What are the odds for Dogecoin price to trigger 75% upswing this week

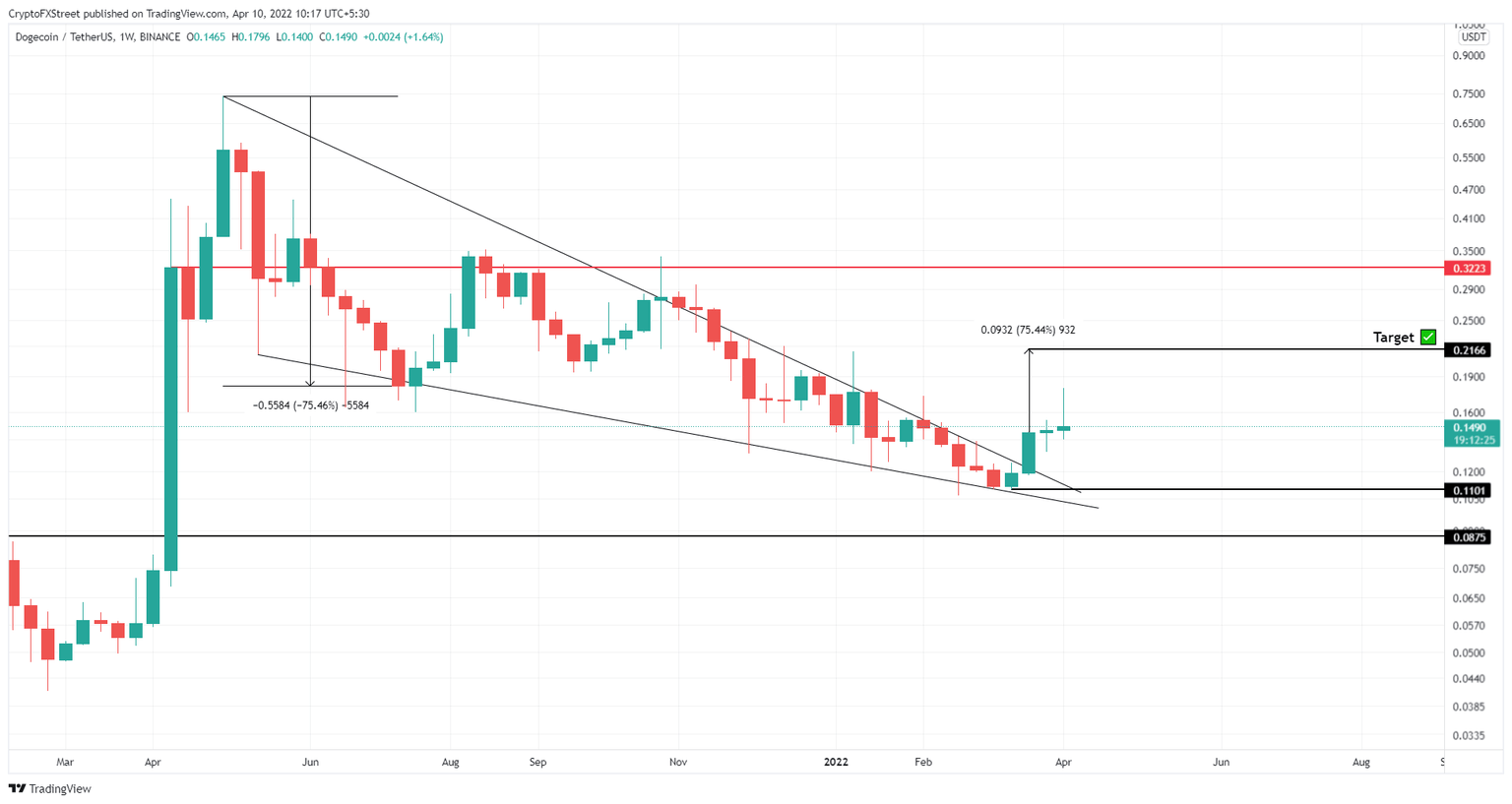

- Dogecoin price action since May 3, 2021, has set up a multi-month falling wedge pattern, hinting at an explosive move.

- Since its breakout, DOGE is consolidating before triggering its 75% upswing to $0.216.

- A weekly candlestick close below $0.11 will invalidate the bullish thesis for DOGE.

Dogecoin price seems to be favoring the bulls as lost gains this week are in recovery mode. A continuation of this trend is likely to kick-start the exponential run-up for DOGE.

Dogecoin price coils before an explosion

Dogecoin price action between May 3, 2021, and March 14 created four lower highs and five lower lows on a weekly chart. Connecting these swing points using two trend lines results in a falling wedge formation.

This technical formation forecasts a 75% run-up to $0.216, determined by adding the distance between the first swing high and low to the breakout point at $0.123. DOGE produces a weekly candlestick close above the falling wedge’s upper trend line in the last week of March, signaling a breakout.

However, the following week saw massive profit-taking and downturns due to Bitcoin’s flash crash, undoing the 28% gains.

Regardless, DOGE has rallied nearly 5% today and is currently trading around $0.150. A continuation of this uptrend could result in 42% gains. A local top is likely to form around $0.216, which is the theoretical target for DOGE.

In a highly bullish case, where buying pressure builds up, investors expect the Dogecoin price to extend to the next hurdle at $0.322. This move would bring the total gain to 113%.

DOGE/USDT 1-day chart

While the outlook for DOGE is optimistic, a sudden U-turn for the big crypto could ruin this textbook falling wedge setup.

A weekly candlestick close below $0.11 will create a lower low and invalidate the bullish thesis for the Dogecoin price. Such a development would open the path for DOGE to crash to $0.087, where sidelined buyers or long-term investors might step in to give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.