Which coins can outperform Bitcoin (BTC) in the short-term point of view?

The cryptocurrency market is neither bullish nor bearish today as some coins are trading in the red zone while others are in green.

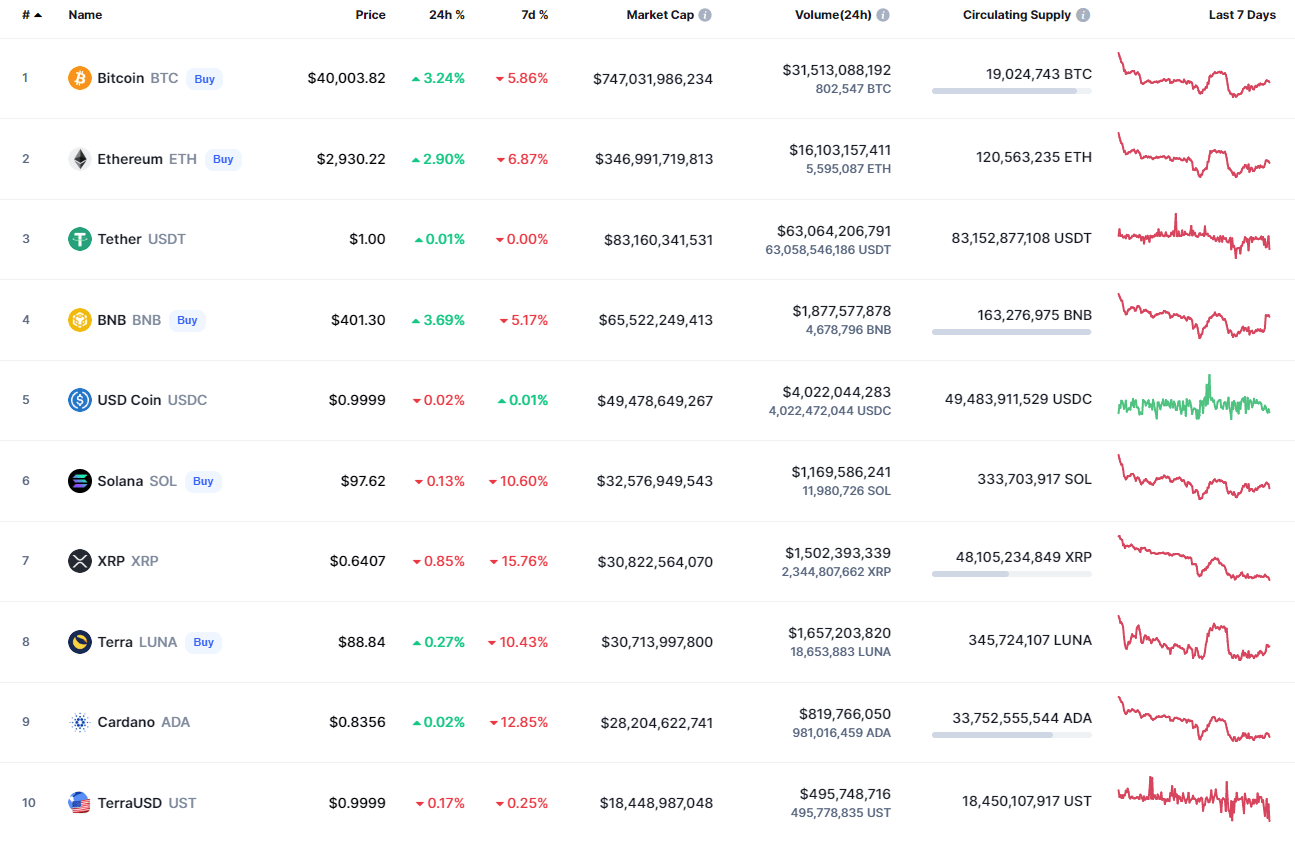

Top coins by CoinMarketCap

BTC/USD

Bitcoin (BTC) is going up today, rising by 3.38% over the last 24 hours.

BTC/USD chart by TradingView

Bitcoin (BTC) is coming back to the $40,000 mark today, confirming bulls' power. However, from the mid-term point of view, the main crypto is not ready yet for the prolonged upward move as the price keeps trading in a wide range between the support at $32,871 and the resistance at $48,234. In this regard, sideways trading is the more likely scenario for the next few days.

Bitcoin is trading at $39,879 at press time.

ADA/USD

Cardano (ADA) has grown the least from the list today, rising by 0.78%.

ADA/USD chart by Trading View

Cardano (ADA) keeps trading in the sideways range despite today's slight growth. However, if bulls manage to get the rate to the $0.85 mark by the end of the day, the rise may coninue to the zone around $0.90.

ADA is trading at $0.8364 at press time.

BNB/USD

Binance Coin (BNB) is the biggest gainer from the list today, rising by almost 4%.

BNB/USD chart by TradingView

Binance Coin (BNB) is outperforming most of other coins as it is about to fix above the crucial $400 mark. Thus, the buying trading volume keeps rising, confirming bulls' efforts to come back to mid-term growth. Likewise, there is a high possibility to see a return to the $400-$420 zone shortly.

BNB is trading at $402.4 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.