VeChain partners with Wanchain to launch cross-chain bridges to over 40 blockchains

- VeChain collaborates with Wanchain to enable cross-chain interoperability with over 40 blockchains, including Bitcoin and Ethereum.

- The development is expected to enhance liquidity and expand DeFi opportunities within the VeChainThor ecosystem.

- Technical analysis shows VET rebounding from a key support level, hinting at a potential rally.

VeChain (VET) announced a strategic partnership with Wanchain on Wednesday to integrate cross-chain bridges connecting its VeChainThor blockchain to more than 40 other networks, including major chains like Bitcoin (BTC) and Ethereum (ETH). The development is expected to enhance liquidity and expand Decentralized Finance (DeFi) opportunities within the VeChainThor ecosystem. The technical analysis shows VET rebounding from a key support level, hinting at a potential rally.

VeChain unlocks cross-chain interoperability

VeChain announced on Wednesday the first full cross-chain bridging service on its network, via a strategic partnership and integration with Wanchain, a leading decentralized blockchain interoperability solution.

“Through this integration, assets will become transferrable between VeChain and over 40 leading blockchains, including Bitcoin, Ethereum, Solana, BNB Chain, Polkadot, and many more,” says VeChain in its X post.

#Wanchain unveils the first-ever cross-chain bridge to @vechainofficial!

— Wanchain (@wanchain_org) May 21, 2025

Fully connecting this $2+ billion enterprise blockchain with the Web3 ecosystem.

With $BTC, $ETH, $USDT, $USDC and more VeChain is ready to enter the DeFi world with a roar! 👇https://t.co/ZDQKZJDL4B pic.twitter.com/MCBS1Z3pdH

Moreover, VeChain’s native tokens—VET, VTHO, and B3TR—can freely move to other major blockchains. This partnership is a positive development for its network and price in the long term as it unlocks new liquidity, utility, and use cases for the ecosystem. On Wednesday, VET rose slightly by 2.28% following the news. At the time of writing on Thursday, it continues to trade higher by 1.5%.

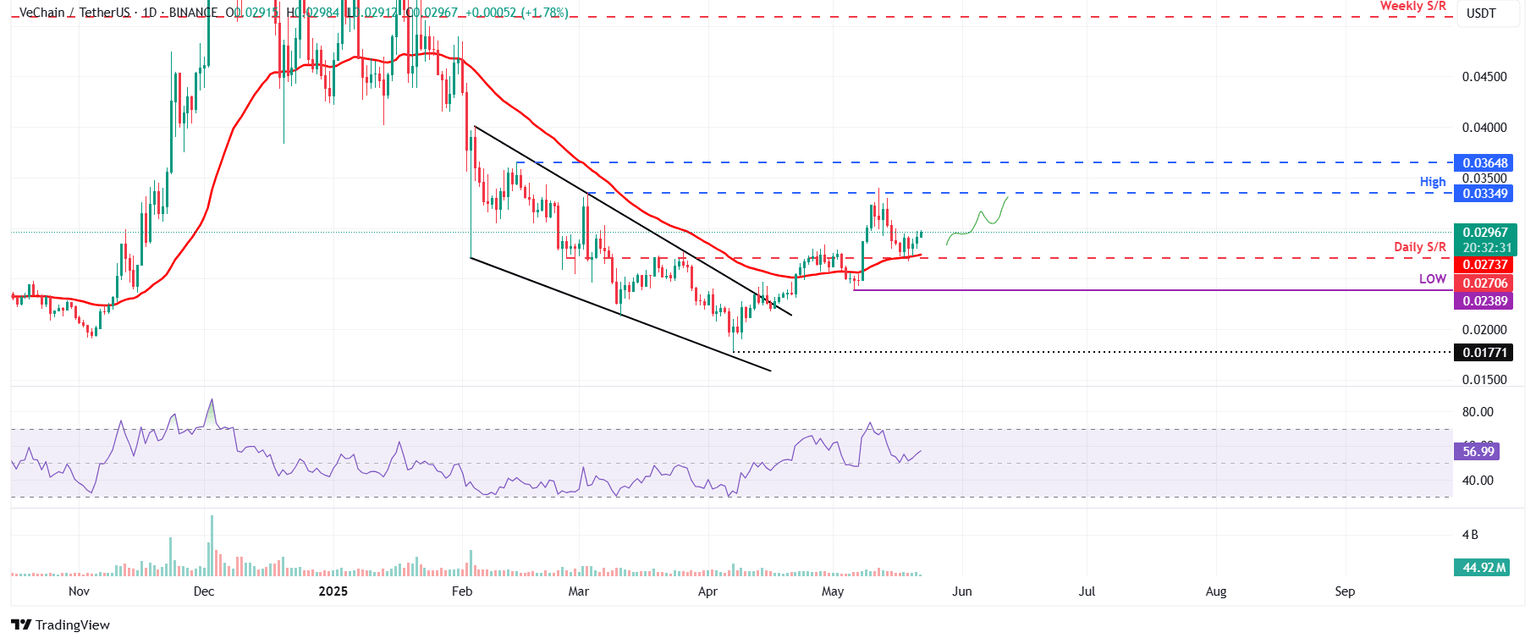

VeChain Price Forecast: VET rebounds from key support level

VeChain price faced resistance around the March 3 high of $0.033 last week, and declined 13.17% over the next five days. However, it retested and found support around its daily level at $0.027 on Sunday and recovered 3.8% by Wednesday. This daily support coincides with the 50-day Exponential Moving Average at $0.027, making it a key support zone. At the time of writing on Thursday, it continues to recover, trading at around $0.029.

If VET continues its upward trend, it could extend the rally to retest its March 3 high of $0.033. A successful close above this level could increase gains toward its next resistance level at $0.036.

The Relative Strength Index (RSI) on the daily chart reads 56, rebounding from its neutral level of 50 on Monday and pointing upward, indicating bullish momentum.

VET/USDT daily chart

However, if VET declines and closes below its daily support at $0.027, it could extend the decline to retest its May 6 low of $0.023.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.