What are the chances for Loopring price to visit $2 after clearing this hurdle

- Loopring price attempts to break through the $1.17 hurdle to trigger a quick run-up.

- Investors can expect a 70% upswing to $1.96 after bulls make a comeback.

- A daily candlestick close below $1.03 will invalidate the bullish thesis for LRC.

Loopring price has been on a vertical run-up since March 15 but is currently facing a crucial resistance barrier. A successful flip of this blockade is crucial in triggering explosive moves for LRC.

Loopring price to restart its ascent

Loopring price rallied 108% in two weeks, starting March 15. This move sliced through the $1.17 resistance barrier and briefly flipped it into a support level. However, profit-taking investors knocked LRC below it, blowing out the remaining bullish momentum.

Since March 31, Loopring price has been trying to breach through the $1.17 barrier but has failed, resulting in sideways movement. A decisive flip of this hurdle into a support floor will signal the start of an uptrend. In such a case, LRC will trigger an explosive move to the next resistance barrier at $1.96. This move would constitute a 70% gain and is likely to extend to $2 in some cases. Regardless, the upside for Loopring price is capped at around $2.

LRC/USDT 1-day chart

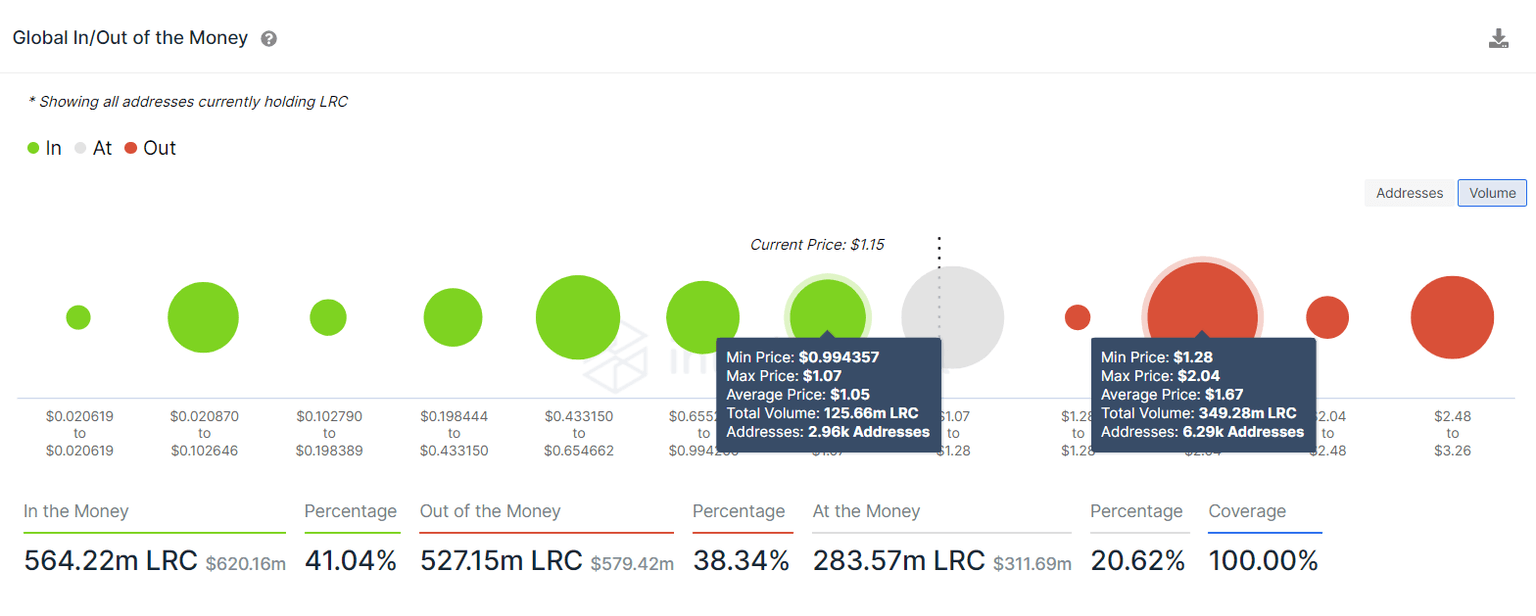

Supporting this move for Loopring price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that the immediate resistance barrier is weak, suggesting the possibility of a move into the next cluster of underwater investors.

This area extends from $1.28 to $2.07, where roughly 6,300 addresses that purchased nearly 349 million LRC tokens at an average price of $1.67 are “Out of the Money.” Interestingly, this target coincides with the bullish outlook from a technical standpoint.

LRC GIOM

Regardless of the bullish outlook, Loopring price needs to flip the $1.17 barrier into a support level and hold above it. Failure to do so could develop into a bearish scenario.

A daily candlestick close below $1.03 will invalidate the bullish thesis for Loopring price. This development will also trigger a further crash to $0.836, where buyers have another chance to attempt a comeback.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.