Uniswap Price Prediction: UNI bears take a breather, not out the woods yet

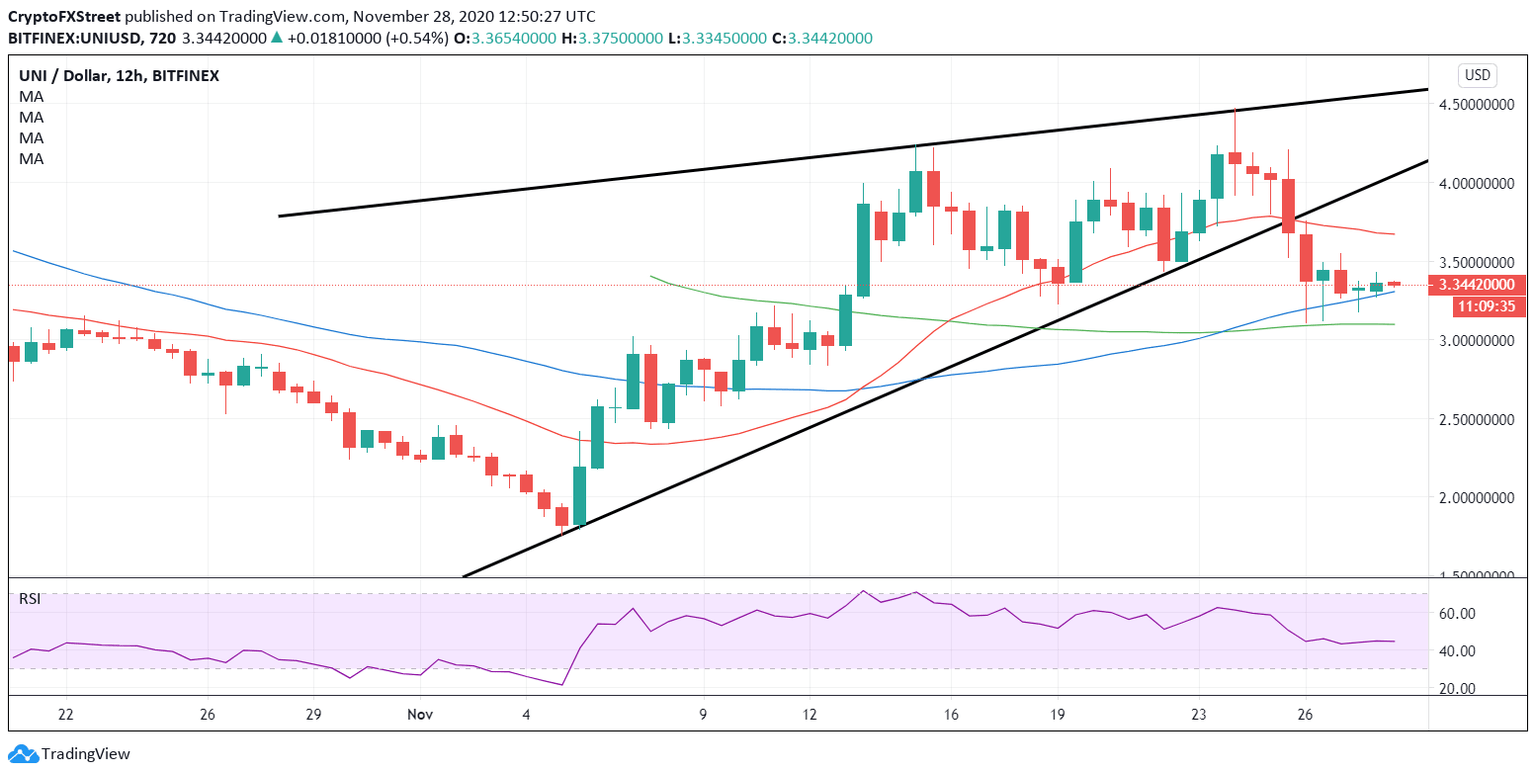

- Uniswap charted a classic rising wedge breakdown on the 12H chart.

- On-chain metrics warrant caution for the UNI bulls.

- 100-SMA cushions the immediate downside.

Uniswap (UNI/USD) turns positive for the first time in five trading sessions this Saturday. The No. 30 coin attempts a bounce from two-week lows of $3.11, as the bears take a breather before the next push lower. At the press time, the price trades around $3.35, adding 2.50% over the 24 hours while on track for a 10% weekly loss.

UNI/USD: 12-hour chart

As observed in the 12-hour (12H) chart, Uniswap has confirmed a classic rising wedge breakdown on Wednesday and since then it has been in a bearish consolidation phase.

The horizontal 100-simple moving average (SMA) at $3.10 has saved the day for the UNI bulls, for now, as the bearish Relative Strength Index (RSI) has recovered from the troughs and turned flat, currently at 45.83.

A breach of the 100-SMA support could intensify the selling pressure, exposing the measured pattern target at $1.068. Alternatively, acceptance above the bearish 21-SMA at $3.68 is critical to negate the near-term downside bias.

Despite the recovery attempt, the downside in Uniswap appears more compelling amid downbeat fundamentals, in the face of a slump in network growth, as indicated by Santiment, a leading provider of on-chain metrics.

“In the last seven days, the number of new addresses decreased significantly. The addresses topped 2,300 on November 17 but slumped to 1,146 by November 26, representing a 50% decline. The downtrend in network growth is a red flag for price growth in the short term,” FXStreet’s Cryptocurrencies News Editor John Isige explains.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.