US regulators issue new statement warning banks about risks from crypto assets such as Bitcoin

- The Federal Reserve, FDIC and OCC jointly issued the statement on Tuesday.

- As per the statement, crypto assets have been stated as inconsistent with “safe and sound” banking practices.

- Bitcoin price led the crypto market into consolidation as the king coin remained rangebound at around $16,000.

FTX’s collapse was not only unexpected but also an unwanted event in the crypto space, Apart from significant losses, it also triggered the regulatory authorities to increase oversight. In line with the same, United States regulatory bodies have warned banking organizations of the risks from crypto assets.

US regulators warn banks to be safe

Three federal regulatory bodies released a joint statement in the late hours of Tuesday stating the risks of the crypto space to the concerned banking organizations. The Board of Governors of the Federal Reserve System (Federal Reserve), the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) were the agencies behind the statement.

According to the statement, following the downfall of companies like FTX, Voyager, Celsius, etc., it has become imperative to increase precautions. The agencies have asked the banking organizations to take a careful and cautious approach to crypto assets just as they have. Adding to the same, the joint statement read,

“Based on the agencies’ current understanding and experience to date, the agencies believe that issuing or holding as principal crypto-assets that are issued, stored, or transferred on an open, public, and/or decentralized network, or similar system is highly likely to be inconsistent with safe and sound banking practices.”

Earlier last month, the Federal Reserve, FDIC and OCC were also in agreement with the Financial Stability Oversight Council, claiming crypto assets to be a “danger group”.

Bitcoin price remains sluggish

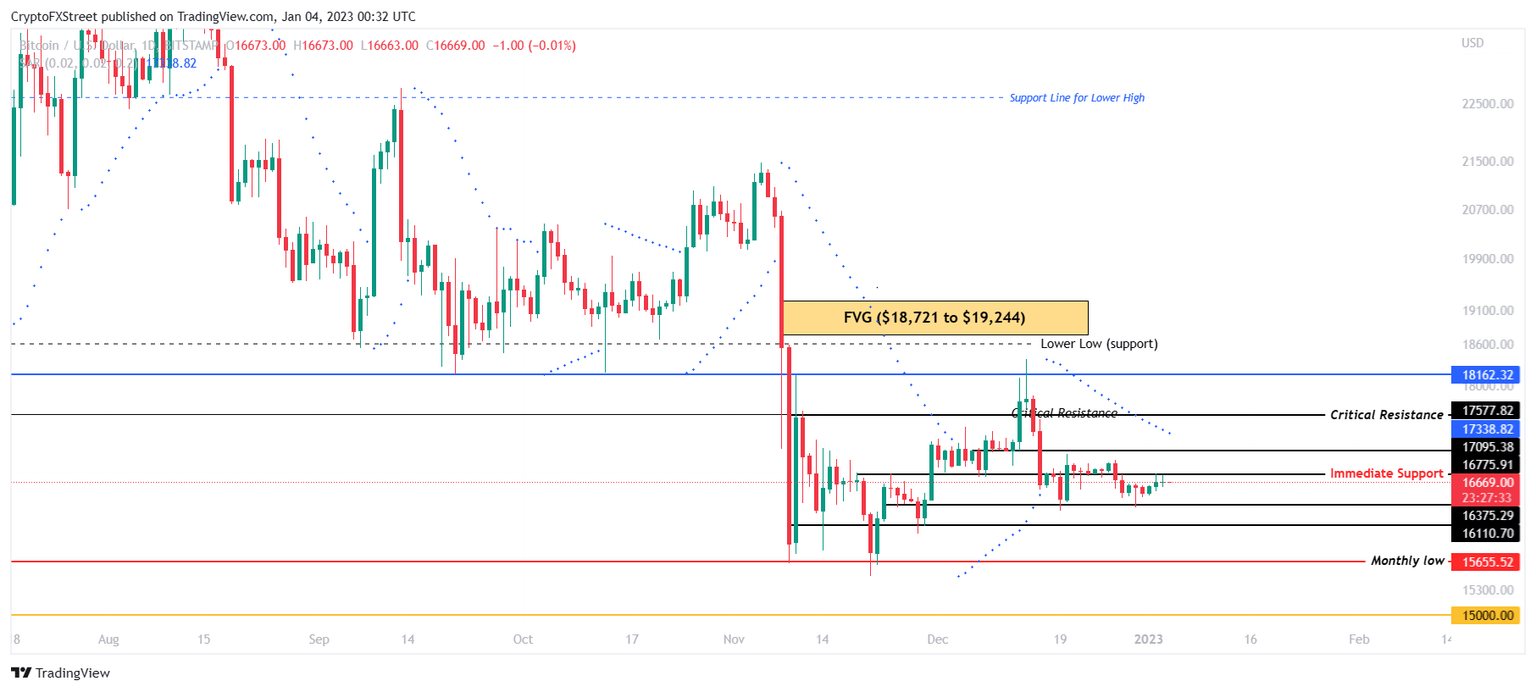

Bitcoin price has been stuck moving sideways around the $16,000 mark. This could be considered as a potential bullish momentum buildup, provided the prices only go up from here and not down.

BTC/USD 1-day chart

However, even if Bitcoin price begins tumbling, it should keep above the $16,000 mark, which has held a solid support level for a while now. This could prevent another significant crash in the crypto market.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.