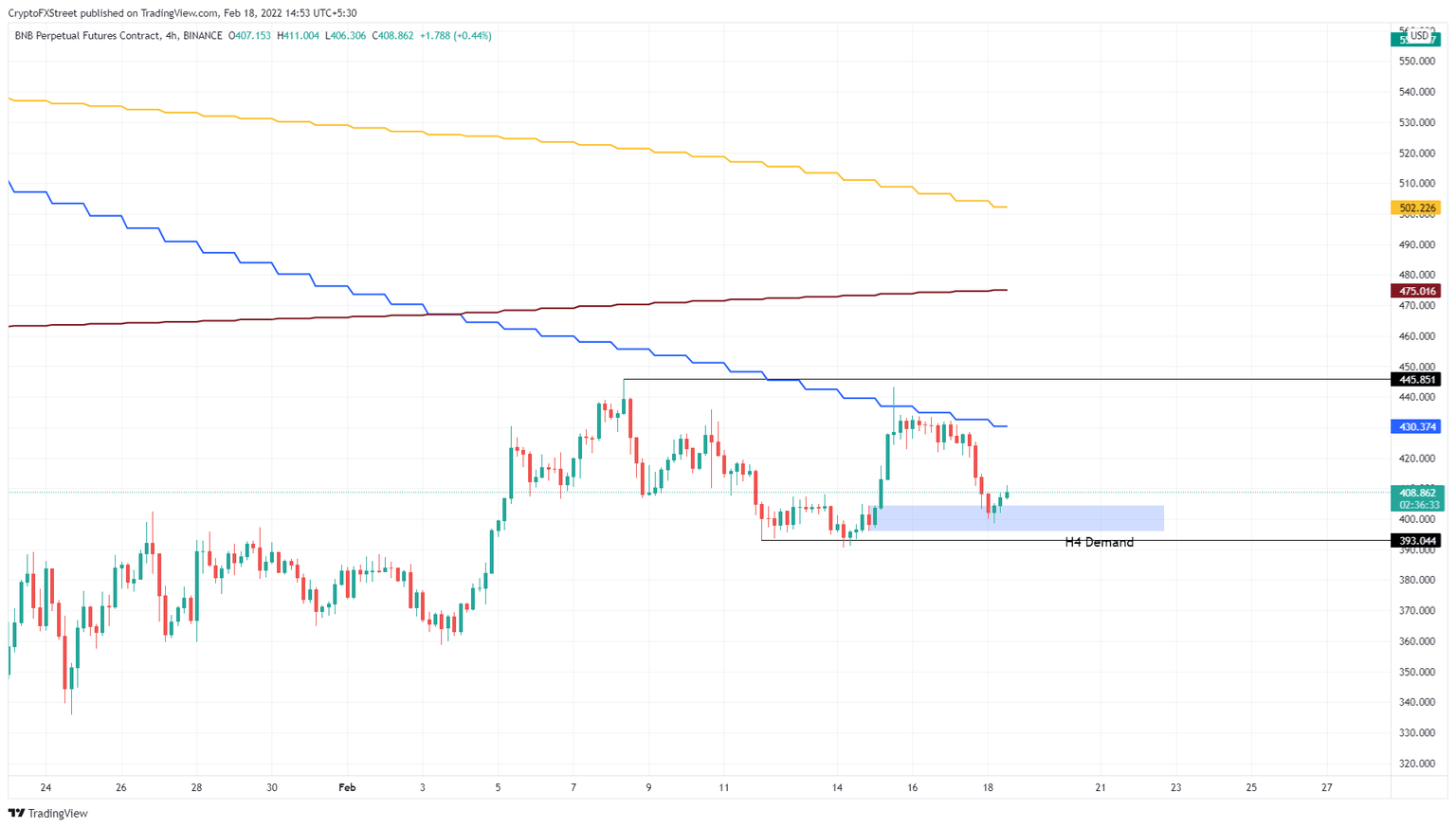

Binance Coin price was rejected by the 50-day Simple Moving Average (SMA) between February 15 and 17, leading to a 7% retracement. The resulting leg down pierced the four-hour supply zone, extending from $396 to $404, where it is trying to stabilize.

Finding a foothold in this area will lead to a strong bounce back to the 50-day SMA at $430, which is the first significant hurdle in the path for Binance Coin price. Clearing this area will open up the road for BNB to make its way to the immediate yet minor blockade at $445.

Beyond this level, Binance Coin price can retest the 200-day SMA at $475, bringing the total ascent to 17%. Interested investors can position themselves long around the demand zone and book profits at $445 and $475.

SHIB/USDT 4-hour chart

The four-hour demand zone, extending from $396 to $404 is crucial to trigger an uptrend for Binance Coin price. Failing to do so could result in a retracement to the immediate support level at $393.

A sweep of this foothold is likely to collect liquidity, but a four-hour candlestick close below it will create a lower low and invalidate the bullish thesis for BNB. Therefore, just under the barrier makes this the ideal place for investors to place their stops.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.