US court upholds ruling in favor of Grayscale, asks SEC to re-review Bitcoin ETF application

- The US Court of Appeals formalized its ruling in the Grayscale vs SEC lawsuit by giving a formal mandate.

- Per the mandate, the SEC will now have to re-review Grayscale’s request to turn GBTC into an ETF.

- Additionally, BlackRock has become the first spot Bitcoin ETF applicant to be listed on the NASDAQ’s trade clearing company DTCC.

Bitcoin has been the center of attention for weeks now as the dispute between the Securities & Exchange Commission (SEC) and the spot BTC ETF applicants continues. However, one significant candidate, Grayscale, is noting substantial support from the US court system, which is pushing the SEC to approve their ETF.

Read more - SEC will not appeal court ruling on Grayscale GBTC conversion to spot Bitcoin ETF - Reuters

SEC must green-light Grayscale Bitcoin ETF

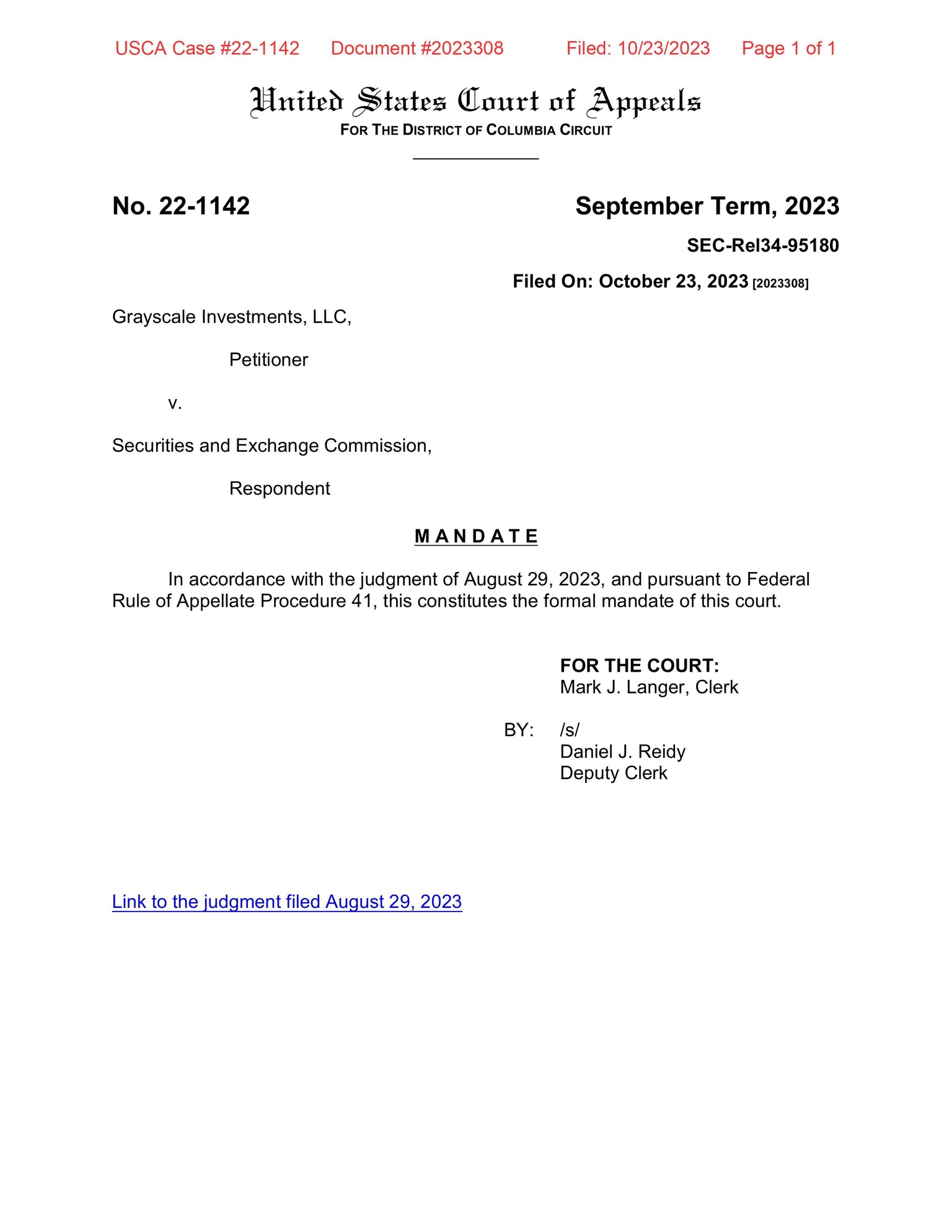

The US Court of Appeals for the District of Columbia Circuit issued a mandate on October 23, which, put simply, asked the SEC to reconsider and once again review the application of the Grayscale Bitcoin Trust conversion into a spot Bitcoin ETF.

The mandate upheld the decision of the court from August 29, when Grayscale won the court’s favor, which noted that the denial of Grayscale’s proposal was “arbitrary and capricious”. Furthermore, the mandate came about ten days after the SEC announced that it did not intend to appeal the earlier ruling.

US Court of Appeals mandate

In the previous hearing, the court ruled that the SEC must have the same likelihood of detecting fraudulent or manipulative conduct in the market for Bitcoin and Bitcoin futures. This is because both the markets do not share much difference except for the existence of the Chicago Mercantile Exchange (CME) acting as the futures market watchdog.

BlackRock might emerge as the winner

Not only was BlackRock the first to file for a spot Bitcoin ETF, inspiring others to follow suit, but it may also become the first to be listed on exchanges.

According to a tweet from Bloomberg ETF analyst Eric Balchunas, the iShares Bitcoin Trust has been listed on the Depository Trust & Clearing Corporation (DTCC). The DTCC is a financial services company that provides clearing and settlement services for the financial markets, including the likes of NASDAQ.

Per this listing, the ticker for BlackRock’s spot Bitcoin ETF is expected to be IBTC. Commenting on the asset management firm’s listing, Balchunas stated,

“This is [the] first spot ETF listed on DTCC, none of the others on there (yet). Def[inately] notable BlackRock is leading charge on these logistics (seeding, ticker, dtcc) that tend to happen just prior to launch. Hard not to view this as them getting signal that approval is certain/imminent

While the SEC has been delaying the approval of spot Bitcoin ETFs, it is expected to green-light all the applications by January 2024.

Read more - “SEC is engaging with Ark Invest on Bitcoin ETF” says Cathie Wood; Bitcoin price to likely crash

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.