US Homeland Security probes Anchorage digital bank amid Blackrock custody expansion

- US Homeland Security’s “El Dorado Task Force” is investigating Anchorage Digital Bank for potential financial misconduct.

- Anchorage previously faced regulatory action for BSA/AML compliance failures.

- BlackRock and Cantor Fitzgerald are among Achorage’s high profile clientele.

Anchorage Digital Bank faces renewed federal scrutiny just as it expands crypto custody partnerships with giants like BlackRock and Cantor Fitzgerald.

Anchorage faces Federal probe despite history of regulatory challenges

Anchorage Digital Bank, the first federally chartered crypto bank in the United States, is under investigation by the Department of Homeland Security’s El Dorado Task Force, according to a report by Barron’s. The task force—focused on fighting financial crimes—has begun contacting former employees of the bank, though the precise nature of the investigation remains undisclosed.

Anchorage has long drawn regulatory attention. In 2022, the Office of the Comptroller of the Currency (OCC) issued enforcement actions against the bank for falling short of Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) standards. The current DHS investigation appears to build on concerns about compliance and financial transparency.

Blackrock’s exposure to Anchorage signals major market impact ahead

Despite being under federal investigation, Anchorage remains deeply embedded in institutional crypto markets. It serves as the primary custodian for BlackRock’s spot crypto ETFs—IBIT and ETHA—which together manage approximately $50 billion as of Q1 2025. The bank also acts as collateral custodian for a $2 billion digital asset financing initiative with Cantor Fitzgerald.

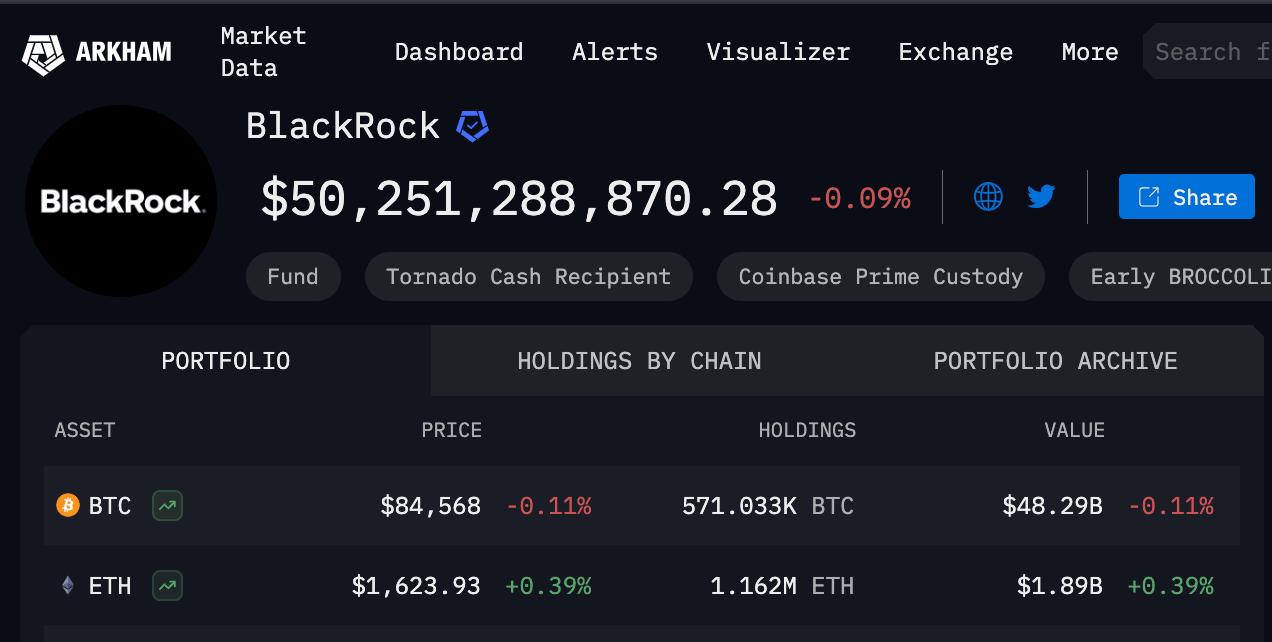

BlackRock total Cryptocurrency holdings as of April 15 | Source: Arkham

According to Arkham data, BlackRock currently holds 571,033 BTC worth $48.3 billion and 1.16 million ETH holding valued at $1.9 billion at press time on Tuesday.

Exposure to top-tier institutions like BlackRock and Cantor Fitzgerald suggests any negative outcome from the investigation could ripple through the broader crypto market. A loss of Anchorage’s banking charter or custodial credibility may force institutional players to re-evaluate crypto custody strategies, potentially delaying broader adoption.

While investigation remains ongoing, outcomes could influence how Altcoin ETFs fund sponsors assess growing regulatory risk for digital asset banks operating at the intersection of crypto and traditional finance.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.