Uniswap price prepares to rebound as the community cheers new grants program

- UNI has retreated to the lower boundary of the short-term flag formation.

- The community of the DeFi project is voting on the grants program worth $750,000 per quarter.

UNI, the token of one of the most popular DeFi protocols, may be ready for a bullish breakthrough. At the time of writing, UNI/USD is changing hands at $3.82. The coin has recovered from the November 26 low of $3.0, however, it is still below the recent top hit at $4.5.

UNI is in a danger zone

On the intraday chart, UNI is trading around the support level created by the lower boundary of the bearish flag formation around $3.7. This continuation pattern is usually characterized by a short-term counter-trend movement. If the price breaks below the channel support, the sell-off may be violent and result in at least a 28% decline with the estimated target of $2.7.

UNI's 1-hour chart

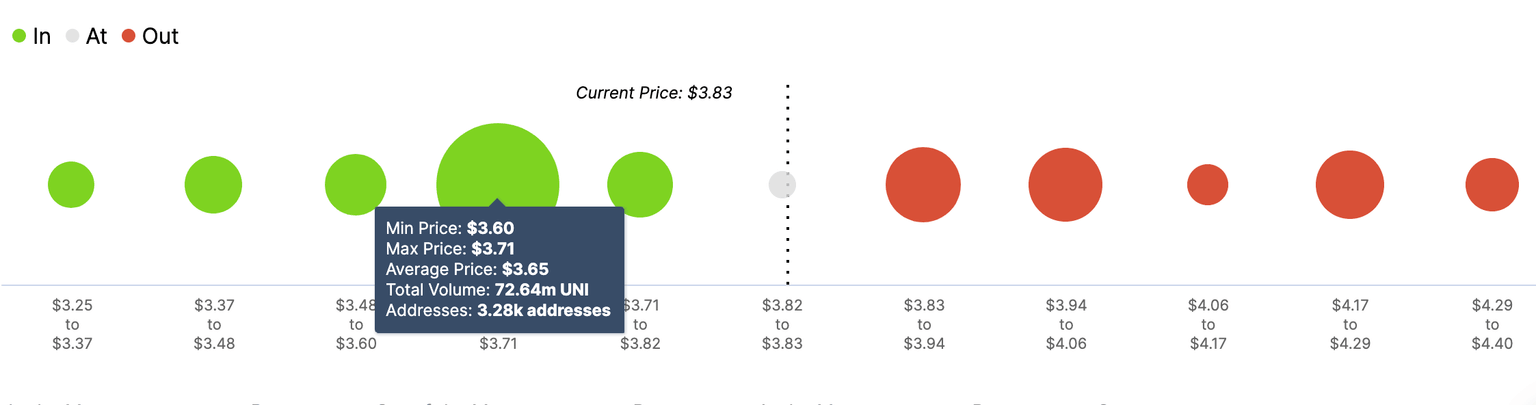

Meanwhile, In/Out of the Money Around Price (IOMAP) model reveals that UNI sits on top of strong support. Over 3,000 addresses bought 72 billion UNI between $3.6-$3.7, making this area a hard nut to crack for the bears. This barrier has the potential to absorb the selling pressure and trigger a new rally. However, a move below may have catastrophic consequences for UNI price as there are no significant support levels below this area.

UNI's In/Out of the Money Around Price" (IOMAP)

On the other hand, the local resistance comes at $4. The IOMAP chart shows that 3,500 addresses purchased over 18 million tokens on approach to this area. Once it is out of the way, the upside is likely to gain traction with the next focus on a channel resistance of $4.3. A sustainable move higher is needed to invalidate the bearish scenario and bring UNI recovery back on track.

UNI unveils grants program MVP

From the fundamental point of view, UNI may gain support from the news that the DeFi protocol looks into the idea of creating a grant program. According to the proposal submitted by a cryptocurrency investor Jesse Walden, the funding program will help speed up its ecosystem development.

The proposed quarterly budget is $750,000. The amount may be changed every six years. At the initial stages, the platform may start sponsoring hackathons and then move on to financing core protocol development.

We propose the program start with an initial cap of $750K per quarter and a limit of 2 quarters before renewal. This sum we feel is appropriate for an MVP relative to the size of the treasury that UNI token holders are entrusted with allocating, the proposal says.

The grants will be financed from UNI Community Treasury and managed by six community members – one lead and five reviewers – re-elected every six months.

Author

Tanya Abrosimova

Independent Analyst