Vitalik Buterin flags risks in Sam Altman's Worldcoin; WLD rally fades

- Vitalik Buterin says centralization, security and privacy pose risks to the Worldcoin project.

- Buterin explains that the risks of using biometric data are privacy leaks, loss of anonymity and lack of security, among others.

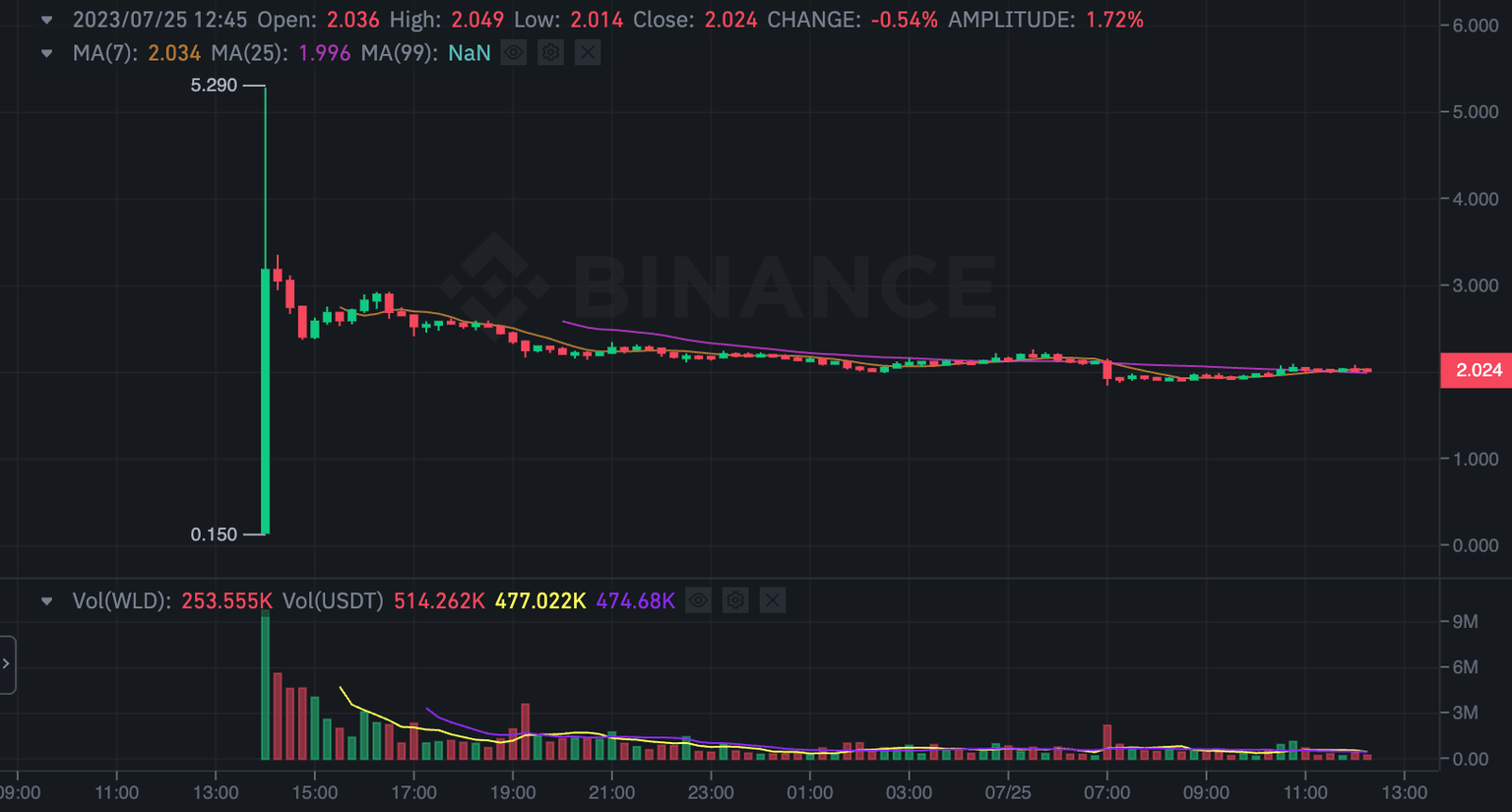

- WLD price wiped out its gains from its mainnet launch and is trading at $2.024 at the time of writing.

Vitalik Buterin, the co-founder of the largest altcoin in the crypto ecosystem, Ethereum, flagged some risks associated with Worldcoin’s (WLD) launch. The Ethereum creator said in a blog post that the centralization of Worldcoin poses a security risk for the database of biometric information collected by the project’s orbs.

WLD price declined across crypto exchanges after Buterin’s blog post.

Also read: Sam Altman's Worldcoin rolls out with massive rally

Vitalik Buterin highlights security risks, concerns on Worldcoin

Worldcoin has shared plans for decentralization in the future, but the project – which was launched on Monday – poses several risks for users and their data, Buterin said. Criticizing Worldcoin for its privacy and security concerns around the Orb, the device used to capture biometric data, Buterin outlined what could go wrong with the project.

The Ethereum founder’s addresses unavoidable privacy leaks, the erosion of people's ability to navigate the internet anonymously, coercion by authoritarian governments, or the potential impossibility of being secure at the same time as being decentralized.

In other words, the privacy and identity of people sharing their biometric data with Worldcoin is at risk in the current state of the project, he said.

WLD price rally cools down

Following Worldcoin’s launch, WLD price climbed to an all-time high of $5.290 on Binance. However, WLD price has wiped out most of these gains and is trading at $2.024 at the time of writing. It is likely that part of this recent price decline is driven by concerns about privacy and security surrounding the Worldcoin project.

WLD/USDT price chart on Binance

WLD trade volume decline alongside decrease in the asset's price, as seen in the chart above.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.