UNI price likely to recover with these developments in Uniswap ecosystem

- Uniswap community passed a proposal to invest $12 million worth of UNI in an automated market maker, Ekubo Protocol.

- Uniswap protocol’s revenue over the past week hit $23.15 million, exceeding that of competitors PancakeSwap, Curve and Balancer several times.

- UNI price held steady above the $4.13 level on Binance, as the asset attempts recovery.

Uniswap, one of the largest decentralized exchanges in the crypto ecosystem, witnessed an increase in its revenue between October 22 and 28. Two bullish catalysts, UNI’s revenue growth and a recently passed proposal, are the likely drivers of Uniswap’s price rally.

Also read: Uniswap price risks 8% crash as Uniwap Foundation sends 500,000 UNI to exchange

Uniswap passes proposal to invest UNI in market maker

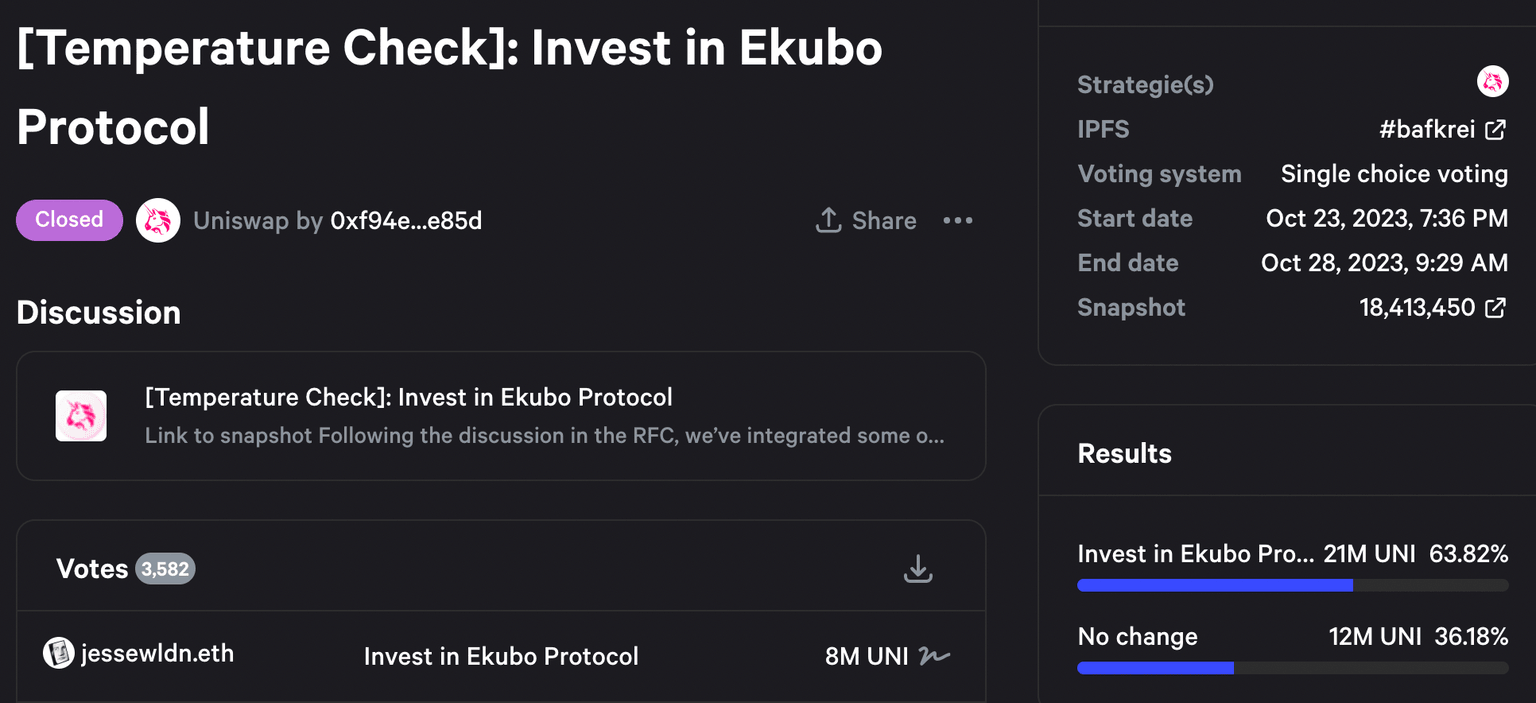

The Uniswap community has passed the temperature check proposal to invest $12 million worth of UNI tokens in the market maker, Ekubo Protocol. 63.82% of the votes were in favor of the investment, Uniswap will receive 20% of the project’s governance tokens in exchange.

Uniswap proposal temperature check voting

The DEX left its competitors to bite the dust as the protocol’s revenue between October 22 and 28 climbed to approximately $23.15 million, while PancakeSwap, Curve and Balancer made $484,900, $385,000 and $122,300 respectively, according to a post by Wu Blockchain on X (formerly Twitter), posted on October 29. Bullish developments in the Uniswap ecosystem are supportive of UNI price recovery.

UNI price holds steady above $4.13

In the past six days, the Uniswap Foundation deposited a total of 9.8 million UNI tokens, worth $41.8 million to cryptocurrency exchange platforms Kraken, FalconX and OKX, according to data from on-chain tracker Spot on Chain. These deposits increased UNI reserves across exchanges, however the asset’s price sustained above the $4.13 level on Binance, at the time of writing.

Despite mass UNI inflow to exchanges, price declined by 1.92% over the period. With two recent developments in the Uniswap ecosystem discussed above, a recovery in the asset is likely. UNI is exchanging hands at $4.13, down 0.5% on the day.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.