Which coins can withstand the fall of Bitcoin (BTC)?

Bulls could not seize the initiative, and all of the top 10 coins are in the red zone.

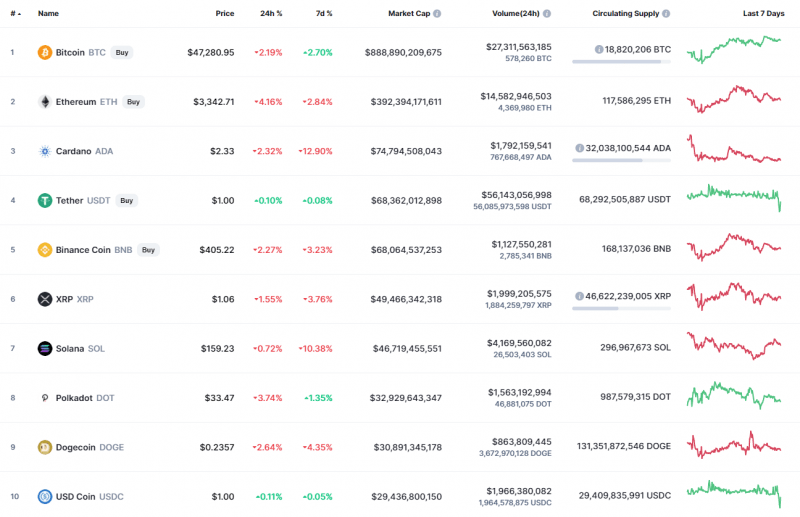

Top coins by CoinMarketCap

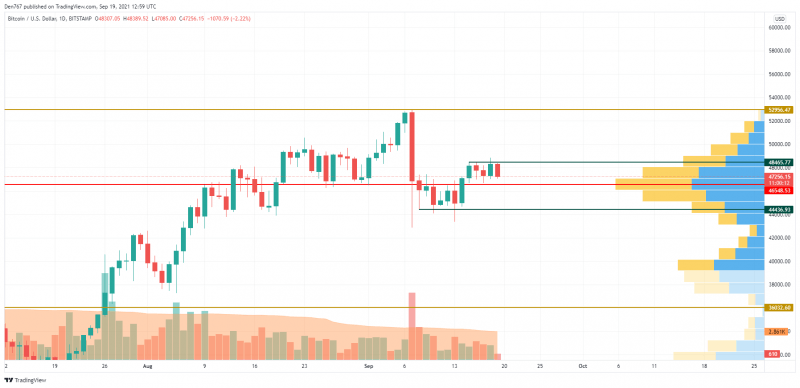

BTC/USD

Bitcoin (BTC) Has lost the least from the list as the rate of the chief coin has gone down by 2.20% over the last day, while the price change over the past 7 days has accounted for +3%.

BTC/USD chart by TradingView

On the daily chart, Bitcoin (BTC) is stuck in the narrow channel between the resistance at $48,465 and the zone of the most liquidity at $46,548. The trading volume is at its lowest levels, which means that traders have not accumulated enough power for a big move.

In this case, one needs to pay close attention to the resistance, the breakout of which may lead to growth to $50,000.

Bitcoin is trading at $47,381 at press time.

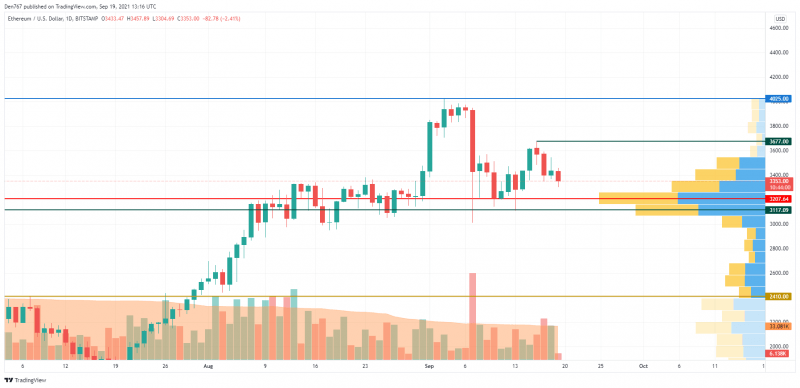

ETH/USD

Ethereum is the biggest loser today as the main altcoin has lost 4% of its price share.

ETH/USD chart by TradingView

Ethereum (ETH) is more bearish than Bitcoin (BTC) as the altcoin could not fix above the $3,500 mark.

At the moment, a more likely price action is a test of the liquidity zone around $3,200, where a potential bounceback might happen.

Ethereum is trading at $3,347 at press time.

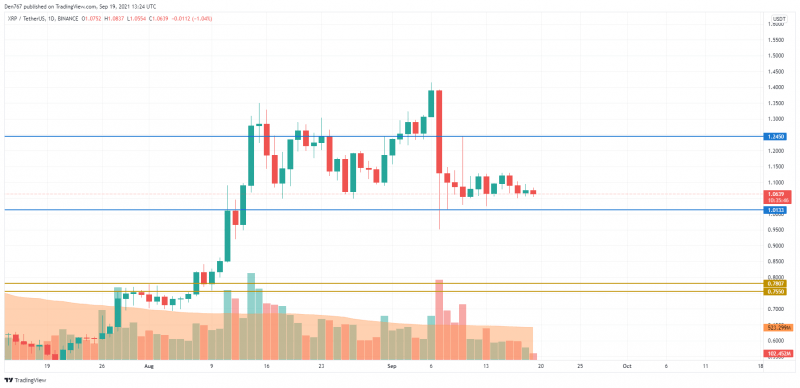

XRP/USD

XRP is also not an exception to the rule as it has been located in a downtrend for the past 24 hours.

XRP/USD chart by TradingView

XRP is trading similarly to Bitcoin (BTC) as neither sellers nor buyers can dominate the market. However, the price is located closer to the support at $1.0133, which means that currently bears are more powerful than bulls. In this case, they can fully seize the initiative if the price breaks the support and fixes below it on the daily chart.

XRP is trading at $1.0624 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.