Uniswap price jumps to new all-time high and aims for more

- Uniswap price reached a new all-time high at $38.16 on April 12.

- The digital asset had a massive 30% surge in the previous three days.

- On-chain metrics show practically no resistance ahead for the decentralized exchange token.

Uniswap has seen a massive surge in the last three days, hitting a new all-time high and reaching $18.5 billion in market capitalization. Despite the significant rally, the digital asset seems poised for more.

Uniswap price faces no critical barriers ahead of new all-time highs

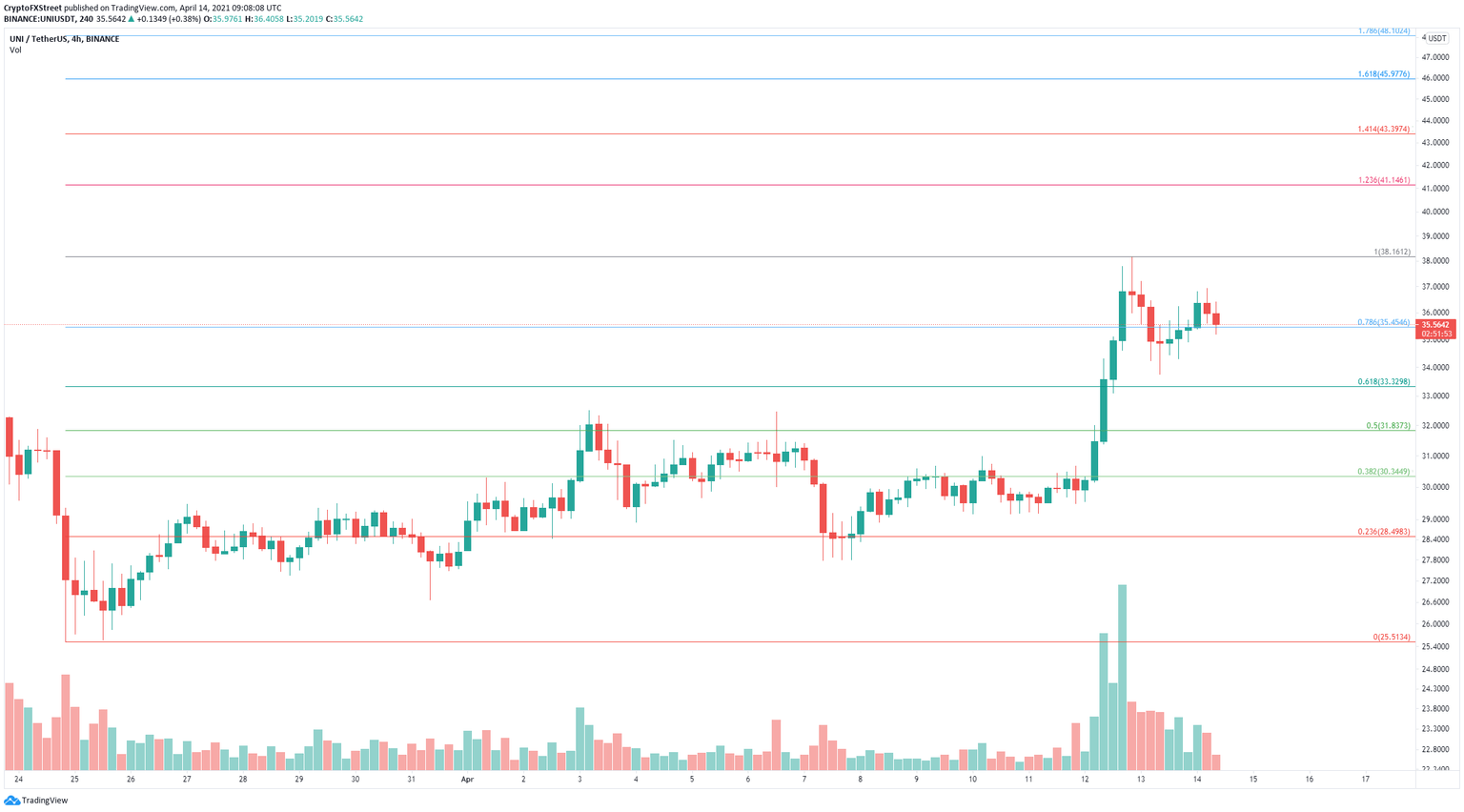

After a brief consolidation period down to $33.75, Uniswap managed to climb back above the 78.6% Fibonacci retracement level at $35.45 and aims for a new leg up above the previous all-time high of $38.16.

UNI/USD 4-hour chart

The next price target is located at $41.14 where the 123.6% Fibonacci level stands. Above that, Uniswap price could reach $43.39 as well at the 141.4% Fib level. According to the In/Out of the Money Around Price (IOMAP) chart, this is quite likely.

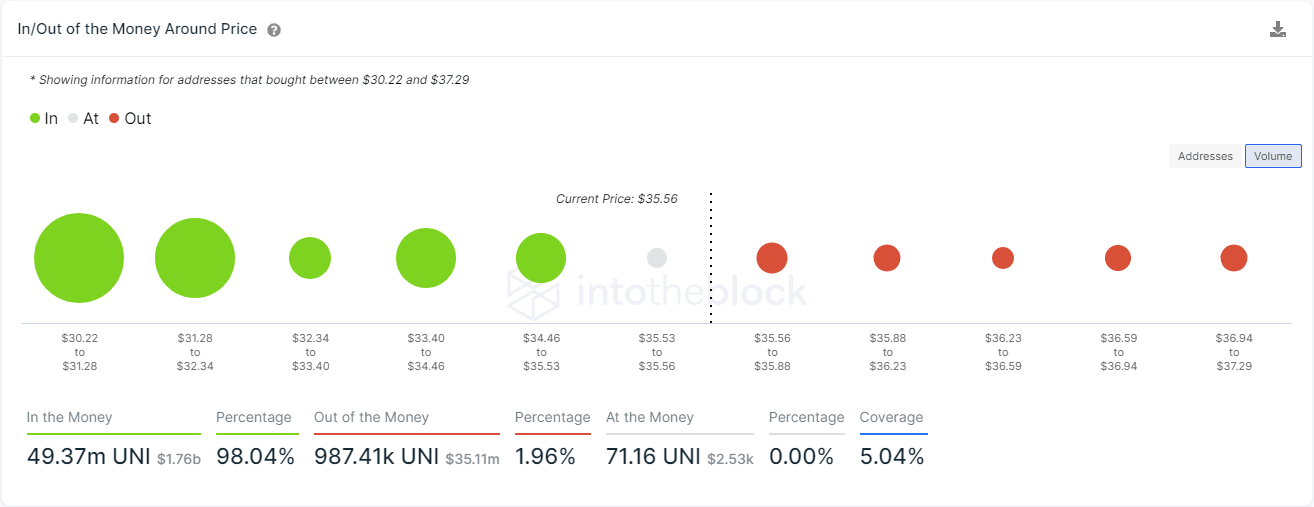

UNI IOMAP chart

The IOMAP model shows no significant resistance levels ahead. The most important barrier is the previous all-time high of $38.16. On the way down, there is a massive support area between $32.34 and $30.22 where 20,000 addresses purchased 36 million UNI tokens.

Losing the 78.6% Fibonacci retracement level at $35.45 could quickly drive Uniswap price down to the 61.8% Fib level at $33.32, just above the critical support area shown by the IOMAP.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.