VeChain Price Forecast: VET could retrace 13% after a new all-time high

- VeChain price hints at a pullback after the Momentum Reversal Indicator (MRI) flashed a reversal signal.

- Now, VET could correct 13% to the 38.2% Fibonacci retracement level at $0.066.

- The sell-off might extend another 13% if the above barrier fails to hold.

VeChain price has been surging non-stop since hitting a local bottom on February 28. Now, VET could pullback before it establishes a clear direction.

VeChain price hints at a lower low

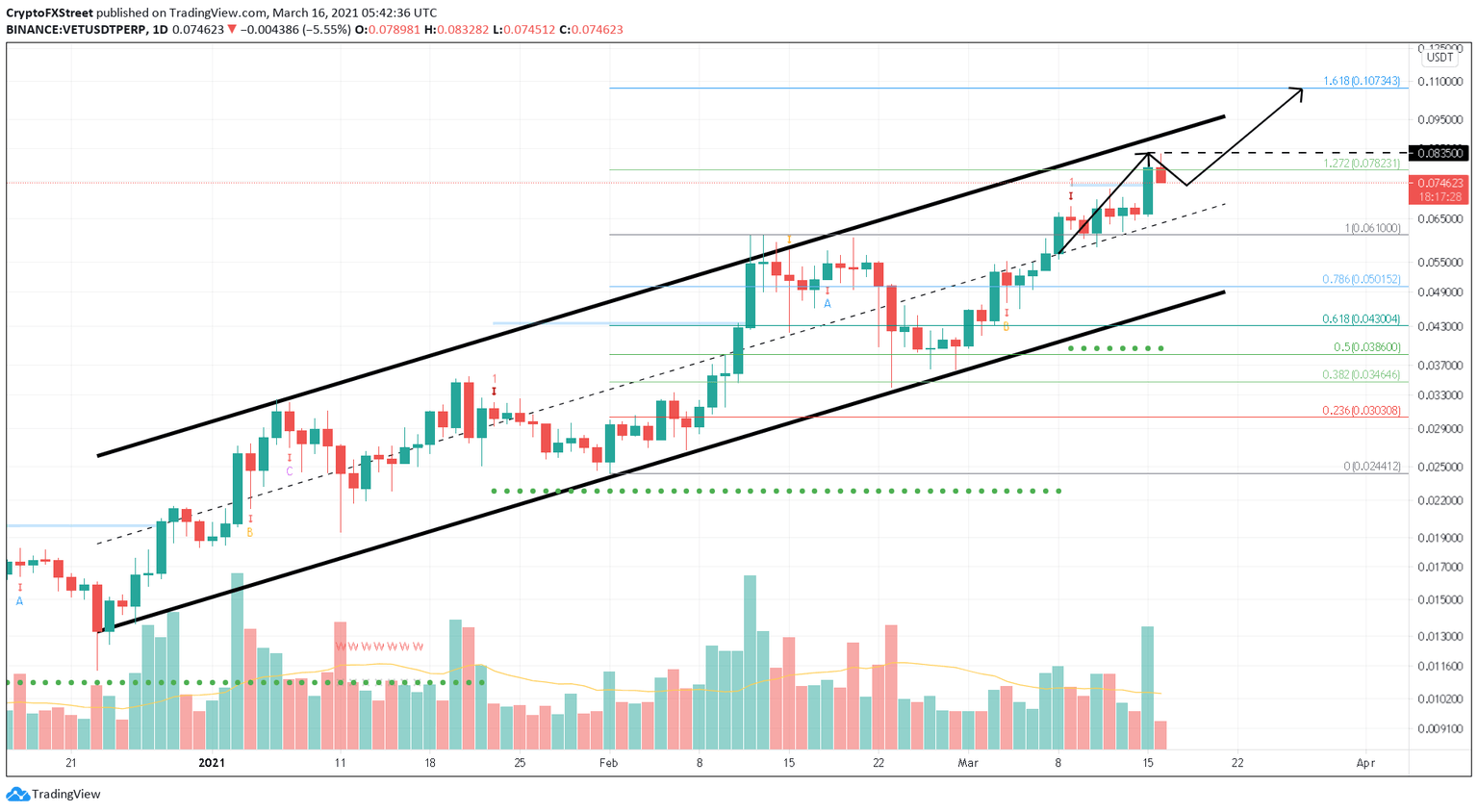

VeChain price has been consolidating inside an ascending parallel channel for almost three months. The 130% bull run has hit its target at $0.0835, creating a new all-time high for VET.

Now, the altcoin shows signs of retracement before establishing a new trend. VeChain could either continue its ascent and breach past the setup or correct to an immediate demand barrier.

VET/USDT 1-day chart

Supporting the bearish scenario is the MRI’s “preemptive top” signal in the form of a yellow down arrow on the 4-hour chart. This setup forecasts a one-to-four candlestick correction.

So, VET’s logical course of action would be a 13% pullback to the parallel channel’s middle line, which coincides with the 38.2% Fibonacci retracement level at $0.066.

In case of excessive profit booking, sellers could extend the pullback to either the 50% or the 61.8% Fibonacci retracement levels at $0.062 or $0.058, respectively.

VET/USDT 4-hour chart

However, investors should note that VeChain price blasted through the breakout line around $0.074 on the daily chart, suggesting a massive spike in bullish momentum could follow. A daily candlestick close above this level hints at a continuation of the bull rally.

A decisive breach of the recent all-time high at $0.0835 will invalidate the bearish thesis and serve as a secondary confirmation of the optimistic scenario. In such a case, VET price could ascend another 35% to $0.10, which coincides with the 161.8% Fibonacci retracement level seen on the 1-day chart.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.