Uniswap price sharply reverses while Buterin proposes UNI as an oracle token

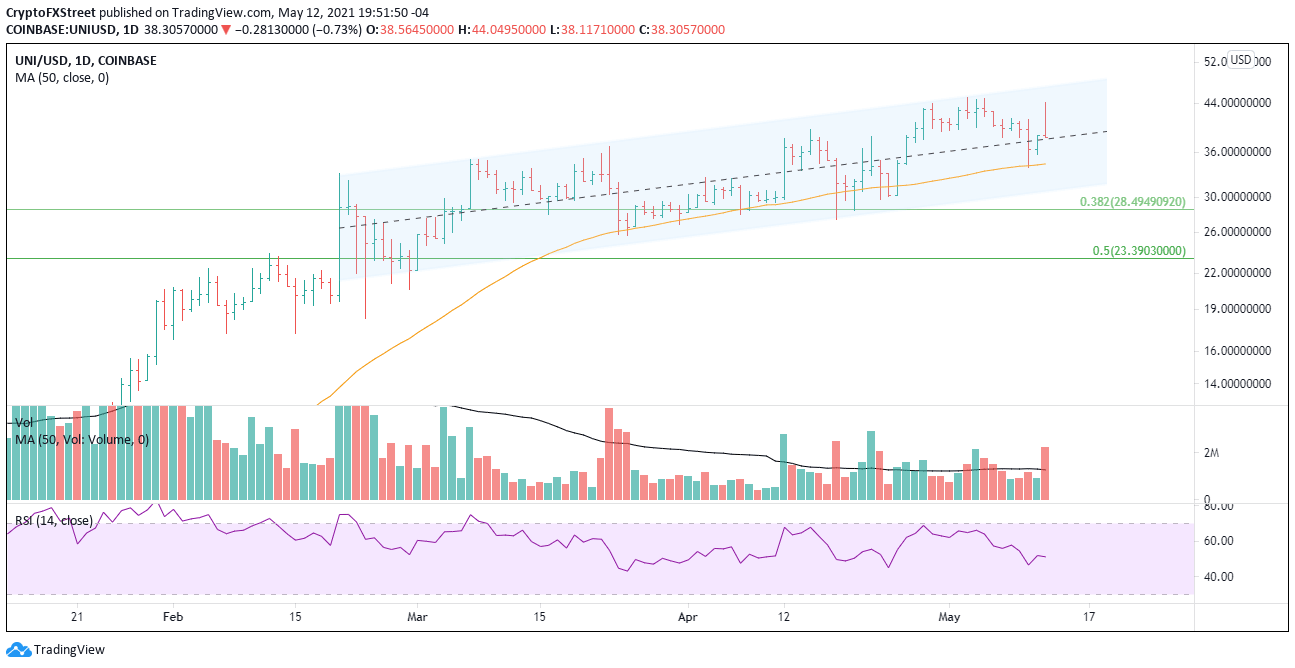

- Uniswap price locked in an ascending channel since February.

- 50-day simple moving average (SMA) has contained weakness over the last three months.

- Ethereum creator, Vitalik Buterin, promotes Uniswap’s UNI as a highly secure oracle for a DeFi ecosystem.

Uniswap price has steadily climbed since the February sell-off, but the price gains have been muted relative to the performance of other altcoins, particularly since the March low. UNI is currently trading just above the mid-line of an ascending channel, offering few clues about price direction.

Uniswap benefits from a more robust stablecoin ecosystem

On Uniswap’s governance forum, Ethereum creator Vitalik Buterin advocated that UNI should be an oracle token for successful decentralized finance (DeFi) ecosystem and fiat currencies. Oracles are used for broadcasting and sharing price data, determining liquidation prices and thwarting 51% attacks. Simply put, price oracles are essentially data feeds that connect Ethereum to off-chain, real-time information so smart contracts can utilize them.

Buterin listed several areas of DeFi, such as algorithmic stablecoins, synthetic assets and collateralized loans that lean on a price oracle to function correctly. He recommended that Uniswap develop its oracle on the Augur or UMA design to enable more robust data. The better the data, the better DeFi protocols can function correctly.

UNI is well-positioned to be a token for decentralized oracle, said Buterin, thanks to its large market capitalization at just over $22 billion. A large market capitalization makes attacks far more expensive. The cost of attack “is absolutely essential to maximize, thus market cap is key.”

Overall, the decision would also be good for Uniswap v3 because it “heavily benefits from the existence of a more robust stablecoin ecosystem.”

Uniswap price lacks catalyst to break channel range

Uniswap price has moved in an ascending channel for more than two months, registering minor new highs but preventing a notable breakout. The 50-day SMA has been pivotal support during minor corrections. It remains in an uptrend, keeping the hopes of a rally continuation high and promoting a neutral outlook for the altcoin.

With that said, if today’s selling accelerates, support will manifest around the mid-line of the channel at $38.04. Still, the emerging weight of a downturn in the cryptocurrency complex will motivate sellers to quickly push Uniswap price down to the 50-day SMA at $34.36 and then the channel’s lower trend line at $30.55.

An undercut of the channel’s lower trend line will introduce further selling and a test of the 38.2% Fibonacci retracement of the rally beginning in November 2020 at $28.49. The final line in the sand for Uniswap price is the 50% retracement at $23.39. A failure at that level would raise more significant, fundamental concerns about Uniswap and UNI.

UNI/USD daily chart

If the current weakness stalls, speculators should be prepared for a test of the channel’s upper trend line at $47.09. Until a daily close above the trend line, no further upside targets should be considered.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.