Vitalik Buterin states Ethereum faces same issues it did in 2017 as network continues to struggle

- Ethereum as a network has been facing bearishness on all fronts, including DeFi and Layer 2.

- Founder Vitalik Buterin stated the network is struggling with privacy, consensus, smart contract security, and scalability even today.

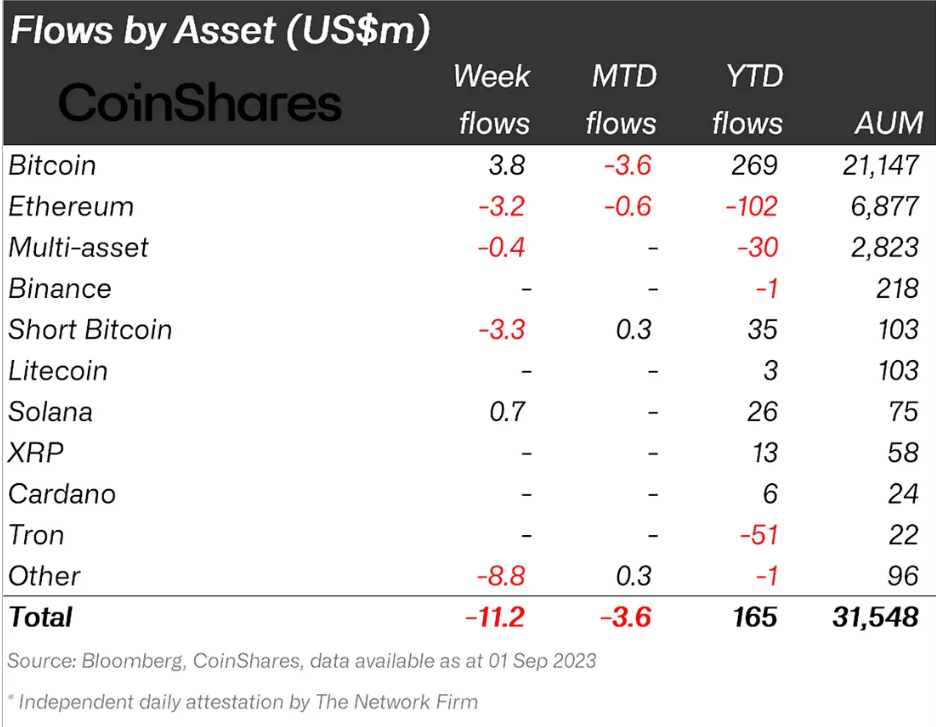

- Institutional interest this past year has been the worst for Ethereum, with the asset noting outflows amounting to $102 million.

Ethereum is considered to be the home of decentralized finance as it brought smart contracts to the limelight when it first launched. While the blockchain pioneered the sector, it was met with a host of issues that – according to the founder Vitalik Buterin – still plague the network.

Vitalik Buterin details Ethereum's issues

During a recent speech at the Nanyang Technological University in Singapore, Ethereum founder Vitalik Buterin shared his thoughts on the technological progress and challenges faced by the network at the moment. Buterin was of the opinion that Ethereum's technological progress has not changed much since its launch six years ago.

According to the founder, the network's main issues still persist, which notably are privacy, consensus, smart contract security, and scalability. He added,

"Back in 2017, the challenge was simply to bring the technology to Ethereum and make zk-SNARKs work…By 2023, the current state of technology is very advanced…We have a long list of very interesting technologies like StarK, ZK Rollup, Cairo, and many more."

Vitalik Buterin further said that of the four smart contract security issues, solving them is a slow process. He noted,

"When you switch from proof-of-work to proof-of-stake, there's a major event "merger" that happens. And when it comes to security, there are no major incidents, because the whole point is that there are no incidents. But sometimes it's important to remember that the event didn't happen, and that's good news. So I think there have been real improvements in this area, but there are still many persistent problems."

Towards the end of the speech, Buterin stated that it is a long journey from the initial concept to practical use when it comes to blockchain and that over the next five years, most of the issues mentioned above could be resolved.

Ethereum losing traction

Ethereum, the home of DeFi, has been losing its hold in the decentralized finance market. This is visible in the decline noted in the Total Value Locked (TVL) on the chain. In the last 12 months, factoring in the various contagions and bank runs, the TVL has slipped from $113 billion to $43 billion at the time of writing. The situation with the Layer 2 solutions' TVL is similar, with the TVL falling from $10.6 billion to $9.5 billion in a month.

Ethereum DeFi TVL

In addition to this, the asset has also been observing the most bearishness from institutional investors. These investors are key drivers of the bull market, and ETH has been on their hitlist since the beginning of the year. Year to date, ETH has recorded over $102 million in outflows, which is concerning for the asset.

Ethereum institutional interest

As more competitive chains with much more lucrative features find footing in the market, it is likely the situation for Ethereum will get worse unless these problems are solved.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.