VeChain Foundation reports $1.2B crypto treasury… but spent just $4M in Q1

The supply chain tracking project has a comfortable cushion in its Foundation treasury, but expenditures were very low through the first quarter of 2022.

The VeChain Foundation has released its financial report for Q1 2022 showing that the project amassed an impressive $1.2 billion war chest but only spent about $4.1 million in the quarter.

VeChain (VET) is a blockchain project designed to enhance supply chain management..

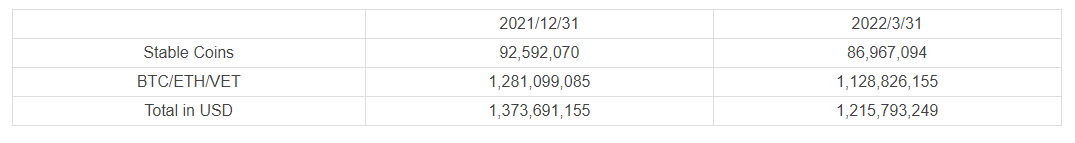

The Foundation’s May 10 financial report for Q1 2022 outlines its balance sheet as of March 31 and how it spent funds through the quarter. Although the treasury opened the year with $1.37 billion in assets between stablecoins, Bitcoin (BTC), Ether (ETH), and VET, it ended with $1.2 billion. The report states that most of the losses were incurred “due to crypto market fluctuations and other VeChain Foundation outgoings.”

The BTC price has fallen 34% since, ETH has fallen 36%, and VET has fallen 54% since Dec. 31, 2021 when the project marked the beginning of its Q1 tracking through March 31.

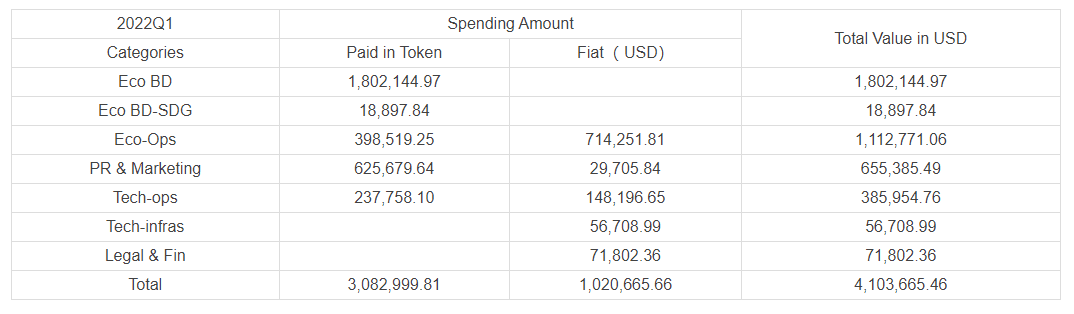

Of the $4.1 million outlaid in the first quarter the Foundation spent $1.8 million on ecosystem business development, which was the highest expense. That includes partnerships, custodians, wallet providers, brokers, community events, and ecosystem project cooperation.

VeChain Foundation treasury from Q1 2022

Next was $1.1 million on ecosystem operations such as team costs, office space, utilities, consulting fees, and external services.

While the report states that the treasury will be used to “ensure the long term development of the VeChainThor blockchain,” it is unclear whether the foundation will open the faucet on its treasury for more expenditures on investments.

VeChain Foundation Expenditures through Q1 2022

Also absent from the report is how much money the Foundation earned through the first quarter. The VeChainThor blockchain collects fees for transactions that are distributed between validators and other stakeholders in the ecosystem. However, data on the total amount of fees accrued is not clear from the financial report.

VeChain’s carbon emissions data management system and VeCarbon’s partnership with cement industry players were announced in the financial report.

During Q1, VeChain launched its own stablecoin through the Stably stablecoin issuer known as VeUSD. It also formed a partnership with Amazon Web Service (AWS) to build the VeCarbon emission management software as a service (SaaS) system for China.

VET has a market cap of $2.6 billion and is down about 0.6% over the past 24 hours, trading at $0.04 according to Coingecko data.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.